2020-05-12

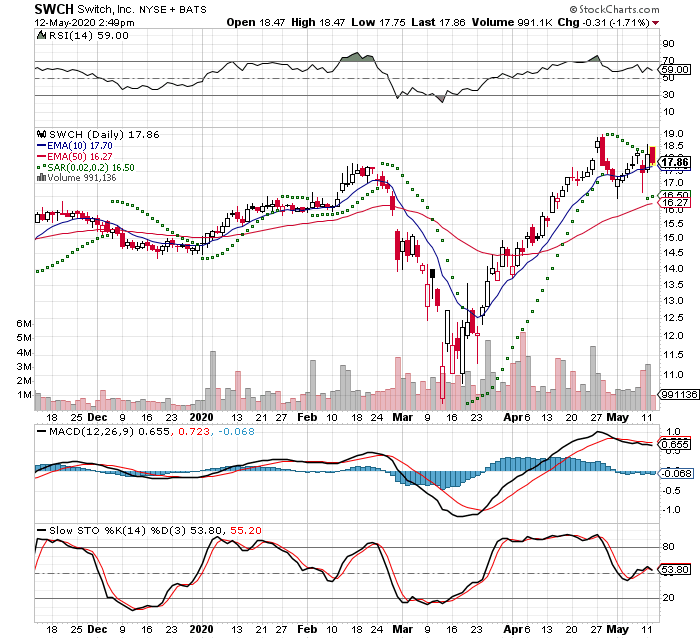

This trade idea came to me when I was reviewing my watch list. It was featured in Investors Business Daily: New America Vol 37 No 3 Week of April 28, 2020. I liked the chart and waited for a pull back to enter the position

I went with Call options to limit my losses. The Jun 19, 2020 Call option has 38 days to expiration and is lottery ticket. They are heavly leveraged and have a high P/E Ratio

I got filled this morning:

Buy to Open 2 SWCH Jun 19 2020 19.0 Call Limit 0.55

IBD Rankings 05/12/20

Composite Rating: 85

EPS Rating: 10

RS Rating: 94

Group RS Rating: A

SMR Rating: C

Acc/Dis Rating: A-

ROE: 5.1%

Debt: 387% – Heavly Leveraged

Outstanding Shares: 103.0m

Float: 75.2m

EPS Due Date: 08/07/20

From TD Ameritrade Quote Summary 05/12/20

P/E Ratio: 223.25x – Price is way out of line with actual earnings

Ex-dividend date: 05/21/20

Zack’s has this as 2 – Buy: SWCH

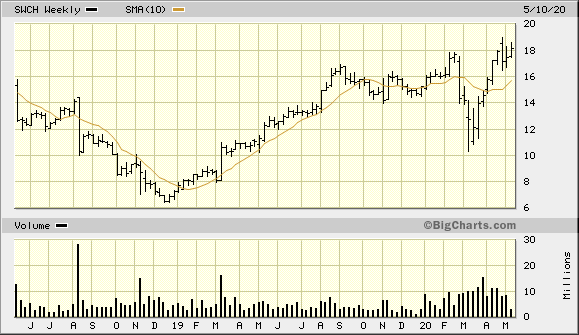

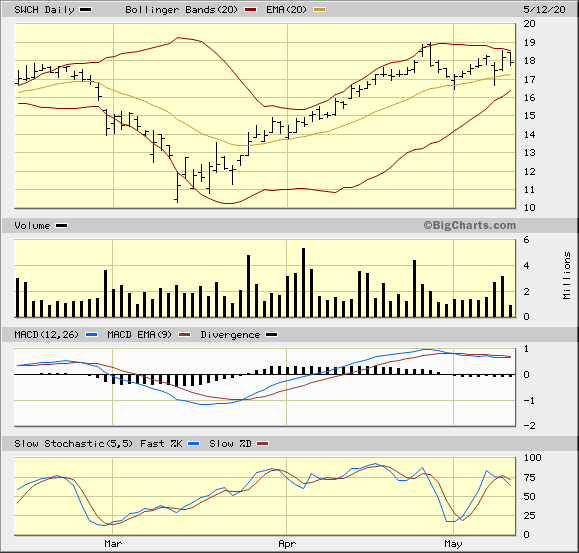

Dr Alexander has a triple screen for viewing charts and Trading for a Living is why I use the following charts