JD.com is China’s largest online retailer and its biggest overall retailer. It offers customers the best online shopping experience. The company is a member of the Fortune Global 500.

2016-06-30

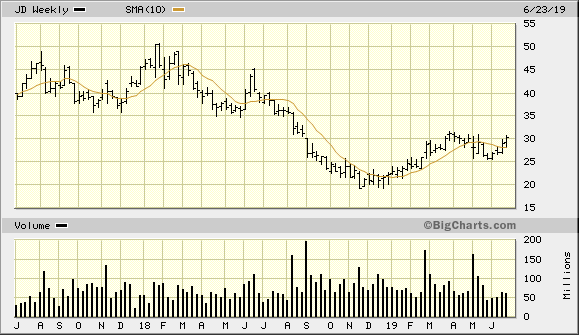

This trade idea came to me by reviewing Investors.com on 2019-06-26 Stocks on the Move. This is a Chinese on line retailer and I am hesitant in purchasing, because of the on going trade war with US and China. I went ahead and did purchase the following day in the afternoon

My cost basis: $30.47

-5% Stop: $28.88

+20% Gain: $36.48

IBD Rankings 06/30/19

Composite Rating: 88

EPS Rating: 75

RS Rating: 72

Group RS Rating: A-

SMR Rating: C

Acc/Dis Rating: A-

ROE: 6.2%

Debt: 17%

Outstanding Shares: 1447.5m

Float: 1158.0m

EPS Due Date: 8/14/19

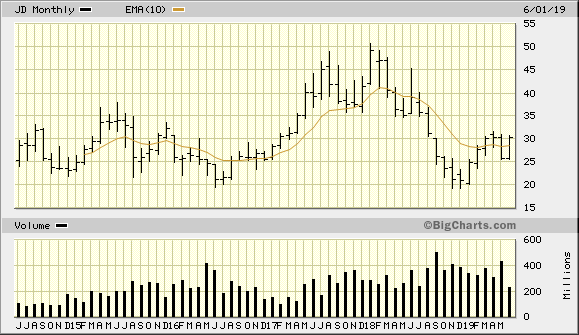

Dr Alexander has a triple screen for viewing charts and Trading for a Living is why I use the following charts

2019-08-12

I had closed out this position on 2019-08-01 at a larger loss than my stop. I was up about 3%, but then the day before I was at about break even. Then the morning the stock bounced up and after lunch it crashed.

I got filled at 27.74

30.40 - 27.74 = -$2.66 / 30.40 = -8.75%

This loss caused me to reduce my overall exposure to the market and reevaluate my use of metal stops. I then took a break from the market to adjust my approach and scale back in to the market more cautiously