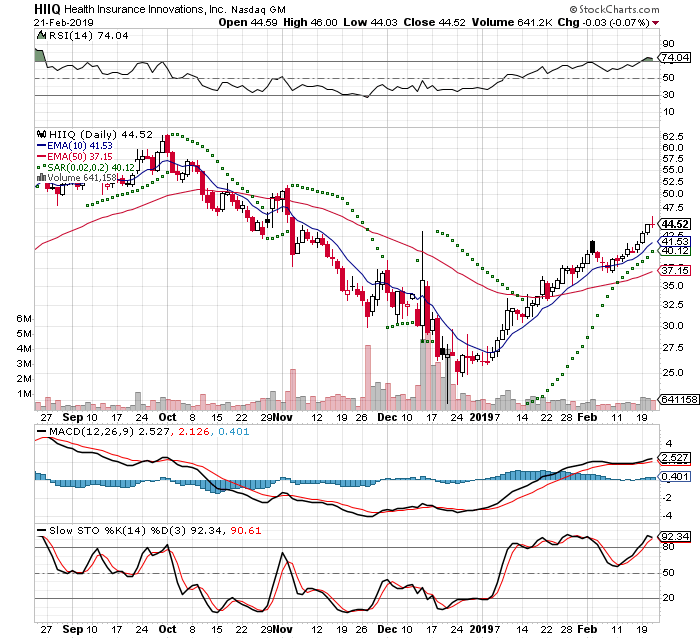

2019-02-21

This trade idea came to from reading Investors Business Daily IBD Weekly Vol 35 NO 46 Week of Feburary 18, 2019. It was featured in IBD50 and it was ranked #24. I added this to my watch list on Sunday. Monday the market was closed for Presidents Day and opened again on Tuesday. Tuesday it stared to move on good volume

I placed a market order for 100 shares after dipping a little at the open and got a decent fill. There are a couple of warning signs. This is a thinly traded company and earnings are being announced soon. This Day 2 of a 7 Trading Day Time Stop

I got filled at $43.01

-5% stop = $40.80

20% Target = $51.53

IBD Rankings 02/21/19

Composite Rating: 99

EPS Rating: 94

RS Rating: 94

Group RS Rating: A+

SMR Rating: A

Acc/Dis Rating: B-

ROE: 41.1%

Debt: 0%

Outstanding Shares: 14.4m

EPS Due Date: 2/26/19

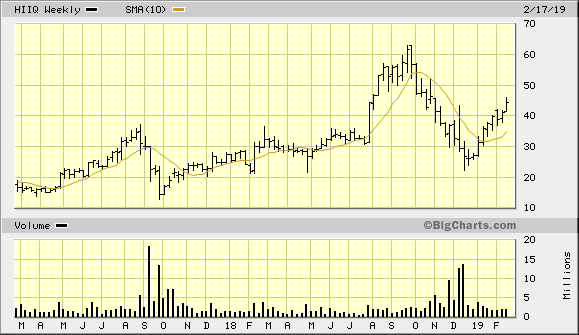

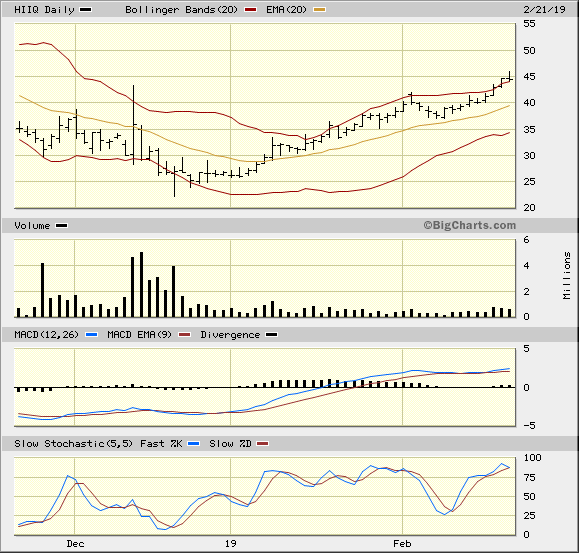

Dr Alexander has a triple screen for viewing charts and Trading for a Living is why I use the following charts

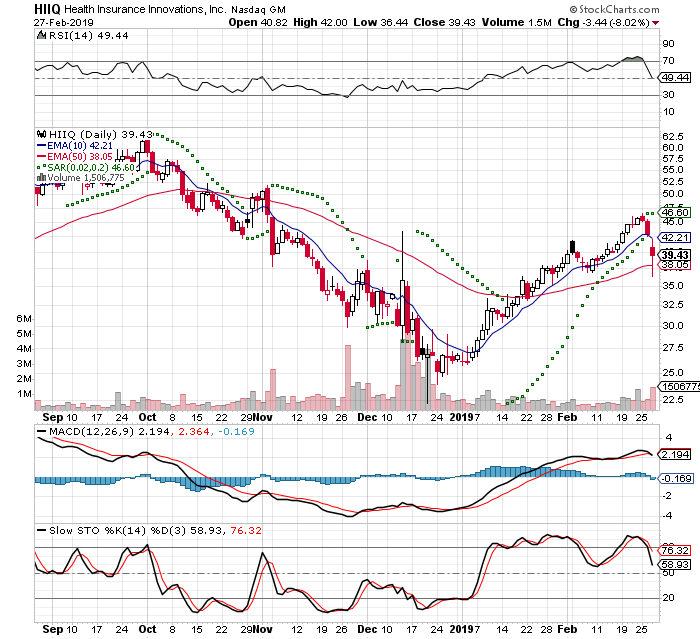

2019-02-27

I closed my position today, because of a stop loss.

I had been up $250 (5-6%) and went down $200 in the past 2 days.

The first drop came yesterday. When the earnings date got moved it dropped 5% that day, but it was on about 63% volume. It was close just under my break even level and I held my ground hoping for a bounce.

It did not come today and in fact it dropped even worse. It opened down and a sold a little after 9 CST. It happened to be close to the high of the day.

I got filled at 40.82

43.01 - 40.82 = -2.19 / 43.01 = -5.1% in 6 Trading Days