At H&R Block, we provide help and inspire confidence in our clients and communities everywhere. We’ve been true to this purpose since the beginning when brothers Henry and Richard Bloch founded the company in 1955. In that time, we’ve prepared more than 800 million tax returns. And we’ve grown to have company-owned and franchise retail locations in all 50 states, Puerto Rico and other U.S. territories, on U.S. military bases internationally and around the world.

2019-06-16

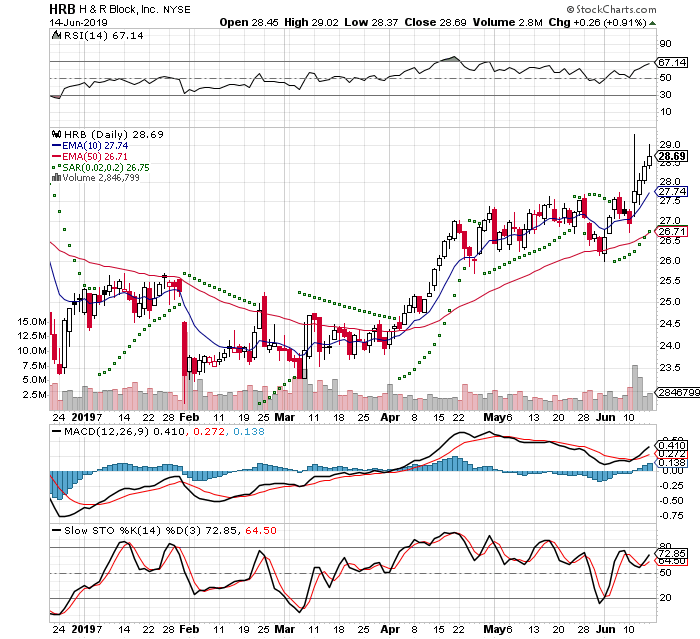

This trade idea came to me by running a scan from TD Ameritrade on Wednesday. This company interred me and I set a buy order the next day

I set the scan to:

Revenue Growth: +25% - >100%

Current Price: $20 - $50

EPS Growth: 15% - >100%

Volume: >100,000sh

MACD Histogram: Negative to Positive

Price/Sales: 2, 2-3

I bought on Thursday 2019-06-05 in the afternoon, because I expected a dip. The stock had gone up 4 straight days and the MACDH had changed to positive. I am currently down a small percentage and looking to exit quick if it starts to move against me.

This Day 2 of a 7 Trading Day Time Stop. The IBD Rankings are below the CANSLIM standard

IBD Rankings 06/19/19

Composite Rating: 82

EPS Rating: 49

RS Rating: 90

Group RS Rating: A

SMR Rating: C

Acc/Dis Rating: C+

ROE: 95.32

Debt: 380%

Outstanding Shares: 203.3m

Float: 201.3m

EPS Due Date: 8/26/19

I got filled at $28.28

-5% Stop: $26.87

20% Target = $33.94

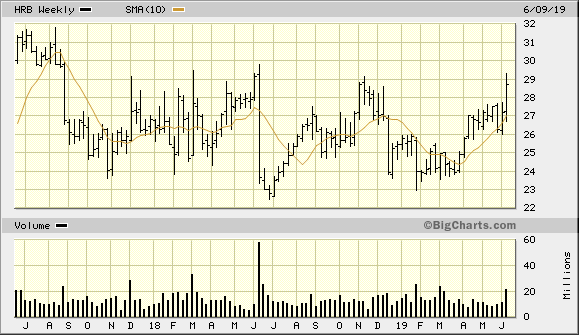

Dr Alexander has a triple screen for viewing charts and Trading for a Living is why I use the following charts

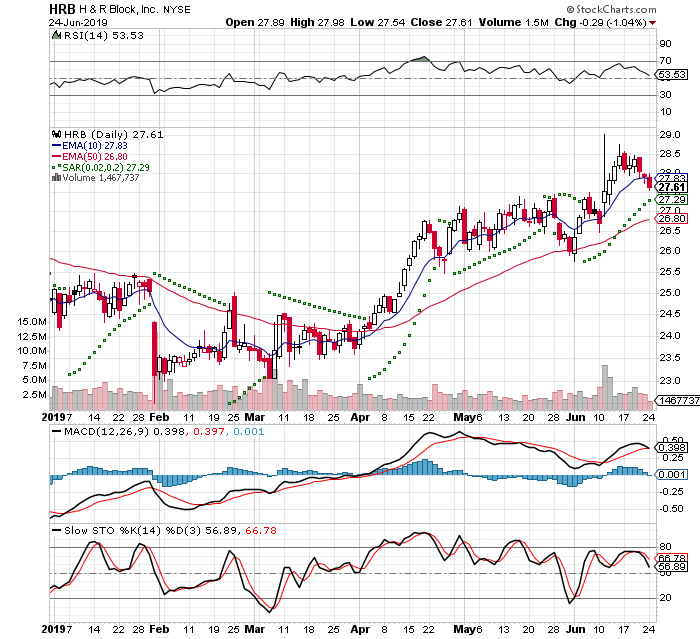

2019-06-24

I closed out the position today and got filled at $27.80. I had bought this on the MACDH positive cross over and that is about to cross back to negative. Also this had hit my 7 Trading Days Time Stop. Time to move on, but this is still on my watch list

28.28 -27.80 = -.48 / 28.28 = -1.7%