2019-07-07

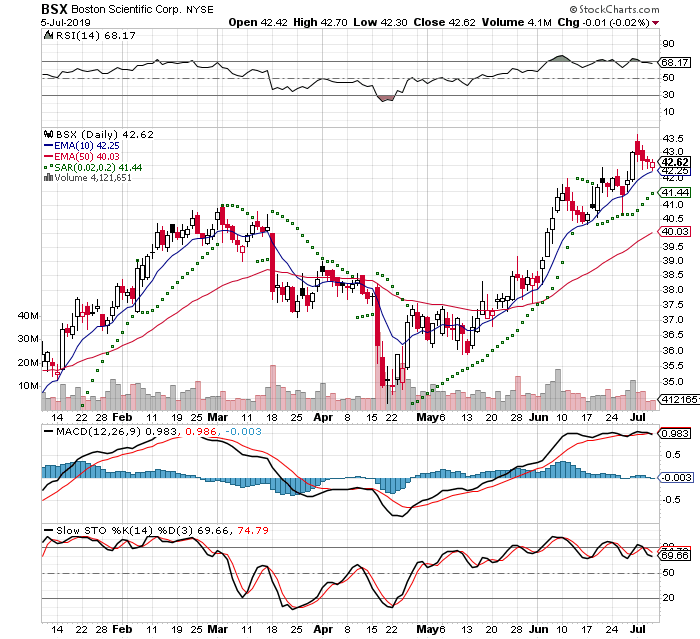

This trade idea came to me a while ago. I had bought this and was one day from my 7 Day Time Stop. It was on Day 5 the indicators I use looked like it was going to turn downward. I was already down I sold.

I first traded it on 2019-06-20 I placed the order late in the afternoon. On that trade

My cost basis: $41.86

-5% stop: $39.78

+20% Gain: $50.24

I kept that on my watch list and then I bought back in on 2019-07-01. This is a risky position, because earnings is 2 weeks away

My cost basis: $

-5% Stop: $

+20% Gain: $

IBD Rankings 07/07/19

Composite Rating: 96

EPS Rating: 85

RS Rating: 87

Group RS Rating: A-

SMR Rating: A

Acc/Dis Rating: A+

ROE: 26.2%

Debt: 55%

Outstanding Shares: 1390.7m

Float: 1376.7m

EPS Due Date: 07/24/19

Trading for a Living: Psychology, Trading Tactics, Money Management

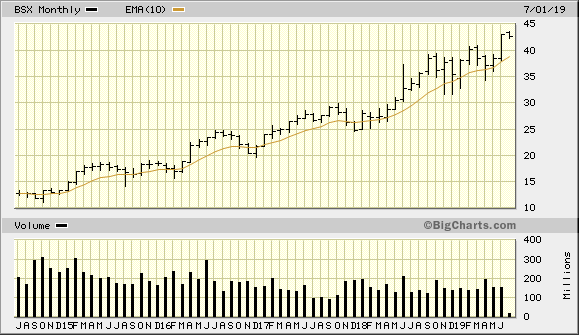

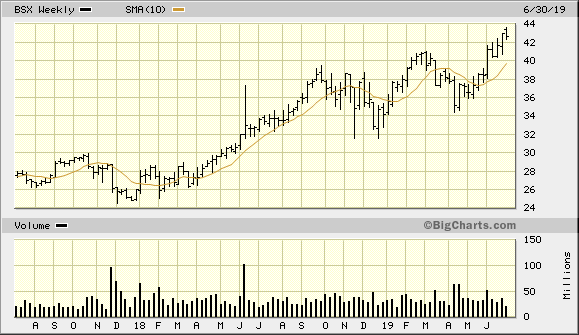

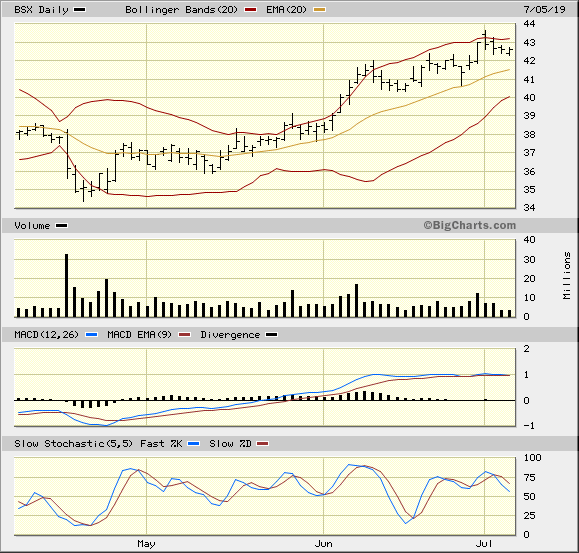

Dr Alexander has a triple screen for viewing charts and Trading for a Living is why I use the following charts