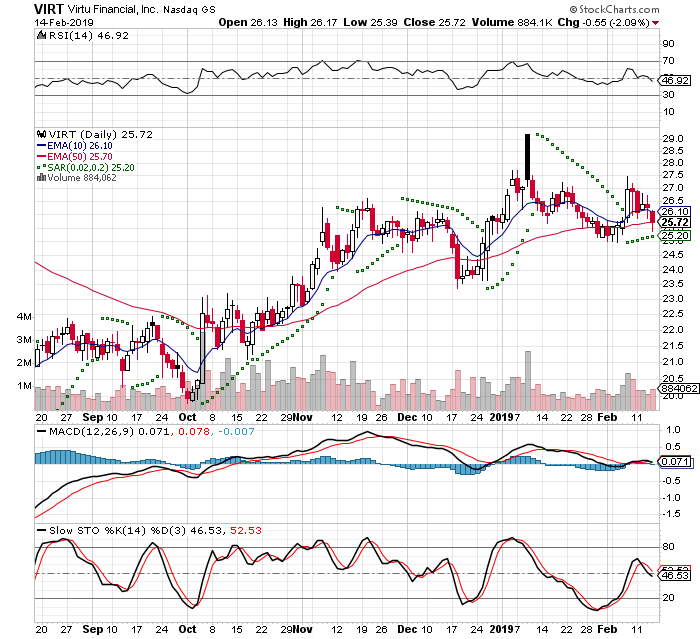

2019-02-14

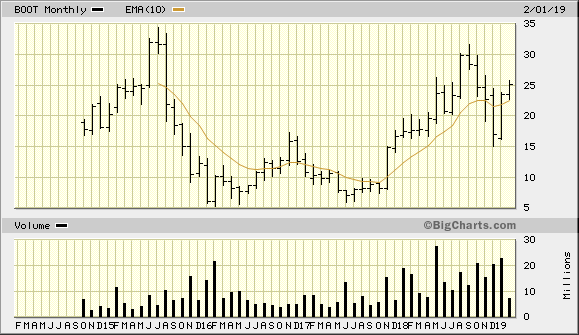

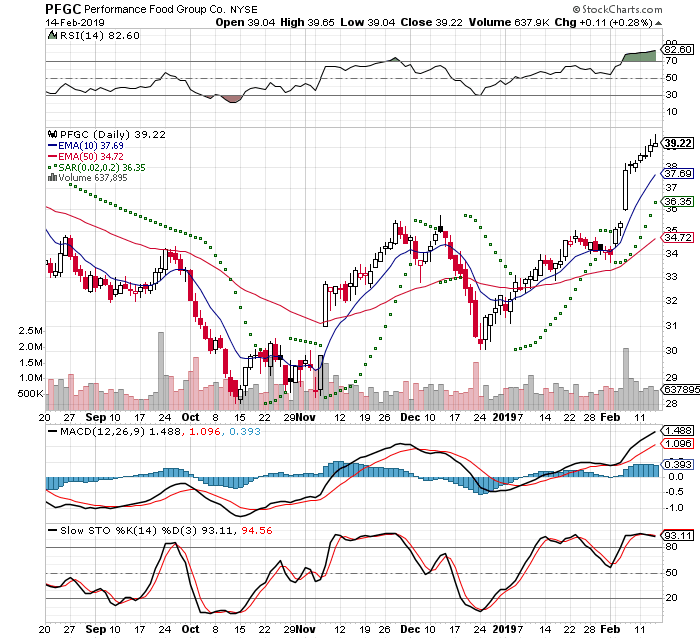

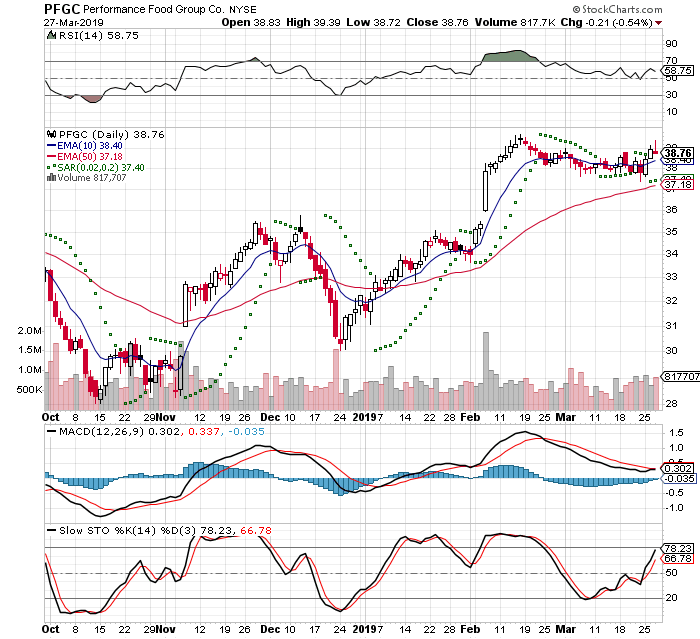

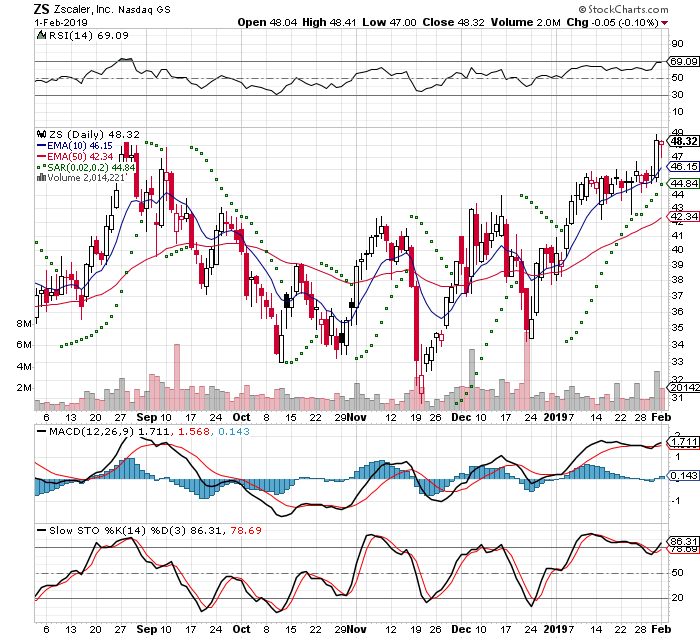

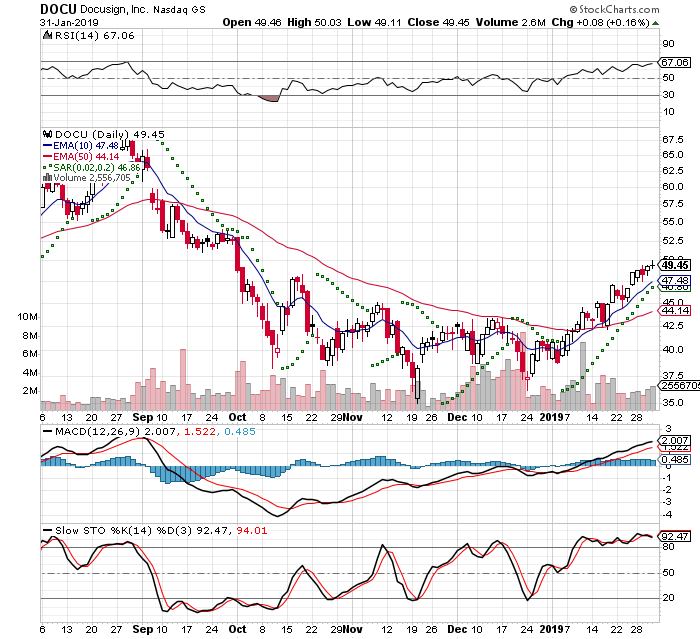

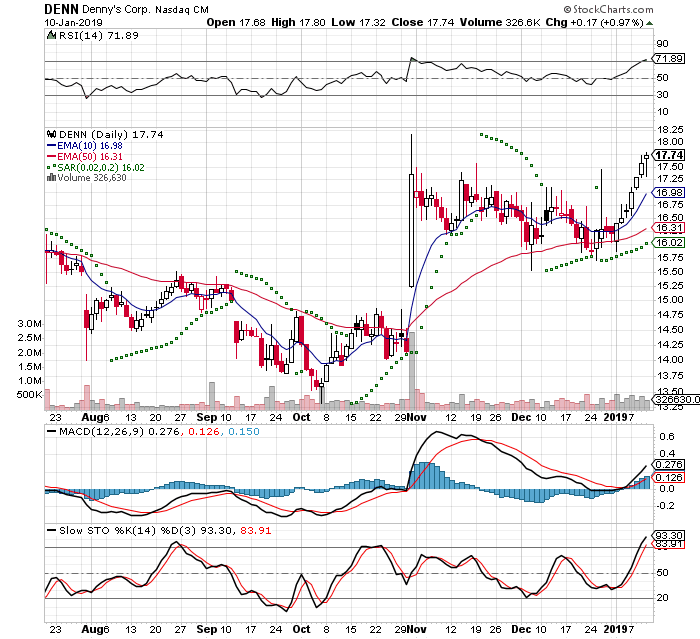

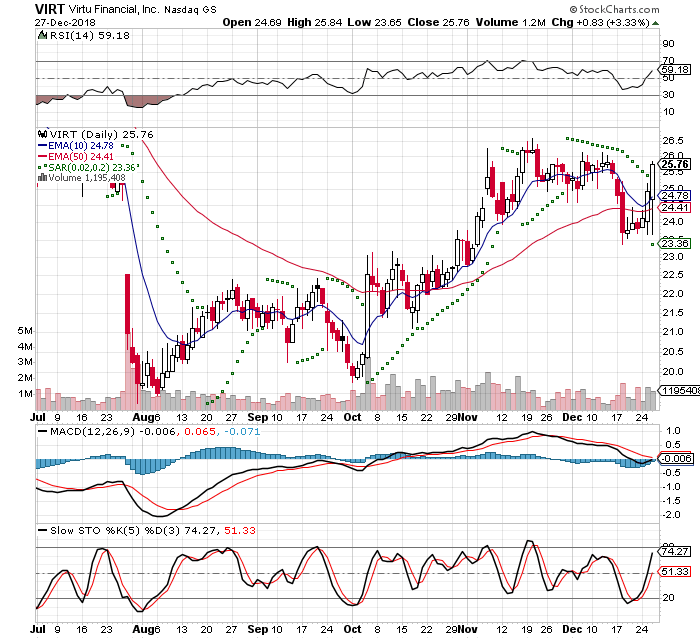

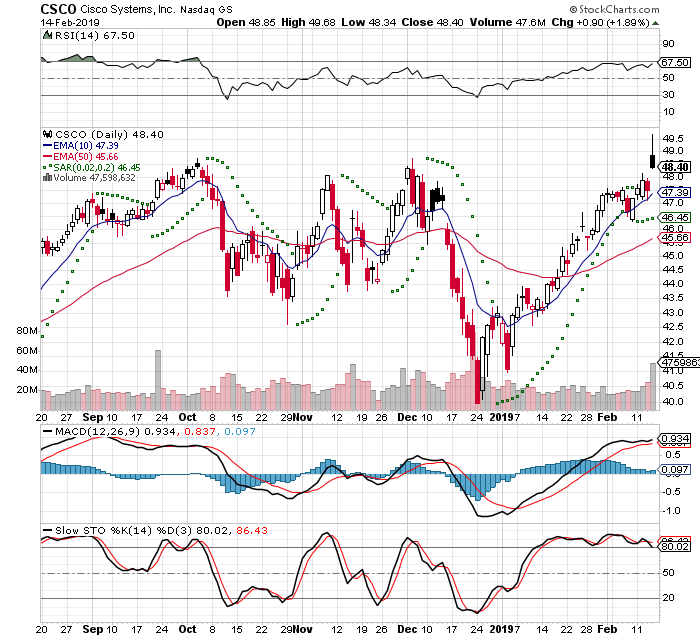

I bought this around 11 AM CST. This was featured in the IBD Stocks on the Move today. They reported earnings this morning and it popped. This was an impulsive trade and really didn't research it. The chart is sloppy and not really confident in this trade

It was a buyable gap up and check out the setup: In The Trading Cockpit with the O'Neil Disciples: Strategies that Made Us 18,000% in the Stock Market

This Day 1 of a 7 Trading Day Time Stop. The IBD Rankings are below the CANSLIM standard

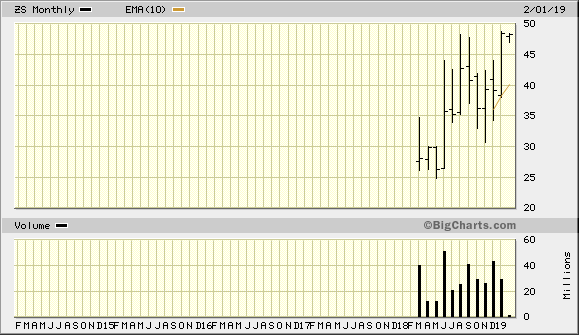

I got filled at $48.86

-5% stop = $46.42

20% Target = $58.63

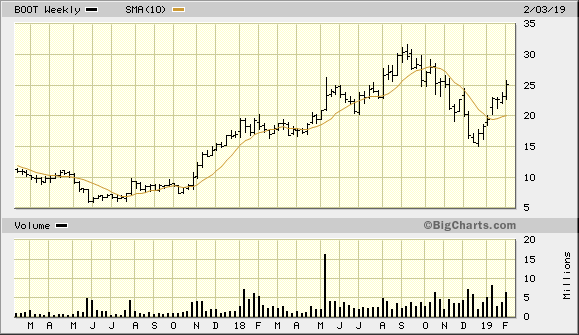

IBD Rankings 02/14/19

Composite Rating: 73

EPS Rating: 76

RS Rating: 82

Group RS Rating: D-

SMR Rating: A

Acc/Dis Rating: D+

ROE: 23.2%

Debt: 47%

Outstanding Shares: 4496.0m

EPS Due Date: 5/16/19

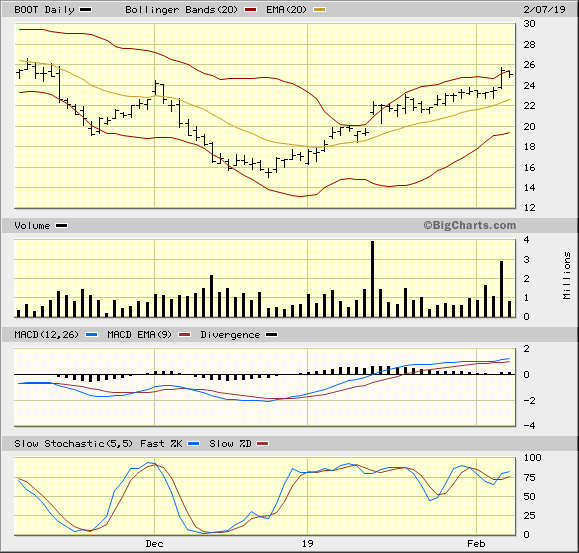

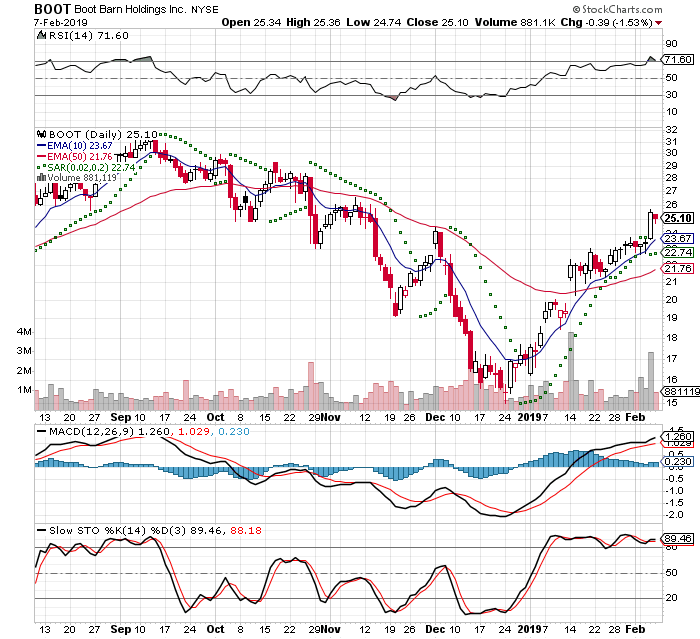

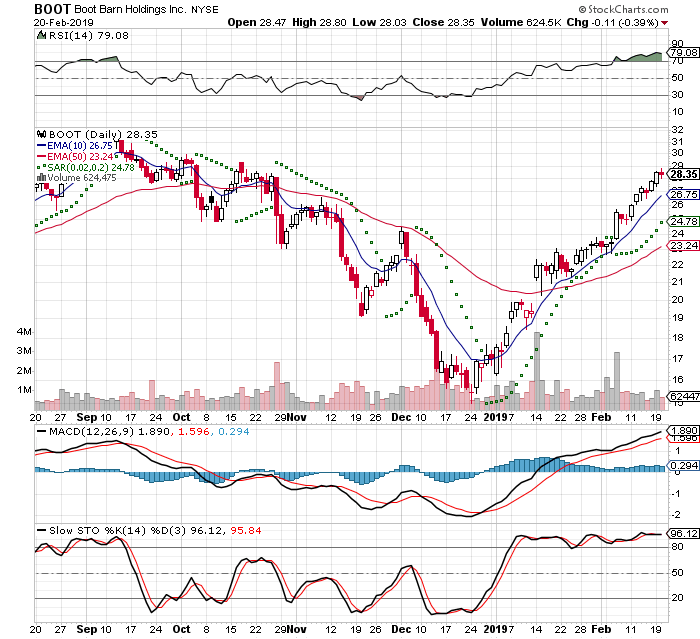

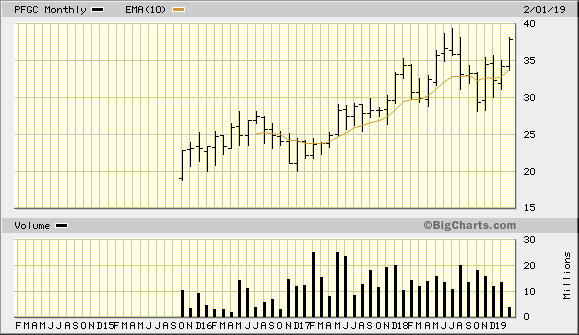

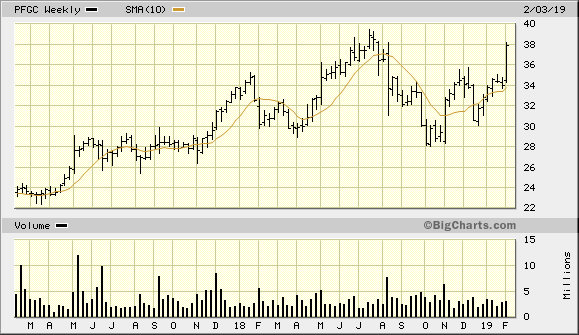

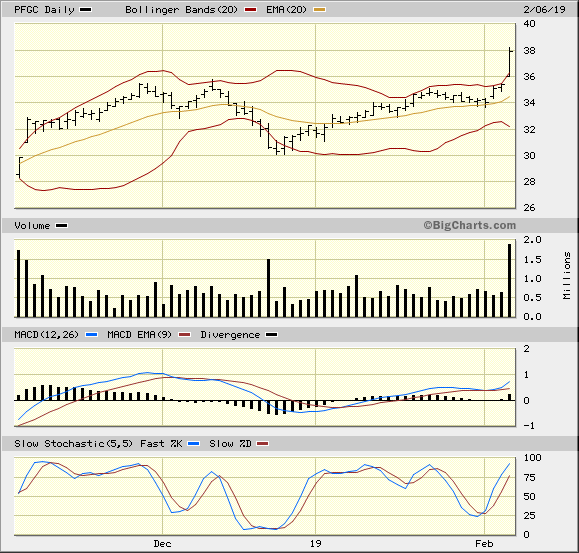

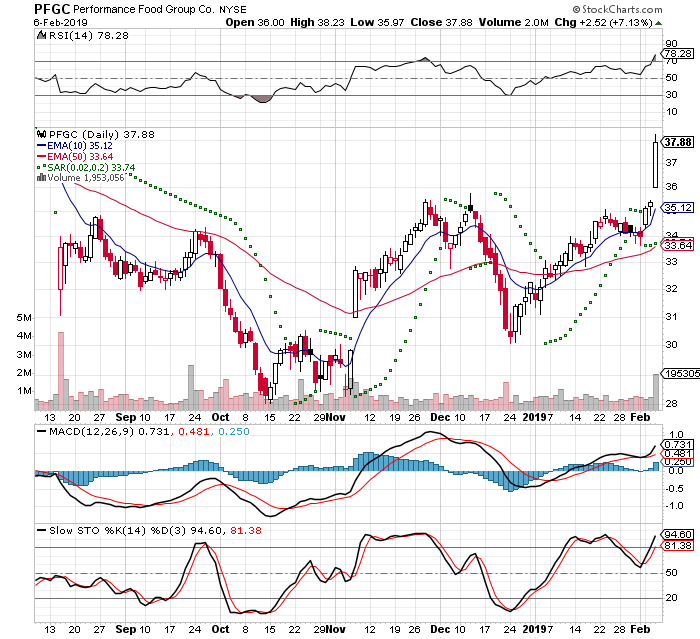

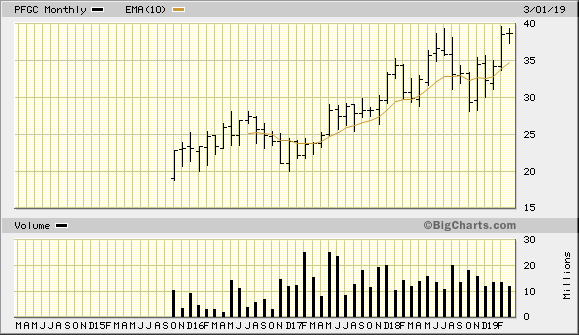

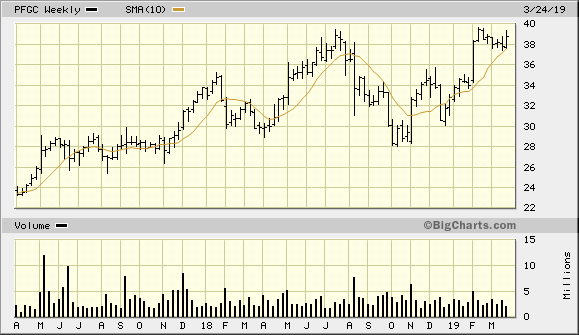

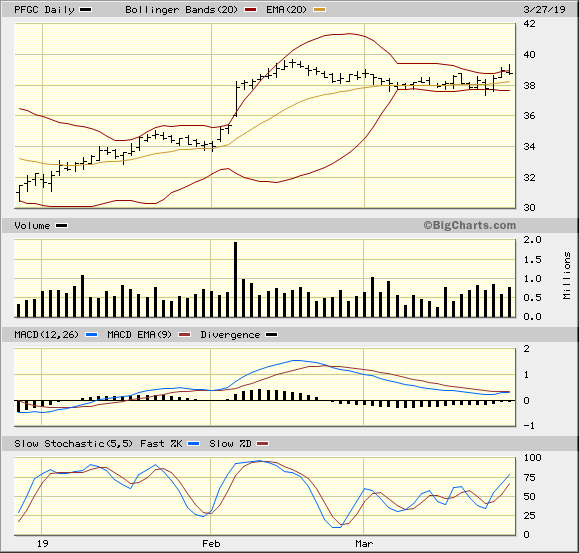

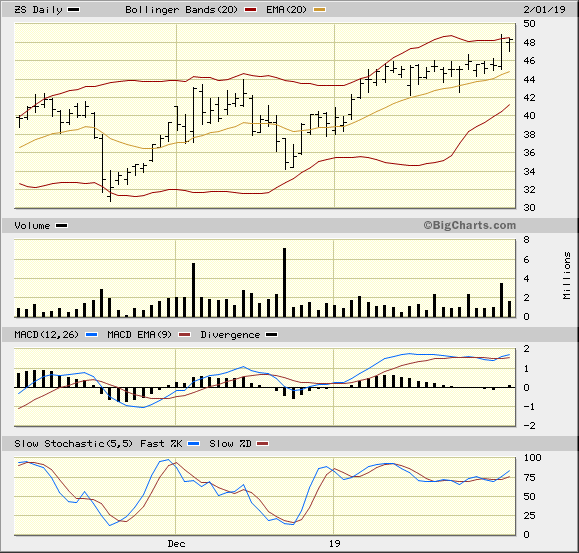

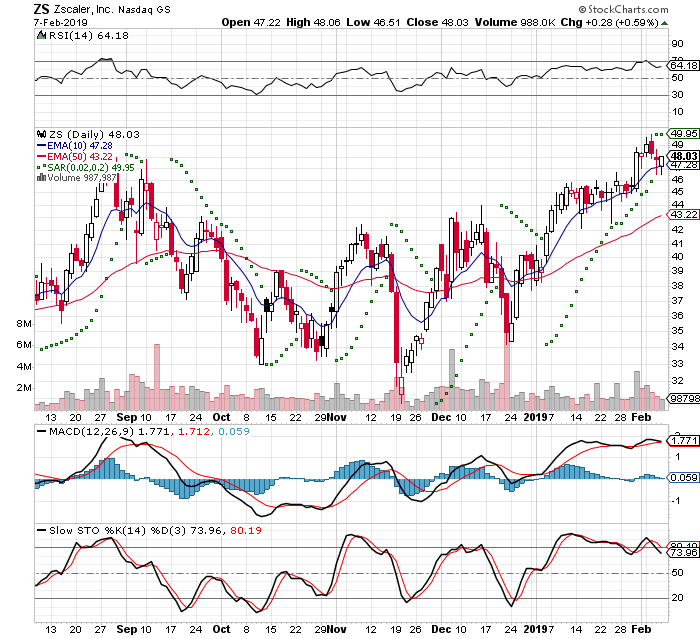

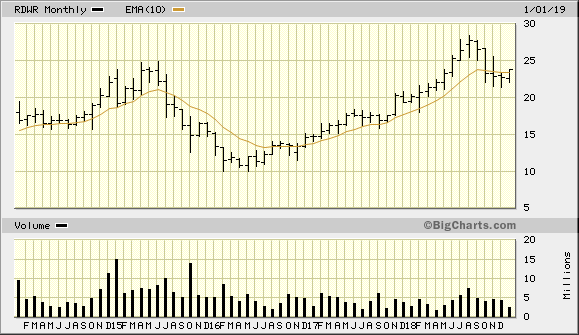

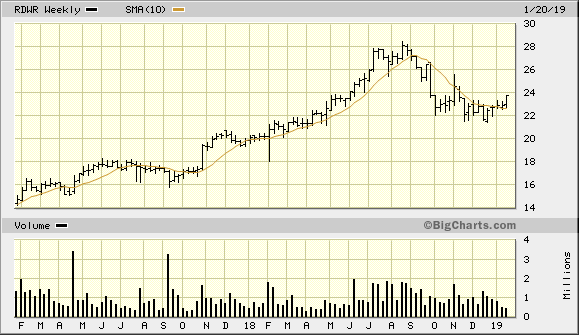

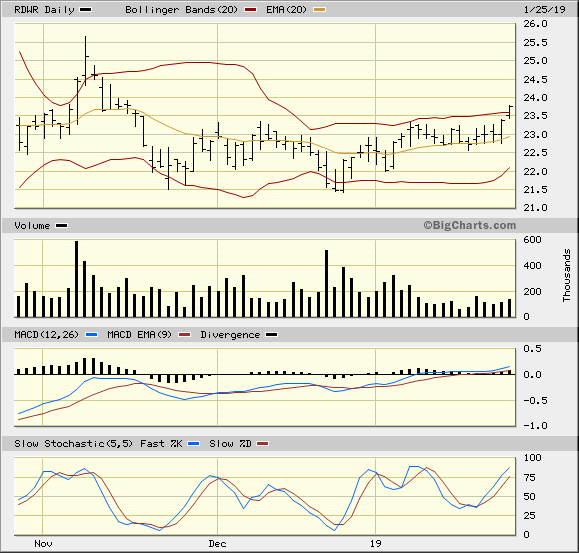

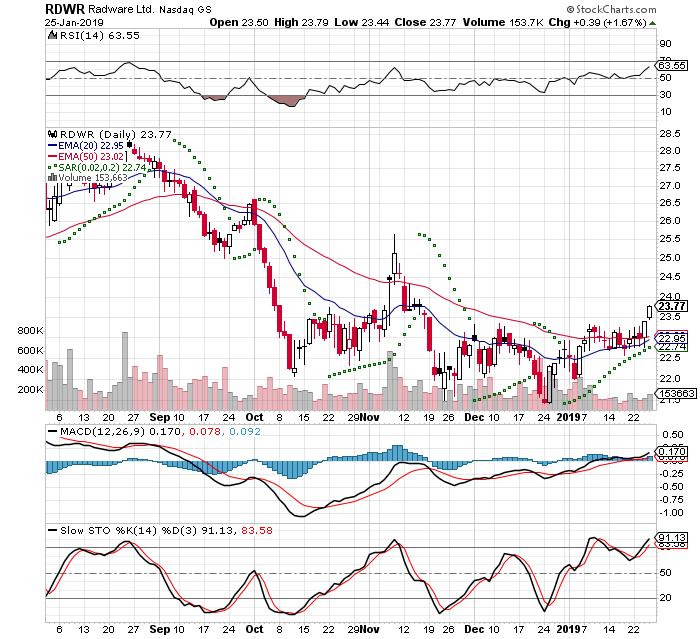

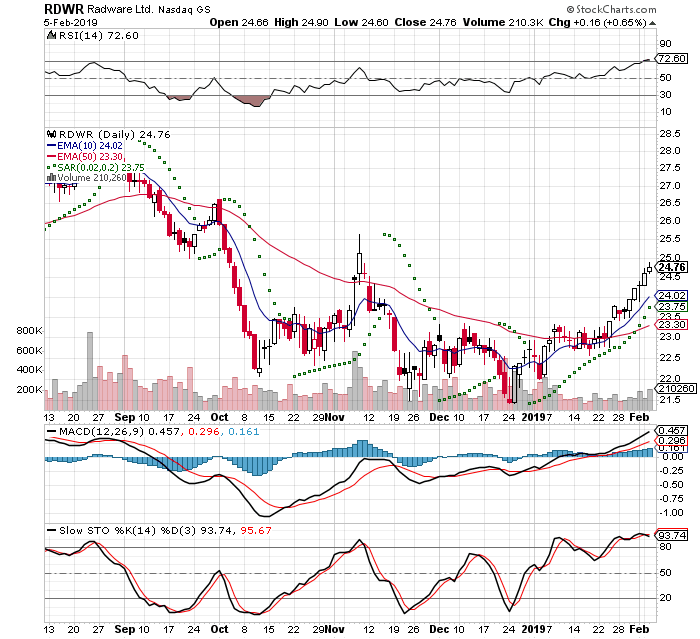

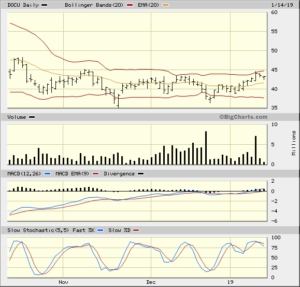

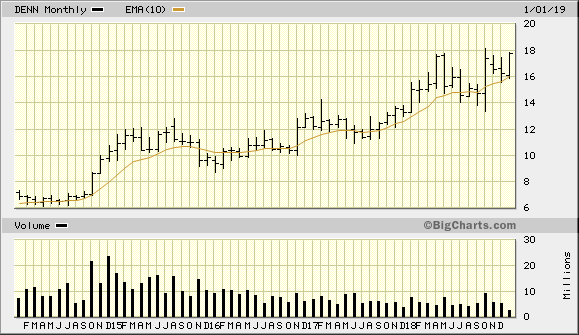

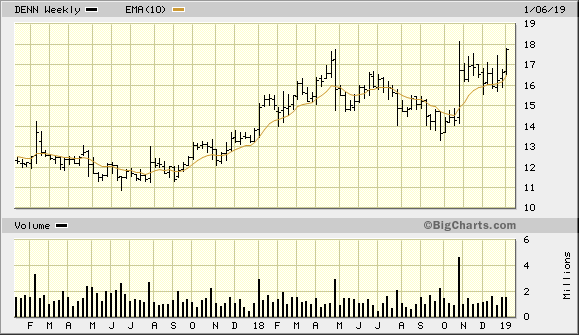

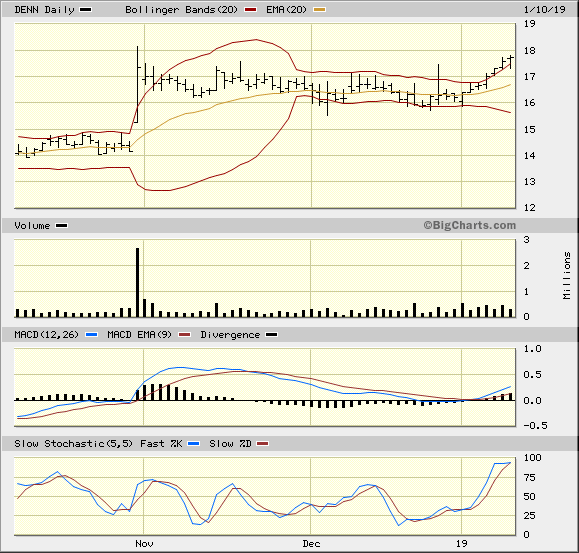

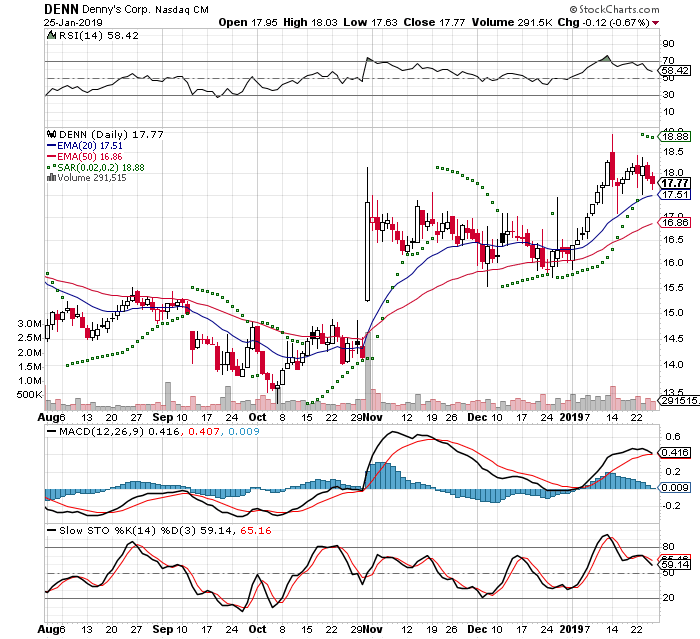

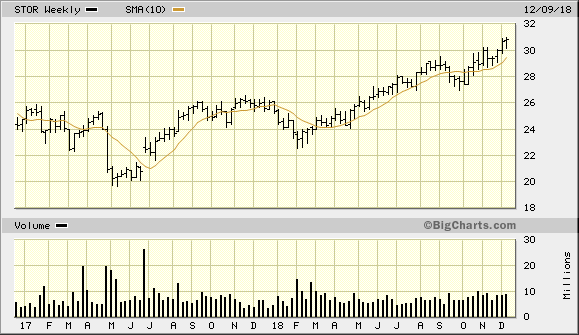

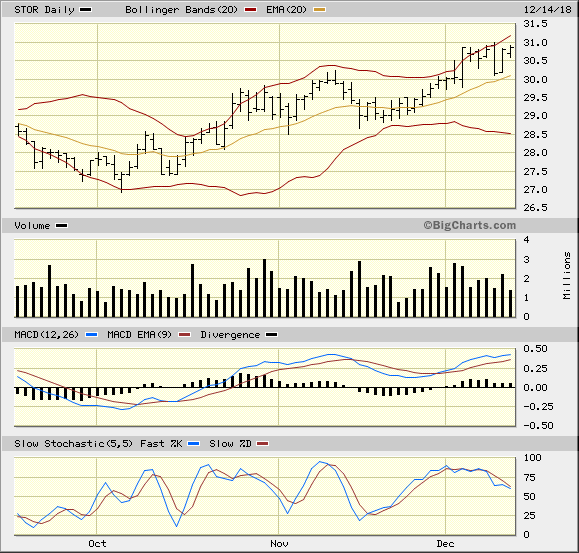

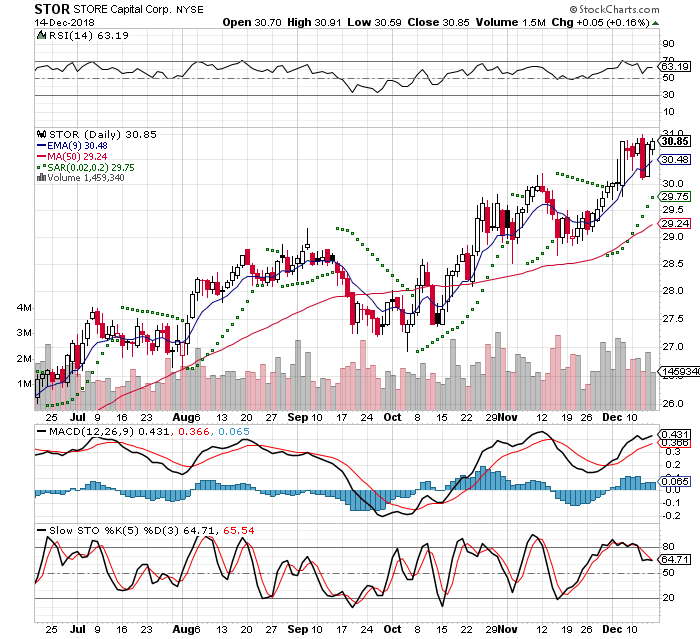

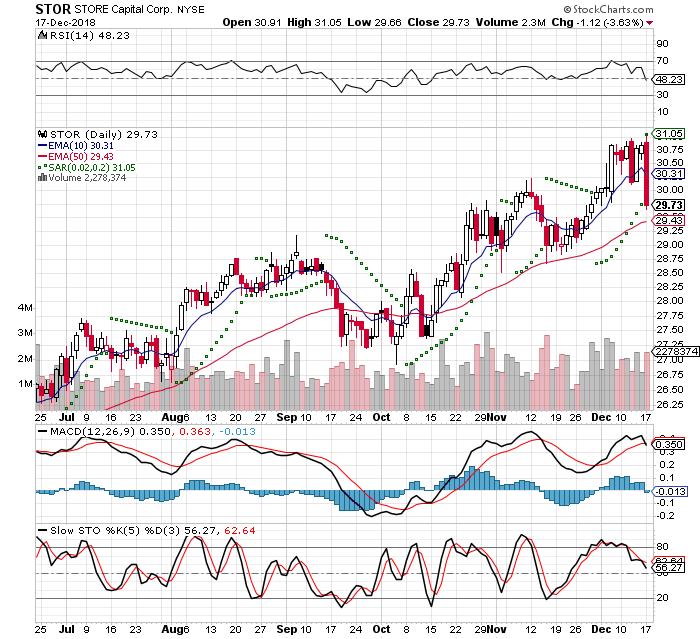

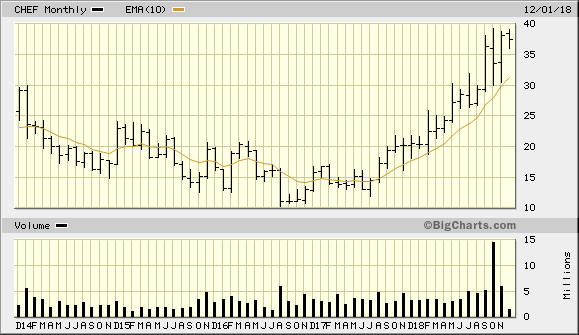

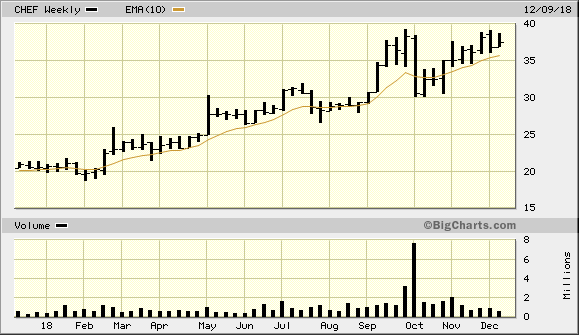

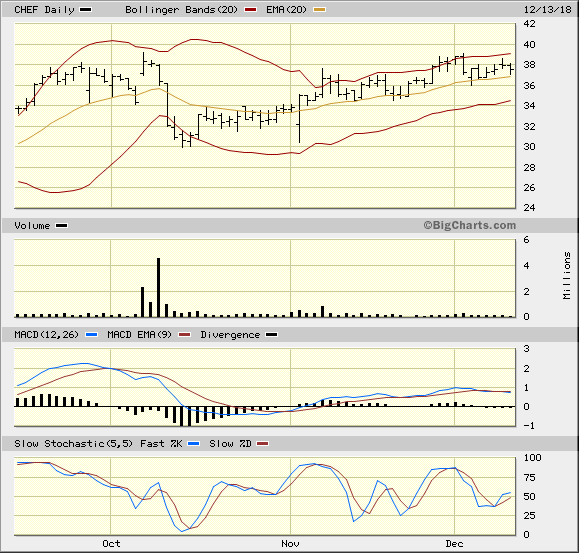

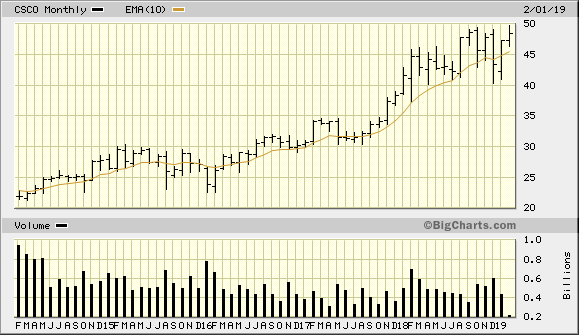

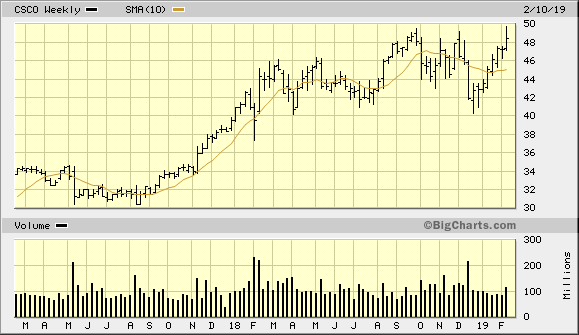

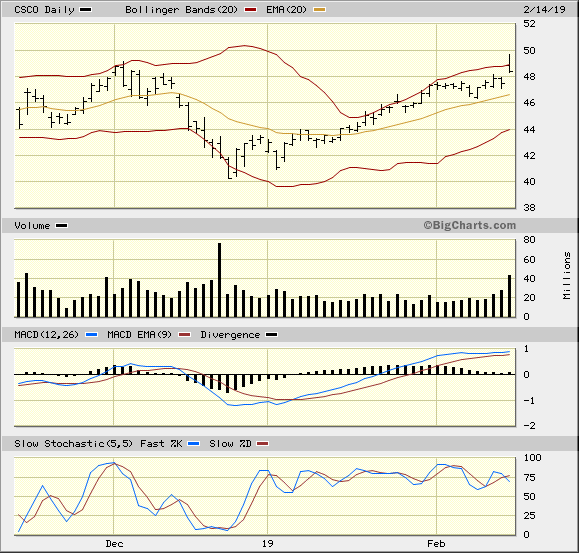

Dr Alexander has a triple screen for viewing charts and Trading for a Living is why I use the following charts

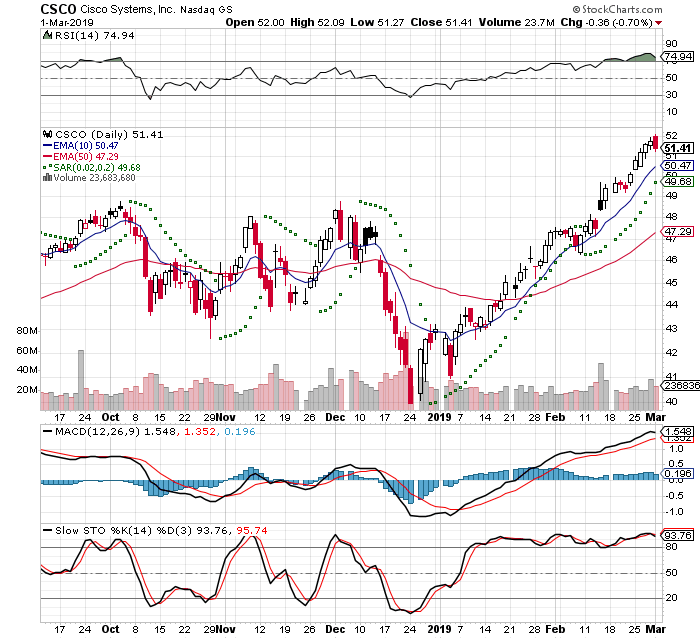

2019-03-03

I closed out of this position in order to be all in cash. I had made a couple of bad trades and wanted to take a step back. I will be scaling back in as the opportunities as the pop. I got filled at $51.78

51.78 - 48.86 = 2.92 / 48.86 = 5.9%