2020-06-01

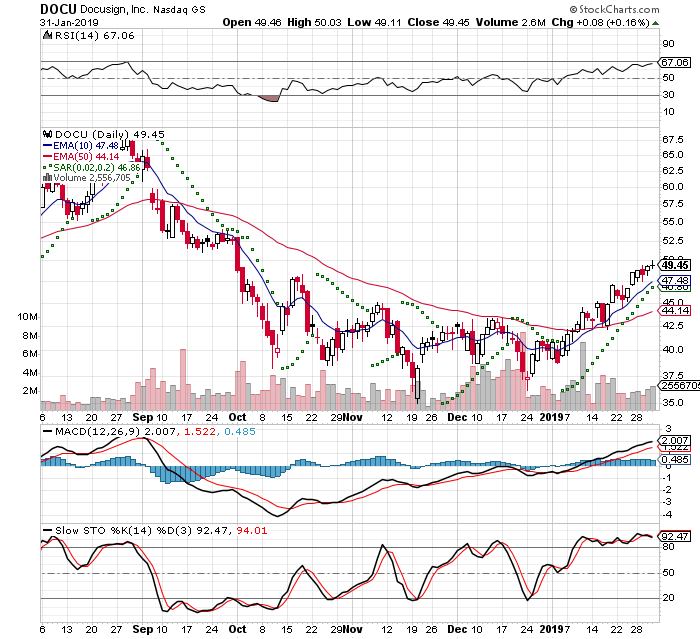

This trade idea from my IBD Stock Screener in my review last night and I decided to pull the trigger

This first came on my radar when it was featured as #28 in IBD50 on Vol37 No 6 Week of May 08. 2020. Then TSM was featured on IBD Stocks on the Move on the 05/13 and 05/14. Currently it is #31 in IBD50 Vol 37 No 8. I am an Investor’s Business Daily guy and highly recommend all of their efforts

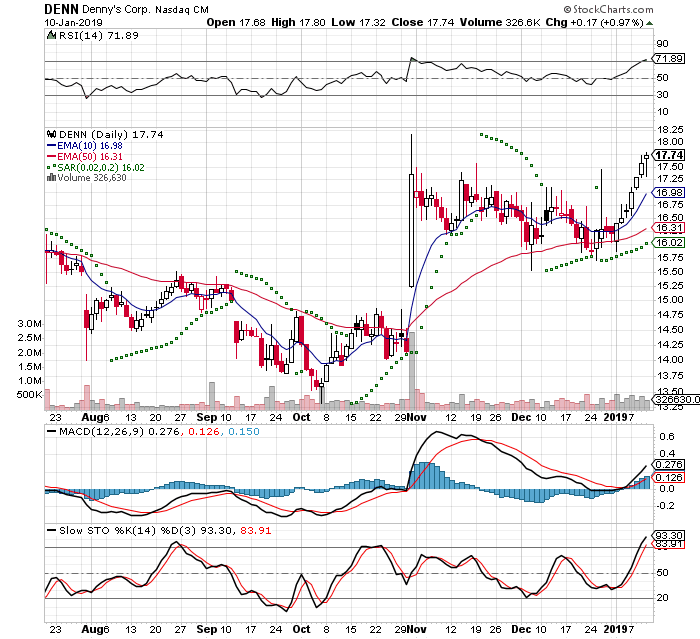

During my weekly review I had liked the charts and I decided on buying an In-The-Money Call Option just past earnings. If earnings get adjusted back this position is screwed\

I placed a Buy to Open Limit Order with the price split between the previous Bid/Ask spread. However it opened higher and did not get filled. I was nervous after lunch that I wouldn’t get filled

I cancelled the order and set the price .30 higher splitting the current Bid/Ask spread. I got filled at $2.80 with 2 contracts

IBD Rankings 06/01/20

Composite Rating: 95

EPS Rating: 89

RS Rating: 79

Group RS Rating: B+

SMR Rating: A

Acc/Dis Rating: D+

ROE: 20.9%

Debt: 2%

Outstanding Shares: 5186.1m

EPS Due Date: 07/16/20

From TD Ameritrade Quote Summary 06/01/20

P/E Ratio: 19.50

Ex-dividend date: 06/18/20

Zack’s has this as 1 – Strong Buy: TSM

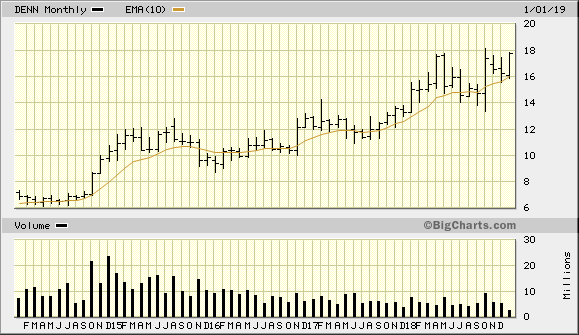

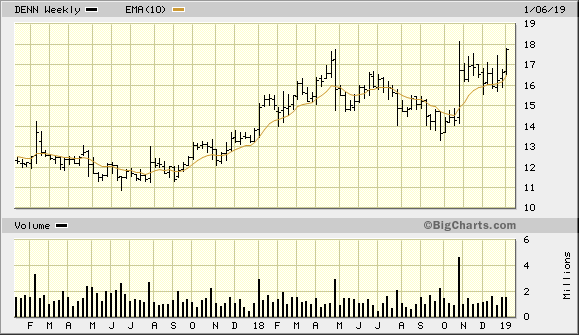

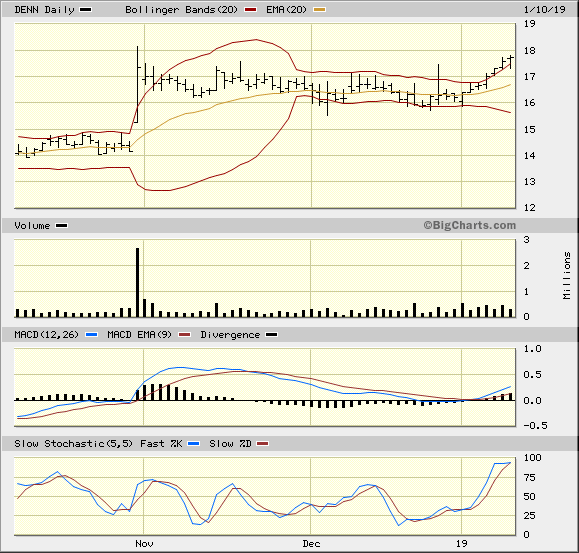

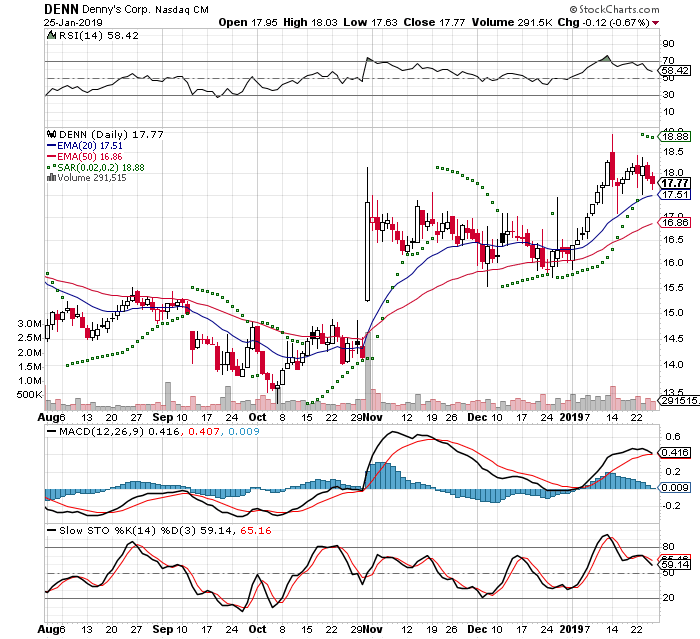

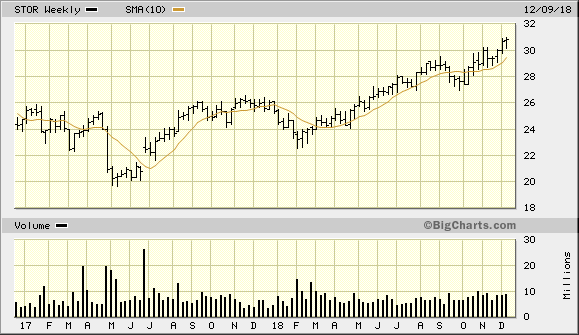

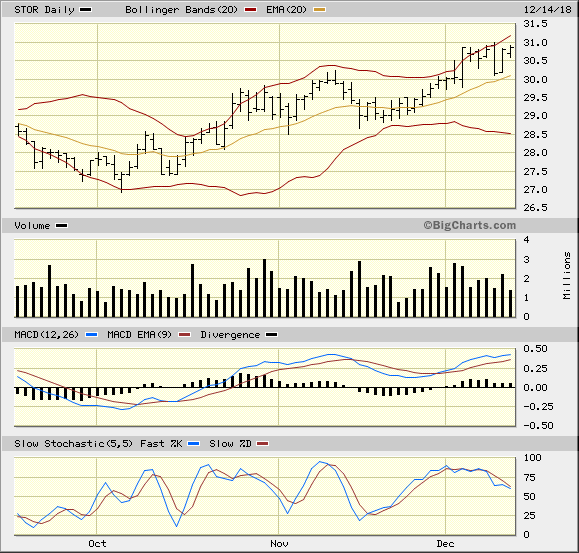

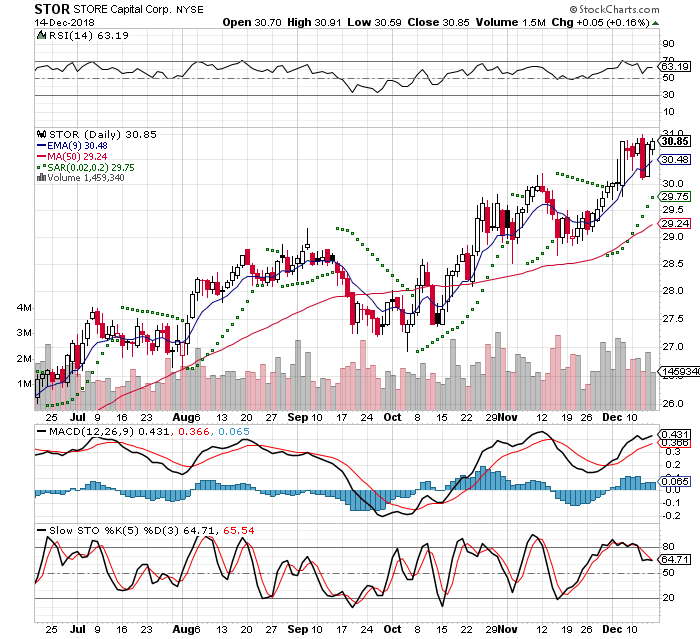

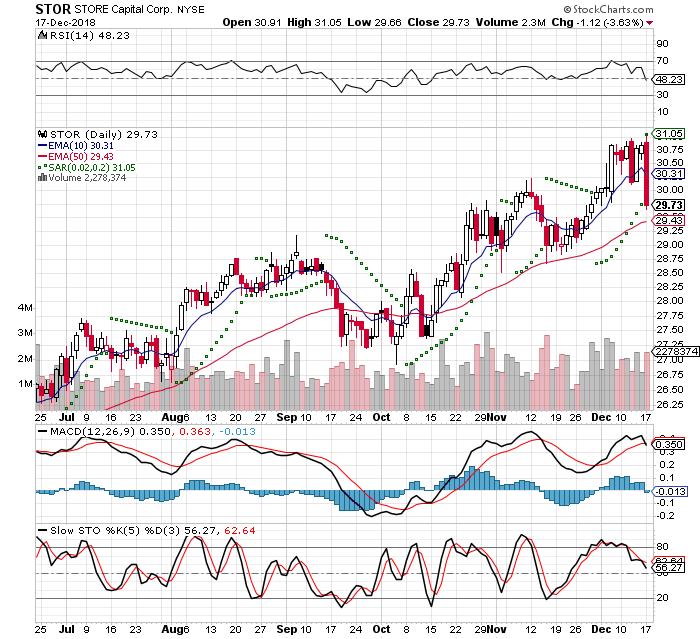

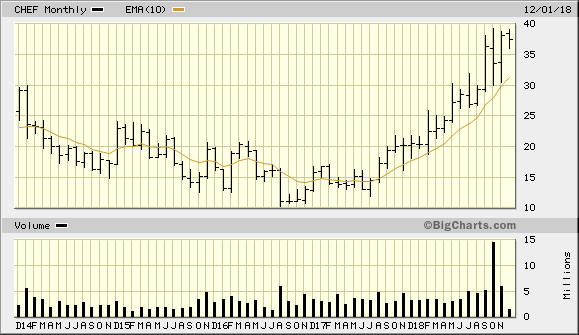

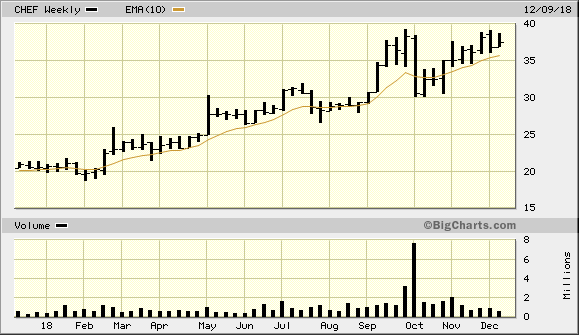

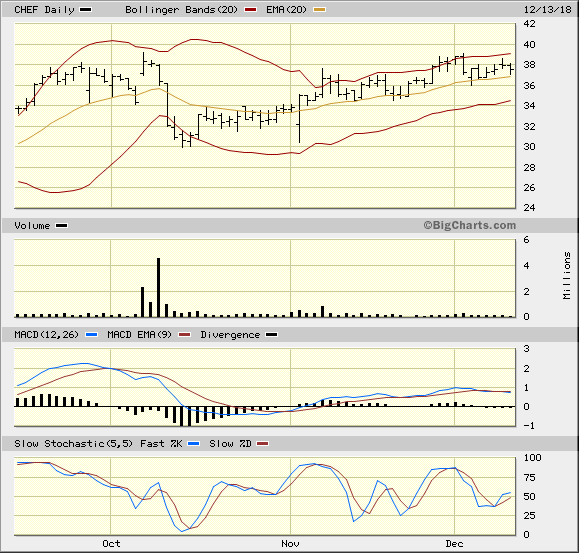

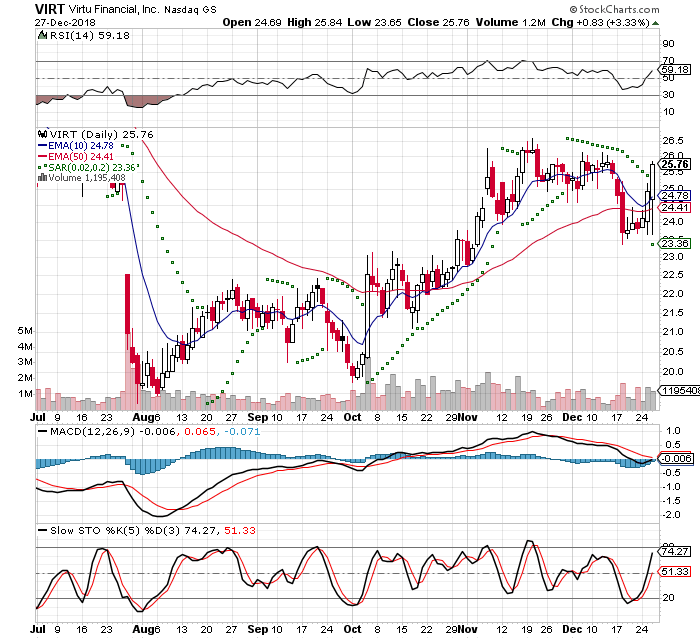

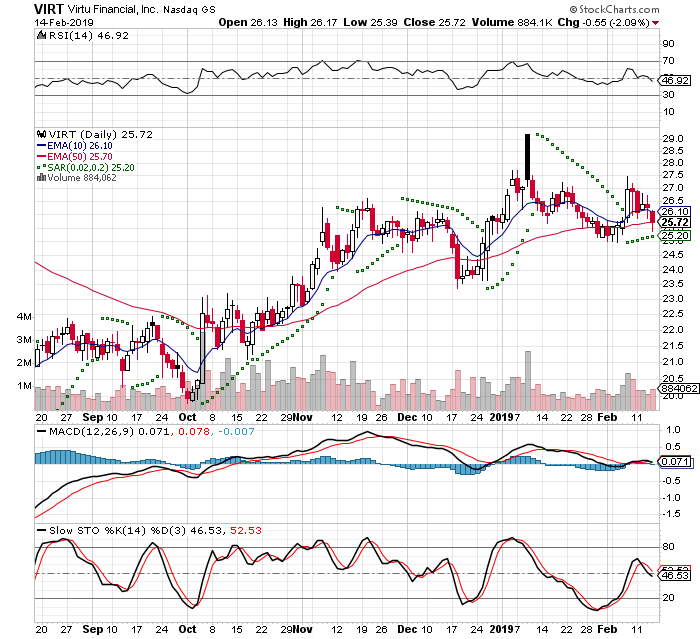

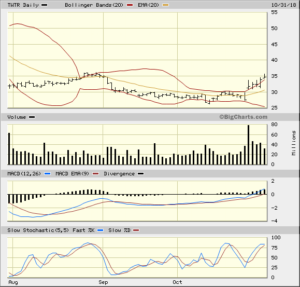

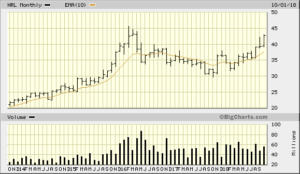

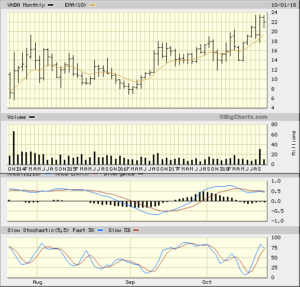

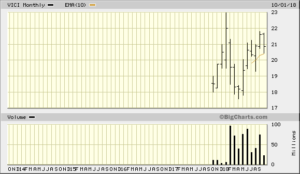

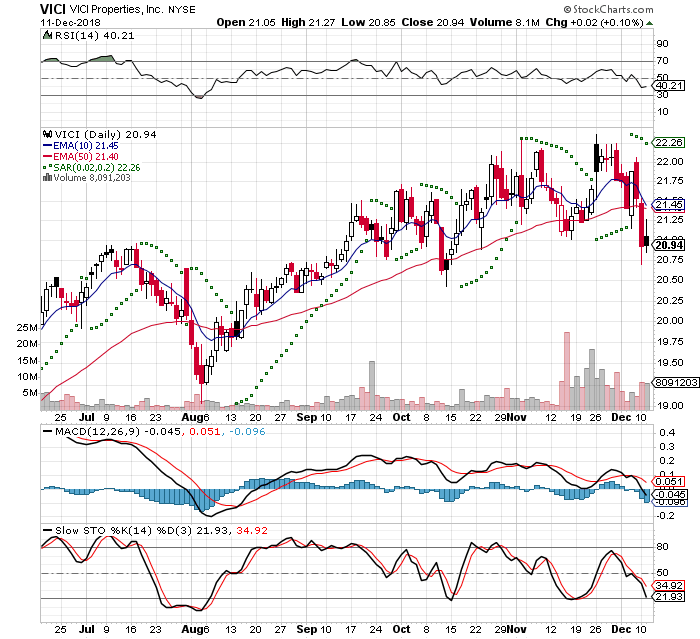

Dr Alexander has a triple screen for viewing charts and Trading for a Living is why I use the following charts

Let me know what you think…