Yahoo Finance Profile Description

OneMain Holdings, Inc., through its subsidiaries, provides consumer finance and insurance products and services. The company operates in two segments, Consumer and Insurance, and Acquisitions and Servicing. It provides secured and unsecured personal loans; credit insurance products, such as life, disability, and involuntary unemployment insurance products; non-credit insurance; and auto membership plans, as well as retail sales finance services. The company also services and holds real estate loans secured by first or second mortgages on residential real estate. As of December 31, 2018, it operated through a network of approximately 1,600 branches in 44 states in the United States, as well as through omf.com Website. The company was formerly known as Springleaf Holdings, Inc. and changed its name to OneMain Holdings, Inc. in November 2015. OneMain Holdings, Inc. was founded in 1920 and is based in Evansville, Indiana.

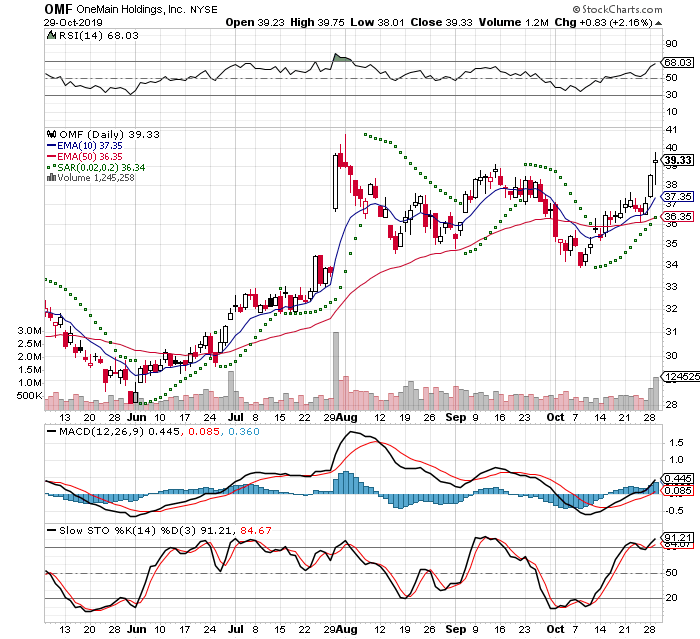

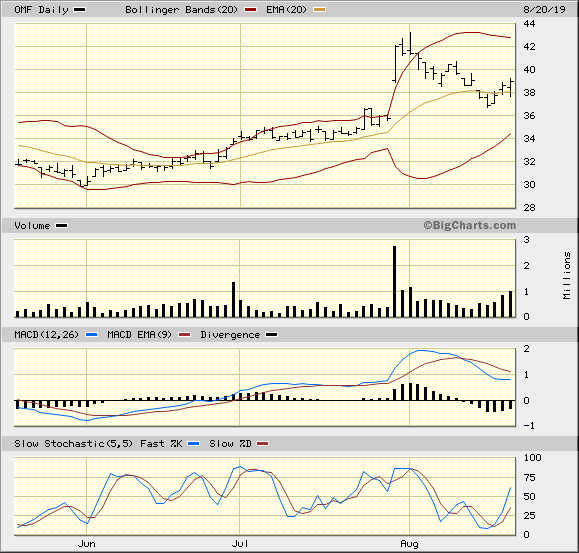

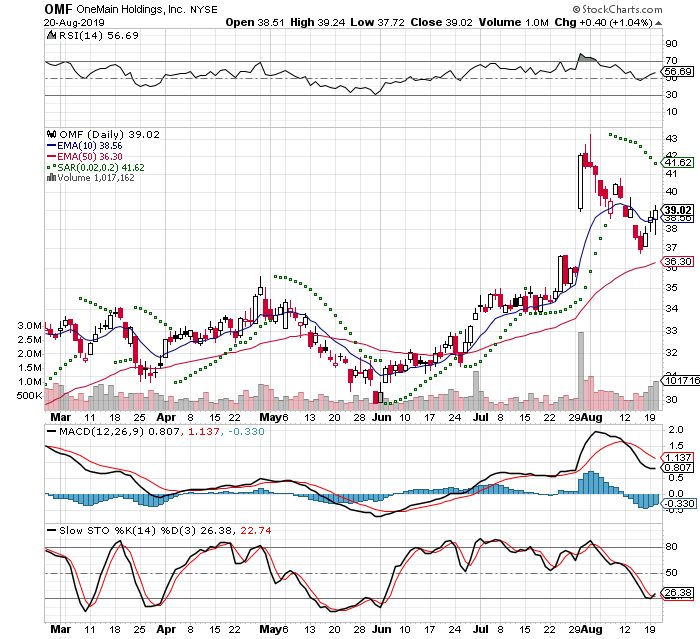

2019-08-20

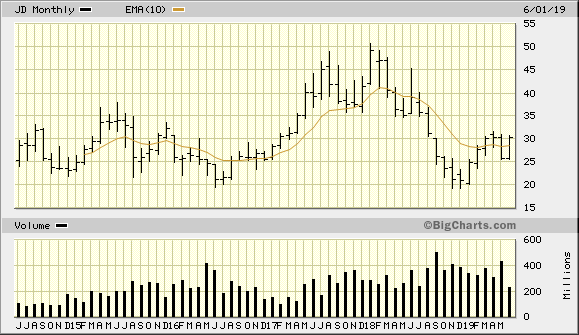

This trade idea came to my yesterday while reviewing Investor's Business Daily Stocks on the Move and today was a follow through day

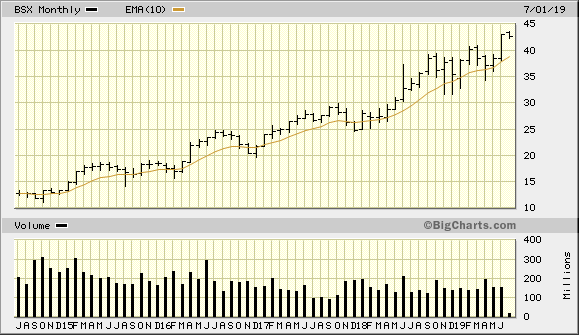

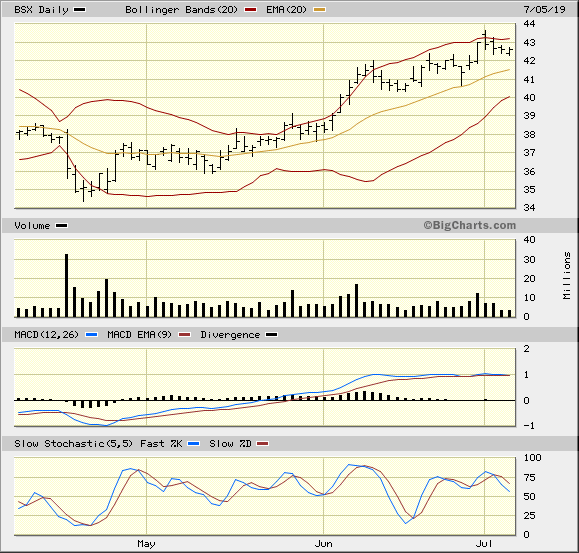

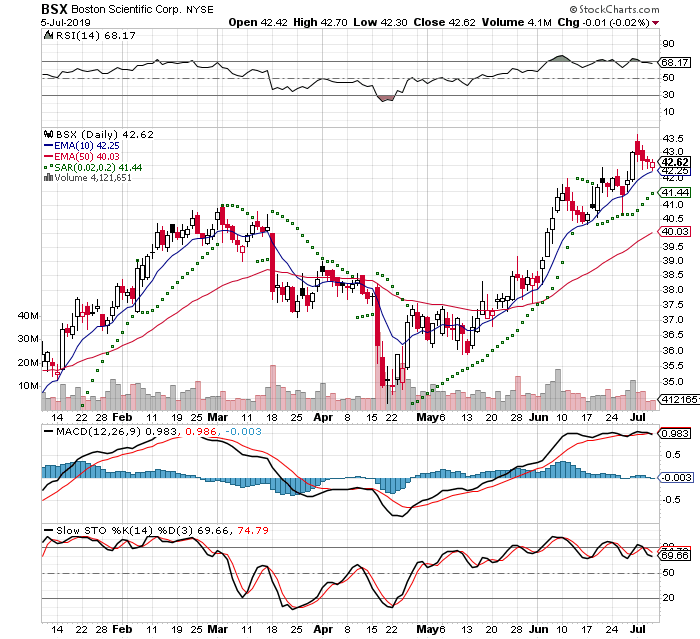

I have had some loses this month and has wiped out my gains for the year. So that being said I am hesitant in jumping back in with the current market condition. The overall market has been down for most of the month and I am currently only in Boston Scientific.

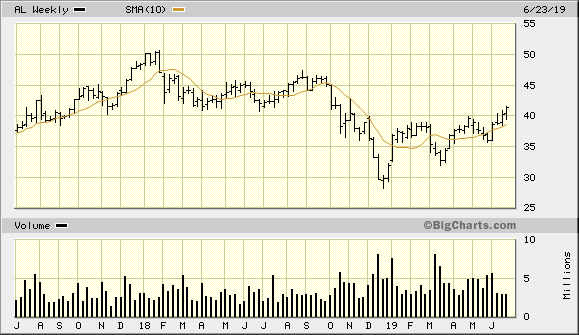

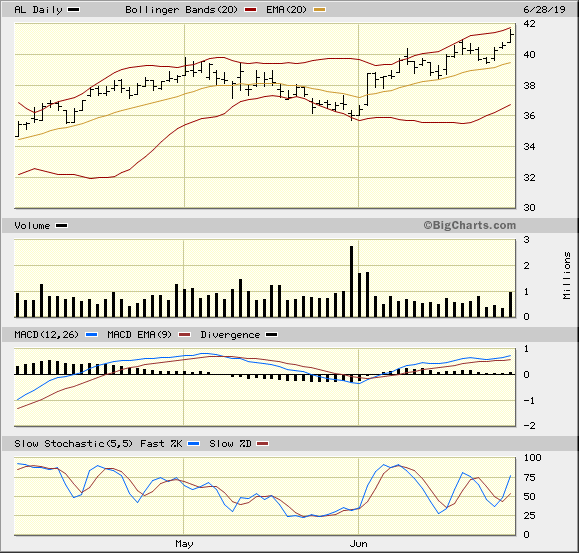

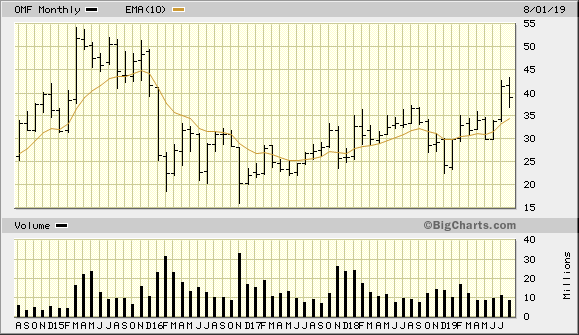

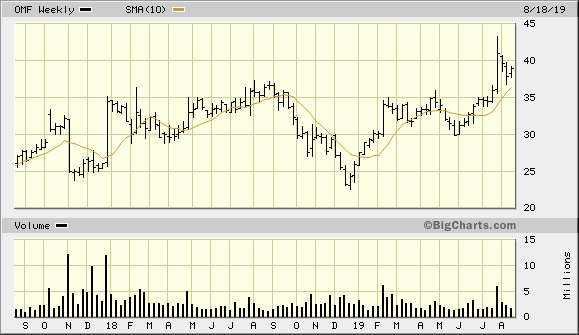

This stock has had a buy gap up and in candlestick lingo the window has been closed. It is now finding buyers again

Check out the setup: In The Trading Cockpit with the O'Neil Disciples: Strategies that Made Us 18,000% in the Stock Market

I am placing a market order tomorrow to guarantee fulfillment. The current stock price is $39.02.

2019-08-21

I got filled at $39.43 this morning

Stop Loss -8% at $35.94

This stop is -$3.09 and this is a wider stop than I normally use. The stop is based on the chart where that level is -2% from the consolidation before the gap at $36.67

Upside Target +20% at $46.83

This will hit some resistance at $43 as it approaches the previous high. That would be about a 10% gain, but I suspect that it would go higher because of the recent trading. After it hits 43 I expect a 6 - 8 week pause forming a cup and handle pattern

IBD Rankings 08/20/19

Composite Rating: 90

EPS Rating: 70 - Caution

RS Rating: 91

Group RS Rating: B1

SMR Rating: B

Acc/Dis Rating: B

ROE: 12.6%

Debt: 400% - Heavily Leveraged

Outstanding Shares: 136.1m

Float: 130.6m

EPS Due Date: 10/29/19

From TD Ameritrade Quote Summary 08/20/19

P/E Ratio: 8

Ex-dividend date: 08/26/19

Zack's has this as a Strong Buy: OMF

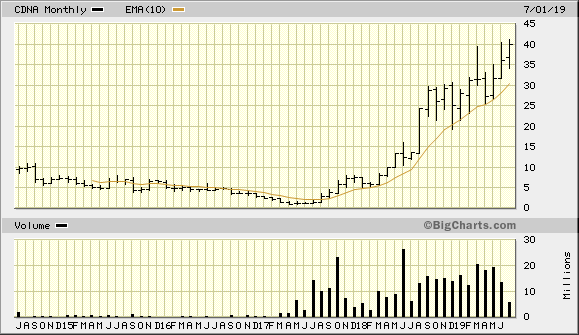

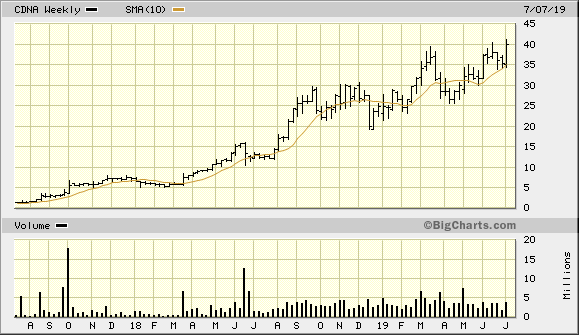

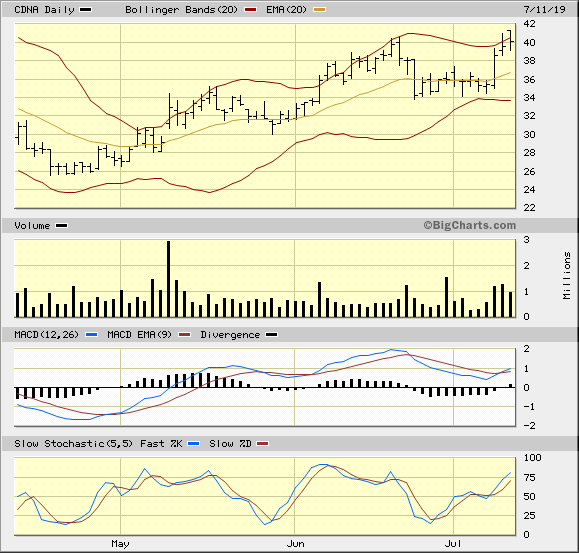

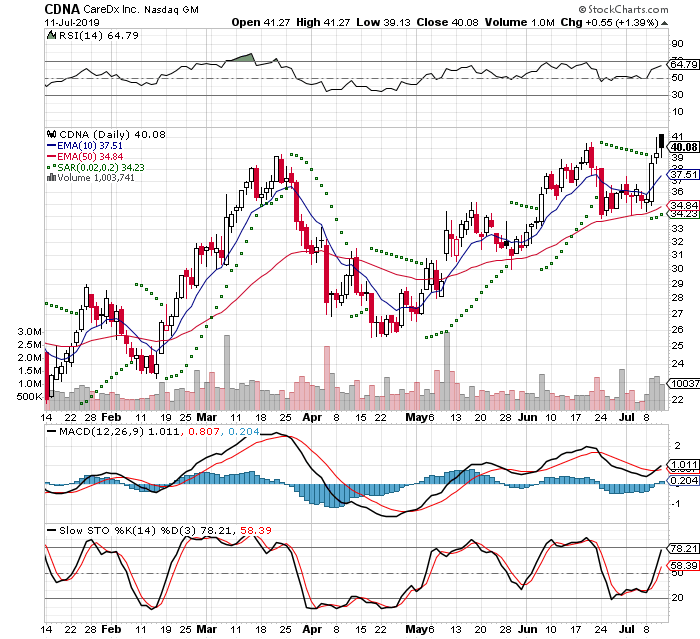

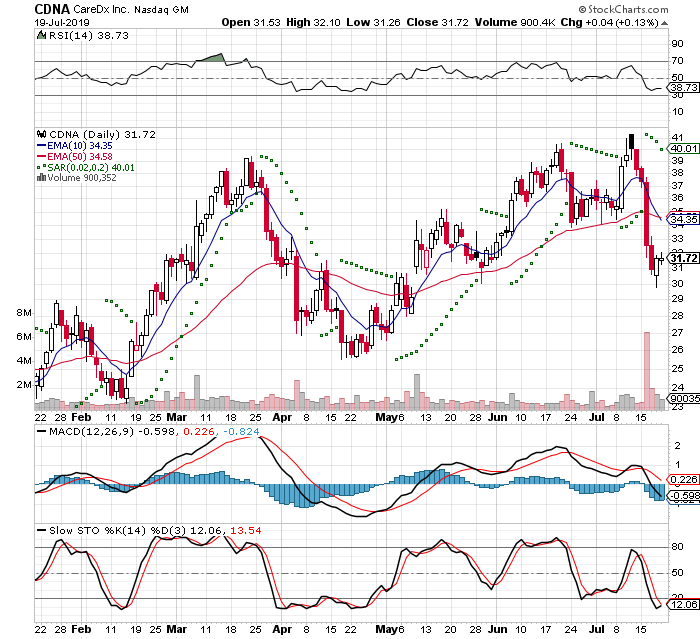

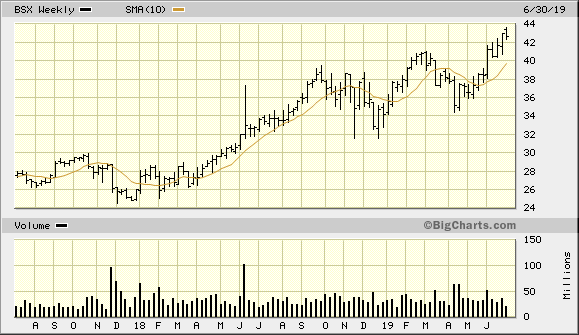

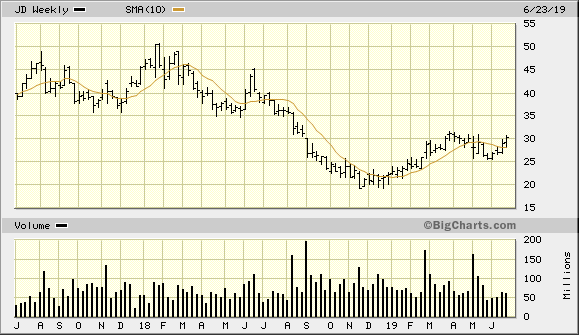

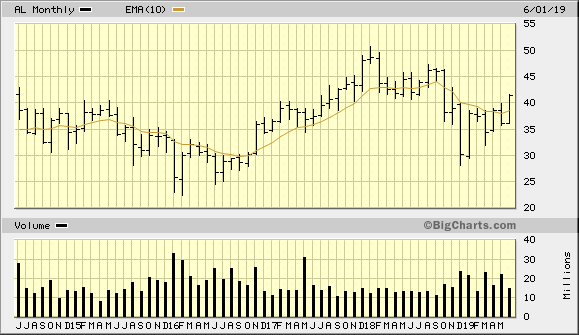

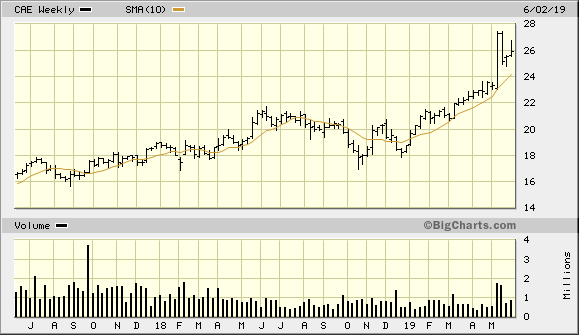

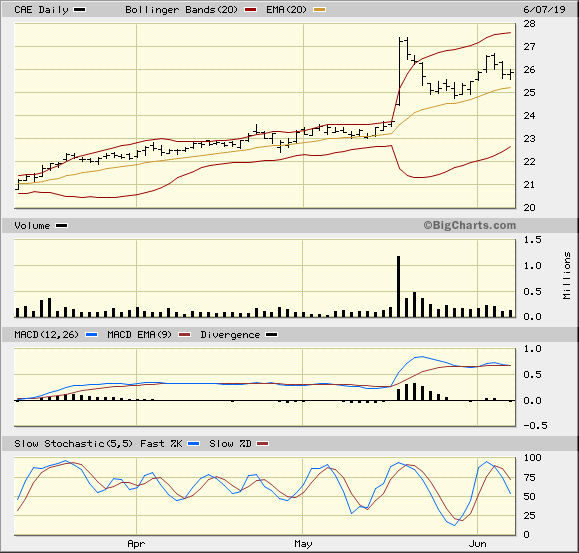

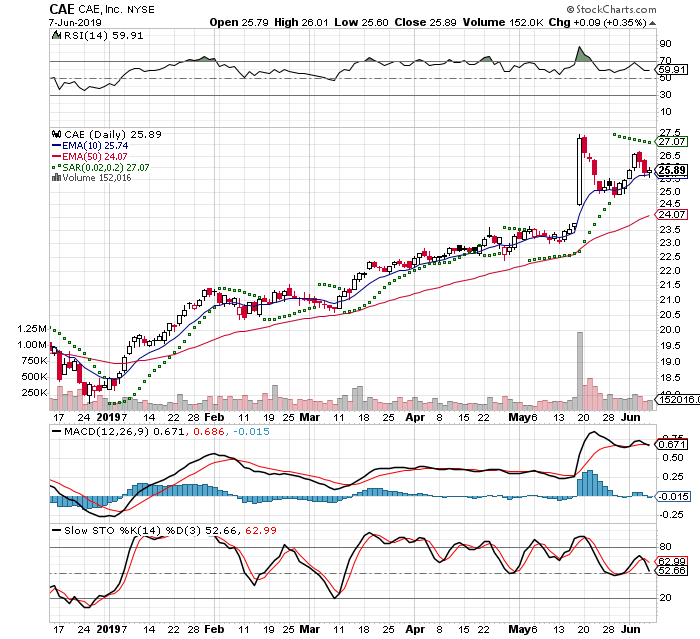

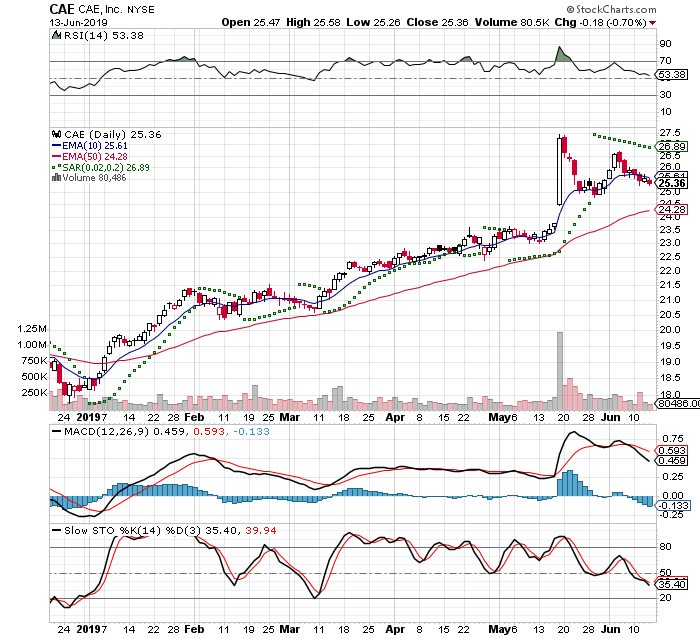

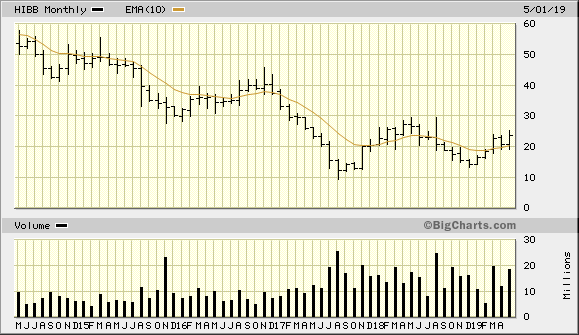

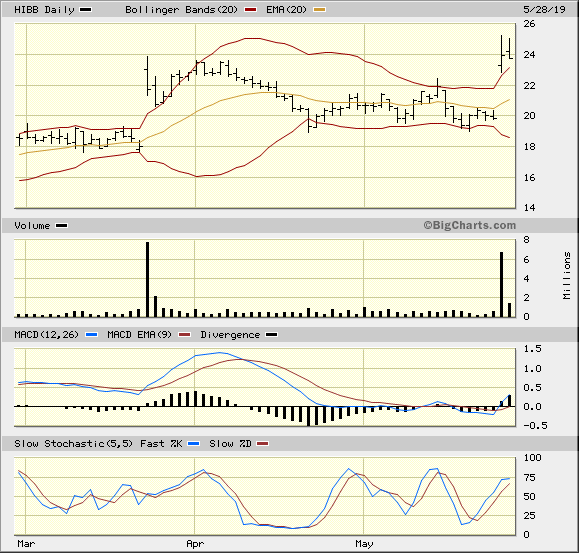

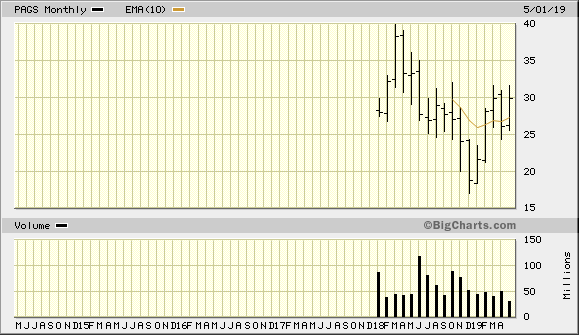

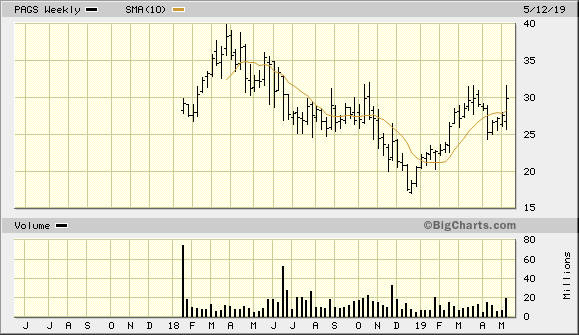

Dr Alexander has a triple screen for viewing charts and Trading for a Living is why I use the following charts

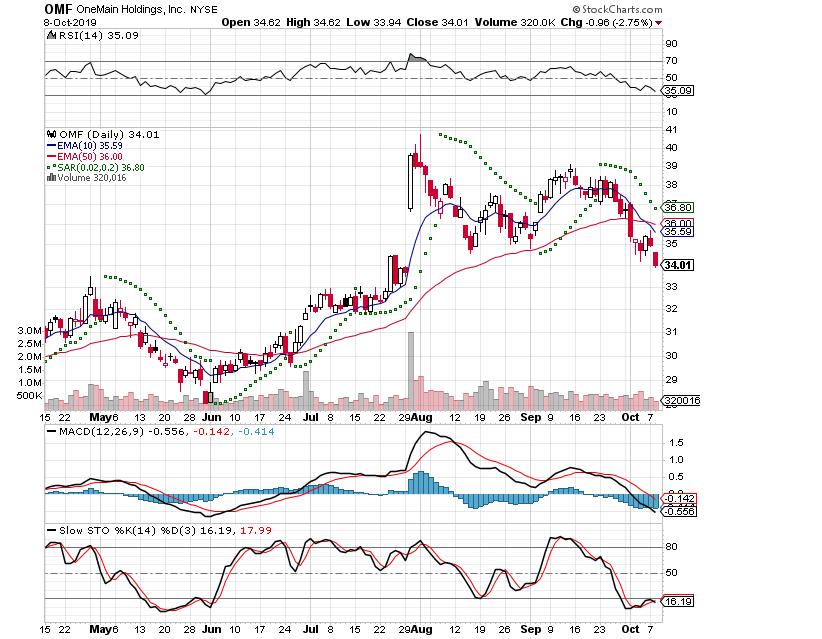

2019-10-08

I closed out the position today and I was very wrong. It move against me and put me underwater. I had been on vacation and had not watched as closely as I should have. I did capture the dividend which was a reason to hold on this

I widened my stop a little lower based on the chart. It has broken lower and I threw in the towel

I got filled at $34.24

$39.49 + 2.25 dividend - 34.24 = -$3 / $37.24 = -8%

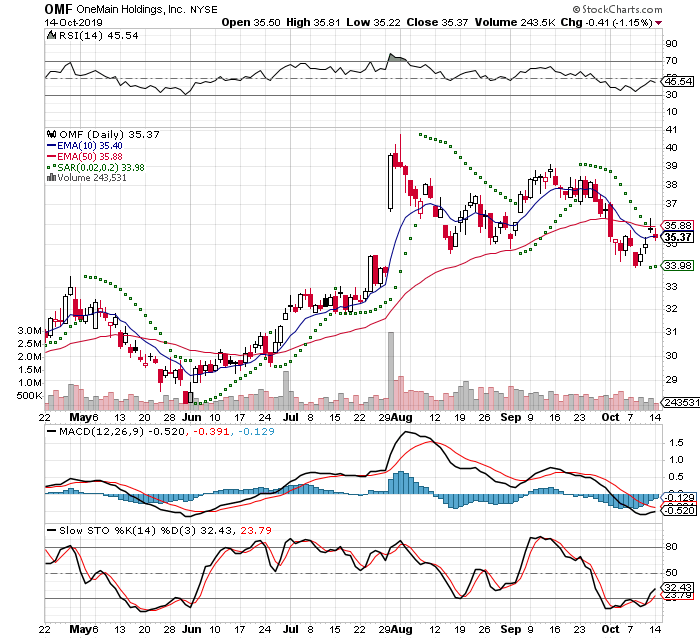

2019-10-14

I bought 2 out of the money $36 call options with an expiration of Nov 15, 2019 as an earnings play. They announce October 28, 2019 after the close

I got filled at 1.55 and will be selling at or before the earnings announcement

2019-10-29

The company reported earnings yesterday and I closed out of my position. I feel that I have regained positive position overall for this company and have captured a large portion of the upside

I got filled at $3.69

$3.69 - $1.55 = $2.14 / $1.55 = +138% in 15 days