2020-06-08

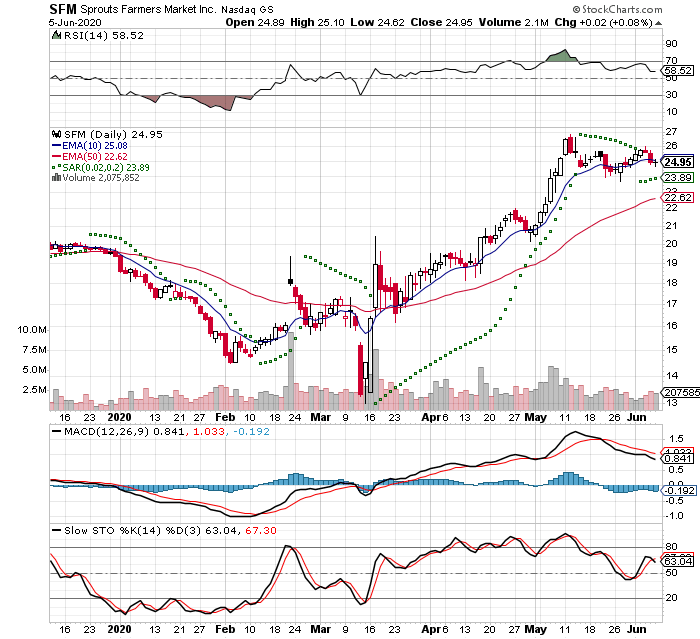

This trade idea came from my weekly review on 06/06. This was on my IBD Total Stock Market Screener. I have this tuned for high financial and lower on the RS. I've also traded this stock before

Sprouts was on Investor's Business Daily Stocks on the Move on 06/02. My IBD Screener on 05/28.The timing seems to be good. I had missed the up move before and it is currently consolidating. SFM is also #17 in the current IBD50

With the current market conditions I am reluctant in owning stocks outright. So, I have been using Call options to limit the overal risk. By buying the Call option I am limiting my loss to the amount that I paid for the option

This trade idea is a stock substitution play with an earnings play as well

IBD Rankings 06/05/20

Composite Rating: 97

EPS Rating: 95

RS Rating: 92

Group RS Rating: B+

SMR Rating: B

Acc/Dis Rating: A-

ROE: 25.6%

Debt: 947%

Outstanding Shares:.117.80

Float: 116.6m

EPS Due Date: 08/01/20

P/E Ratio: 18

Ex-dividend date: No Dividend

Zack’s has this as 2 – Buy: SWCH

2018-02-22

I bought this stock today, because the announced positive earnings and I had been watching this stock since 2018-02-12. This has been featured in Investors Business Daily

The day I bought was very volatile with a 10.5% range on strong volume 178%. I got my order filled at $25.96 and a 7% stop loss is $24.14

Current IBD Ranking

1 rank in group

95 Comp

94 EPS

83 RS

C- group

B SMR

B+ Acc/Dis

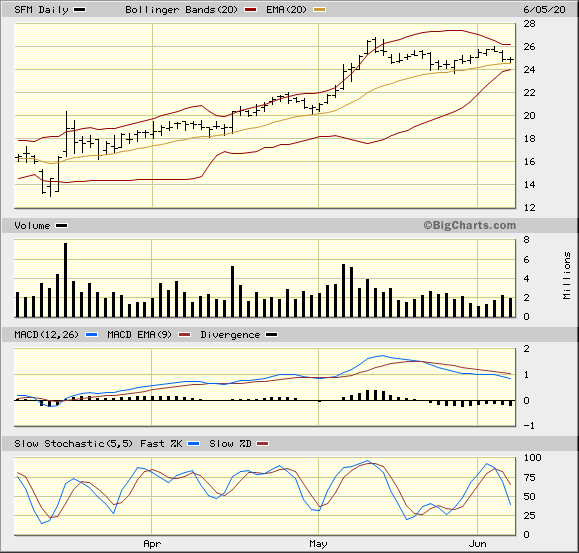

3 Month Daily Chart from bigcharts.com

2018-03-08

I had gotten stopped out when it closed at 24.11 and my order was filled at 24.45. I am looking for another opportunity...

2018-10-18

I had kept this on my stock list for a while and then archived it. Then it showed up in the Investor's Business Daily IBD Weekly VOL 35 N.O. 28 Week of October 15, 2018 -IBD50 Ranking #41

Then today I bought a call option that was At The Money (Option Pricing).

I got filled at: $1.93 with the stock at $27.26

0% stop: $0.00

+20% Target: $25.04

IBD Rankings today

Composite Rating: 98

EPS Rating: 85

RS Rating: 92

Group RS Rating: A+

SMR Rating: B

Acc/Dis Rating: A-

ROE: 21.1%

Debt: 73%

Outstanding Shares: 127.1m

EPS Due Date: 11/1/18

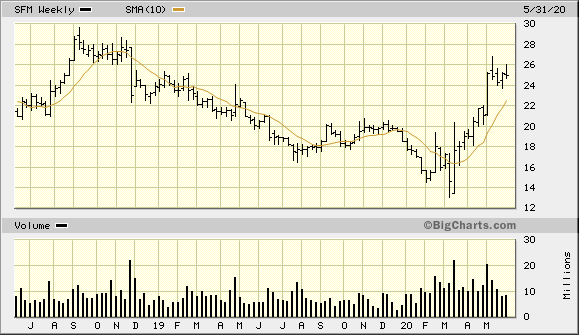

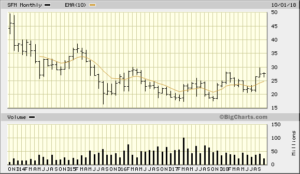

Dr Alexander has a triple screen for viewing charts and Trading for a Living is why I use the following charts

2018-11-01

I closed out of the position today, because they had posted earnings an the market reaction was neutral. I lost about $100 and I'm about done just buying options altogether

I got filled at .80 So I lost $113

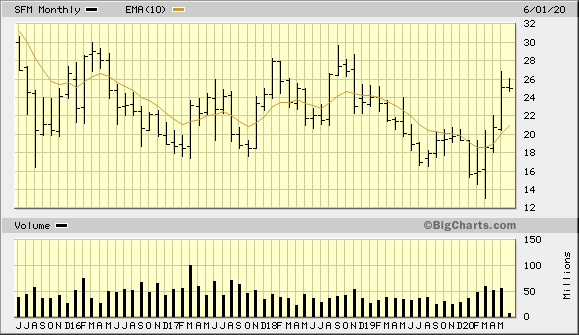

SFM-5-Year-Monthly-from-BigCharts-2020-06-05-1