About the company from Investor Relations

Hibbett, headquartered in Birmingham, Alabama, is a leading athletic-inspired fashion retailer with more than 1,100 stores under the Hibbett Sports and City Gear banners, primarily located in small and mid-sized communities. Founded in 1945, Hibbett has a rich history of convenient locations, personalized customer service and access to coveted footwear, apparel and equipment from top brands like Nike, Jordan, Adidas, and Under Armour. Consumers can browse styles, find new releases, shop looks and make purchases online or in their nearest store by visiting www.hibbett.com or www.citygear.com. Follow us @hibbettsports and @citygear.

2019-05-28

This trade idea came to me by running a scan from TD Ameritrade on Monday and was part of my weekly review.

I set the scan to:

Revenue Growth: +25% - >100%

Current Price: $20 - $50

EPS Growth: 15% - >100%

Volume: >100,000sh

MACD Histogram: Negative to Positive

Price/Sales: 2, 2-3

This produced one company - Hibbett Sports

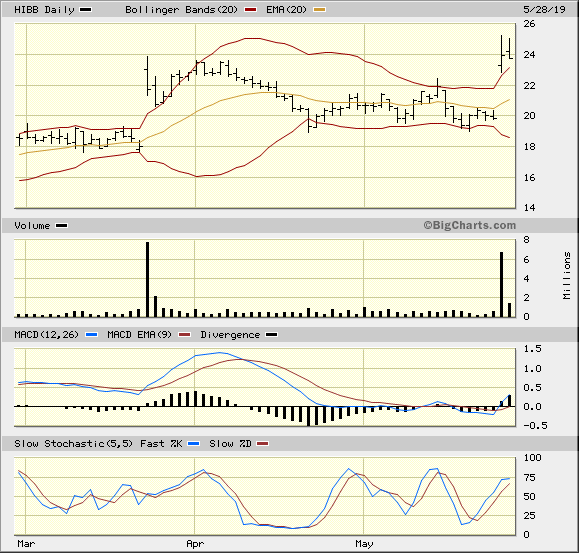

They have posted earnings and the stock popped. It was a buyable gap up and check out the setup: In The Trading Cockpit with the O'Neil Disciples: Strategies that Made Us 18,000% in the Stock Market

I placed a limit order at the previous day's close $23.95 on Friday. The morning open higher as expected and then stayed there through lunch. I had checked the stock at 2:20 EST and I felt that I would not get filled. I cancelled the limit order and bought the company. Of course it then drifted down and I would have been filled anyway. I ended the day with a -2% loss - drat

This Day 1 of a 7 Trading Day Time Stop. The IBD Rankings are below the CANSLIM standard

IBD Rankings 05/28/19

Composite Rating: 88

EPS Rating: 71

RS Rating: 93

Group RS Rating: A-

SMR Rating: C

Acc/Dis Rating: C+

ROE: 10.2%

Debt: 1%

Outstanding Shares: 18.4m

Float: 18.0m

EPS Due Date: 8/24/19

I got filled at $24.27

-3% below the intra-day low of the gap = $22.17

20% Target = $29.13

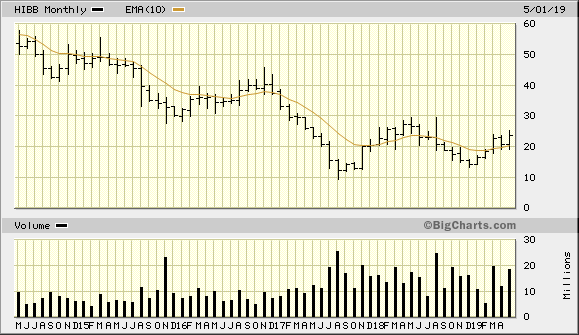

Dr Alexander has a triple screen for viewing charts and Trading for a Living is why I use the following charts

2019-06-10

I closed out the position and got filled at $20.90. This had drifted lower on light volume and it went past my stop. It cost me a large loss