2019-01-27

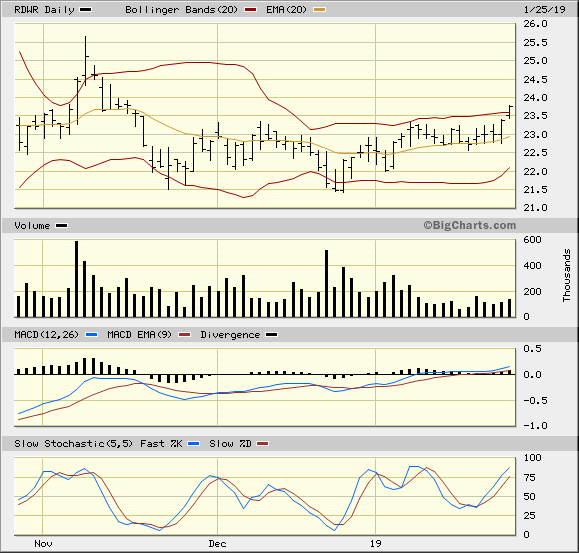

This trade idea came to me a few weeks ago when I was reviewing the IBD Stocks on the Move. It appeared there on last year 2018-12-26. There was a spike in volume and I added it to my watch list. This is a cloud based security service

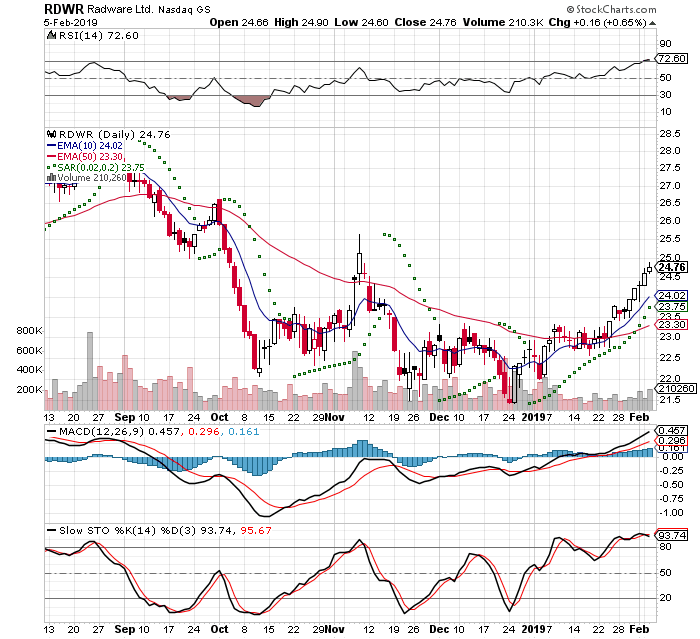

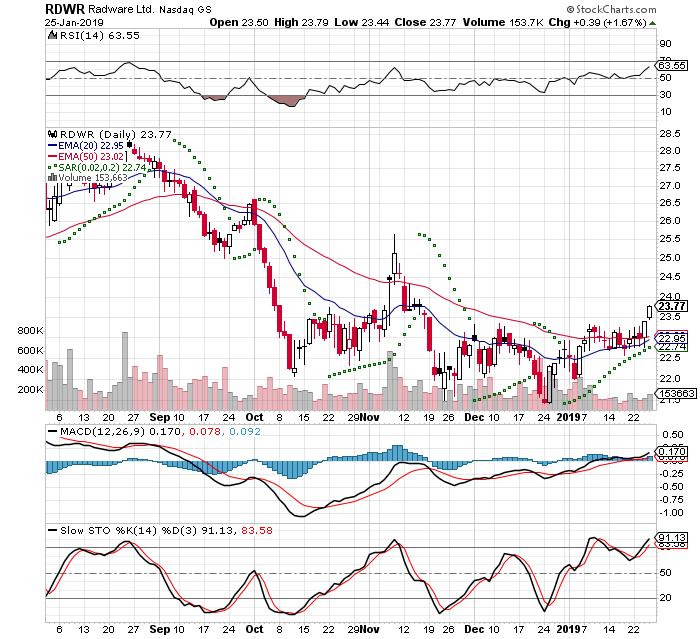

I had closed out Denny's and had cash available. The MACD has crossed the zero line, the 10 day EMA is crossing the 50 day EMA, and the MACDH is positive. The timing of this seemed about right and I bought Friday 2019-01-25.

This had a gap up, but it was on light volume and was hoping for more conviction. Friday was Day 1 of a 7 Day time stop. I limit my trades by 7 trading days, because if a stock is not acting correctly (being positive) buy this time then my capital can be put to better use elsewhere

I got filled at $23.67

-5% stop = $22.50

20% Target = $28.00

IBD Rankings 12/16/18

Composite Rating: 99

EPS Rating: 84

RS Rating: 94

Group RS Rating: A

SMR Rating: B

Acc/Dis Rating: A-

ROE: 5.7%

Debt: 82%

Outstanding Shares: 212.8m

EPS Due Date: 2/20/19

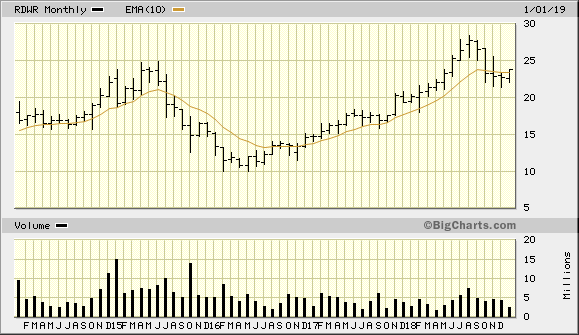

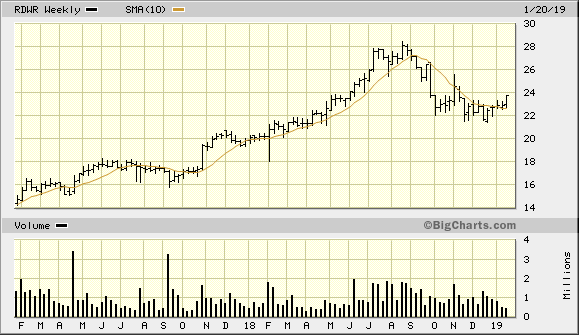

Dr Alexander has a triple screen for viewing charts and Trading for a Living is why I use the following charts

2019-02-05

I sold today, because I did not want to hold during earnings and it was Day 7 for my time stop.

This has had a good run up and feel that it would have to have great earnings in order to maintain this pace of advance. It was progressing on light volume and was not comfortable holding. This will still be on my watch list for awhile.

I got filled at $24.72

24.72 - 23.67 = 1.05 /23.67 = 4.4% 8 days

That's not bad. A trade can easily cut against you. I'll take the profit