2019-01-14

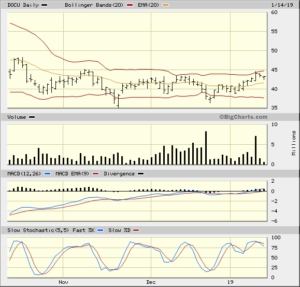

This came to my attention when I was looking at the IBD Stocks on the Move. I had some room in my portfolio as part of my Risk Management. I saw this coming out of a base on strong volume. I opened a position the next morning

I bought on 2019-01-11 and I am currently at Day 2 for a 7 Trading Day Time Stop. The stock has sold off some, but the volume dried up

I did a quick check on the IBD Rankings. These are a little less than the classic CANSLIM method, but based on my reading of the market I was willing to risk the trade.

IBD Rankings 01/14/19

Composite Rating: 83

EPS Rating: 72

RS Rating: 75

Group RS Rating: A

SMR Rating: D

Acc/Dis Rating: C

ROE: 0%

Debt: 0%

Outstanding Shares: 165.2m

EPS Due Date: 2/26/19

Dr Alexander has a triple screen for viewing charts and Trading for a Living is why I use the following charts

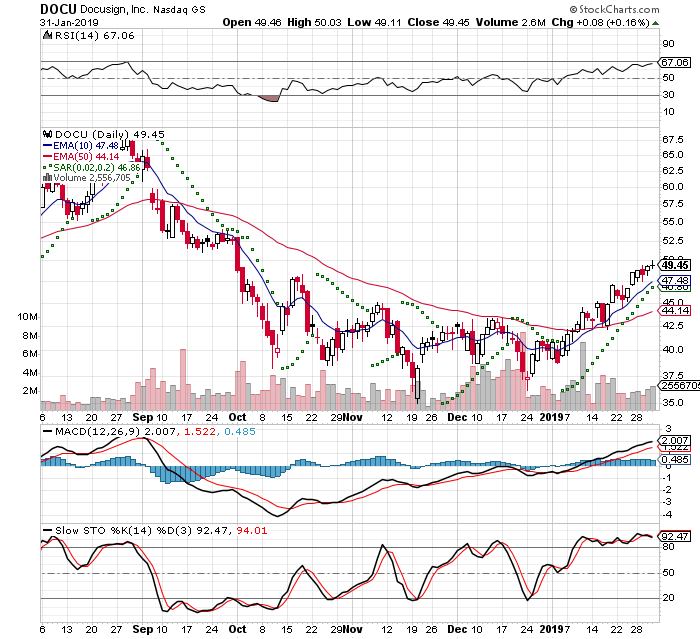

2019-01-31

I closed out my position this morning to lock in profits. The uptrend momentum looks like it is drying up and I expect a drop. I will still be watching this for a while. I got filled at $49.98

49.98 Close - 43.44 Bought = +$6.54 / 43.44 = +15% in 19 days