UNG United States Natural Gas Fund

Fund Details

The United States Natural Gas Fund® LP (UNG) is an exchange-traded security that is designed to track in percentage terms the movements of natural gas prices. UNG issues shares that may be purchased and sold on the NYSE Arca.

The investment objective of UNG is for the daily changes in percentage terms of its shares' net NAV to reflect the daily changes in percentage terms of the price of natural gas delivered at the Henry Hub, Louisiana, as measured by the daily changes in the Benchmark Futures Contract, less UNG's expenses.

The Benchmark is the futures contract on natural gas as traded on the NYMEX. If the near month contract is within two weeks of expiration, the Benchmark will be the next month contract to expire. The natural gas contract is natural gas delivered at the Henry Hub, Louisiana.

UNG invests primarily in listed natural gas futures contracts and other natural gas related futures contracts, and may invest in forwards and swap contracts. These investments will be collateralized by cash, cash equivalents, and US government obligations with remaining maturities of two years or less.

UNG's Fund Benefits

- UNG offers commodity exposure without using a commodity futures account.

- UNG provides features including, intra-day pricing, and market, limit, and stop orders.

- UNG provides portfolio holdings, market price, NAV and TNA on its website each day.

2019-10-08

This trade idea came to me by the book

Set up Buy the Feer and Sell the Greed

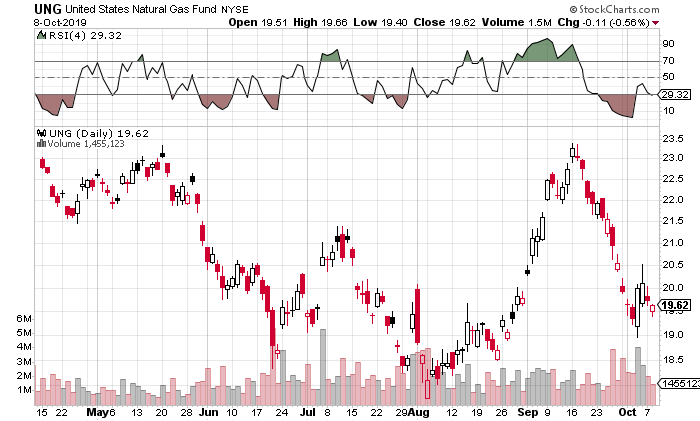

Buy 4 Day RSI oversold below 20 - was at 4.95 on 09/30

Sell 4 Day RSI reaches 50

The is an ETF that tracks natural gas. Liquefied Natural Gas was a hot topic by a couple of the keynote speakers at the Chicago Trade Expo this year. I had held off on purchasing and saw the value drop almost 30% from the May.

Then I saw it pop and have a significant move. I missed the move up and put it back on a watch list. I was looking for a good entry point. It started to drop and I was looking for a rounding out on light volume

That didn't happen and the selling started getting stronger. Then it gaped down and I decided on using a call option to limit the downside. I went will a slightly out of the money call option at $20 and went 46 days out to give me some time

UNG Nov 15 2019 20.0 Call

2019-10-01 Buy to Open $20 Calls Exp 11/15/19 2 contracts Filled at $1.16

The current price $19.65

Target $21.29 at 50 day EMA

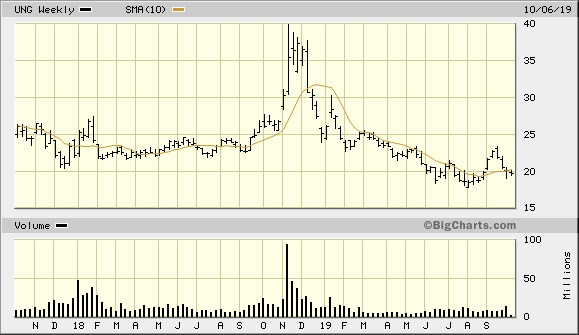

Dr Alexander has a triple screen for viewing charts and Trading for a Living is why I use the following charts

2019-10-24

I closed out this position today, because I felt that it will not be a positive by the time the option expires. This position was positive for a day and basically covered the round trip costs. I think the biggest issue with the trade was the fact that it was below the long term average didn't allow it to lift off of the fear point

I will be adding a filter that a stock will need to be above a 200 day SMA

I got filled at $.63 and I'm glad I only had a Call option to limit my losses

$1.55 - $.63 = -.92 / 1.55 = -59%