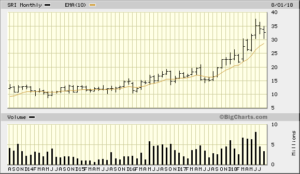

Stoneridge Inc – SRI

2018-08-21

I started watching this on 2018-06-14 and looking for the right time to open a position. I am buying an Out of The Money $35 call Sept 21, 2018. The current price is $32.62

I am expecting the MACD cross over. I bought 3 $35 calls with September 21, 2018 expiration. At the time that I bought the stock price was at S32.72

I got filled at

-100% stop: -.50

300% Target: 1.50

IBD Rankings today

Composite Rating: 96

EPS Rating: 92

RS Rating: 93

Group RS Rating: A+

SMR Rating: B

Acc/Dis Rating: B

ROE: 18.2%

Debt: 51%

Outstanding Shares: 929m

EPS Due Date: 10/30/18

Dr Alexander has a triple screen for viewing charts and Trading for a Living is why I use the following charts

2018-09-23

Well this trade idea didn’t work out. I had expected the MACD and MACDH positive crossover. It didn’t happen and I lost the entire position

The PSAR is above and there was a big o’l red candle in August. The stock was already below the 50 EMA and was at the 100 EMA

There was no planned event happening so I had time decay working against me

This is the cost of tuition in learning the market. This was an impulse buy and was not a good setup