Roku Inc Cl A – ROKU

2018-07-24

I closed out my position today, because I had at one point a 10% gain and that mostly evaporated today. I got filled at $46.86 and I still had a slight gain. There are only a few days left till they post earnings and don’t feel that the stock should be trading like this. I had expected a loss, but not in this percentage

3 Month Daily Chart from Stockcharts

2018-07-06

I have been watching this company from the first IPO. The chart looked like it was setting up for a break out at $40. On 2018-06-07 the stock was at 39.57 . The I bought a slightly out of the money call $40.00 with 42 days left. I got filled the next day. Check out Option Pricing for a definition of OTM, ATM, and ITM.

2018-06-08 Buy to Open 1 ROKU Jul 20 2018 40.0 Call @ 2.9

2018-06-25 Sell to Close 1 ROKU Jul 20 2018 40.0 Call @ 5.4

Closed position including commissions: 532.32

Cost including commissions: -297.67

Total Profit: 234.65

I have continued to watch this company and I decided to purchase the stock outright instead of an option. I got filled

2018-07-06 Buy 100 ROKU @ 45.3

Cost Basis: $45.30

-5% Stop: $4304

+20% Target: $54.36

The IBD Rankings

Composite Rating: 70

EPS Rating: 51

RS Rating: 96

Group RS Rating: B

SMR Rating: N/A

Acc/Dis Rating: A-

ROE: 0

Debt: 0

Outstanding Shares: 48.9m

Next Earnings Announcement: 07/28/18

The rankings are not the CANSLIM and I would normally pass on this opportunity. I think this company has a good product and is well placed in the shift away from cable TV.

Dr Alexander has a triple screen for viewing charts and Trading for a Living is why I use the following charts

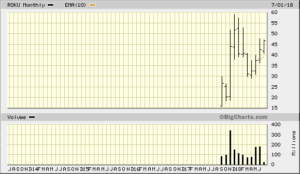

5 year monthly chart from bigcharts

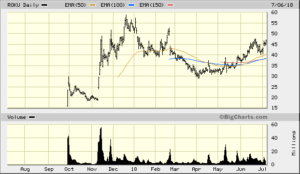

1 year from Bigcharts

3 month daily from Bigcharts

3 month daily from Stockcharts