2019-02-06

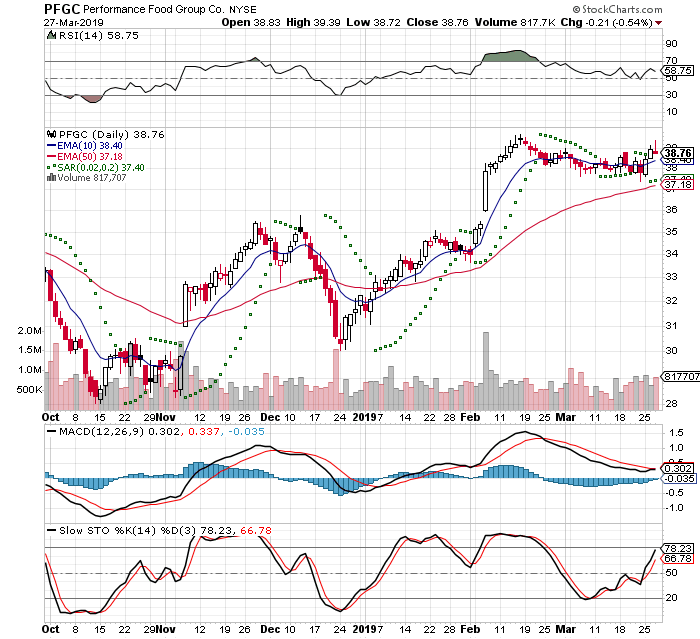

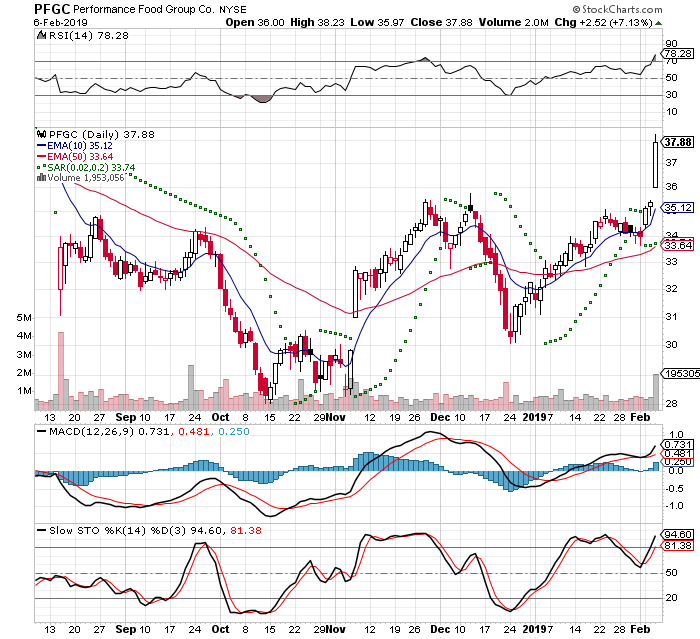

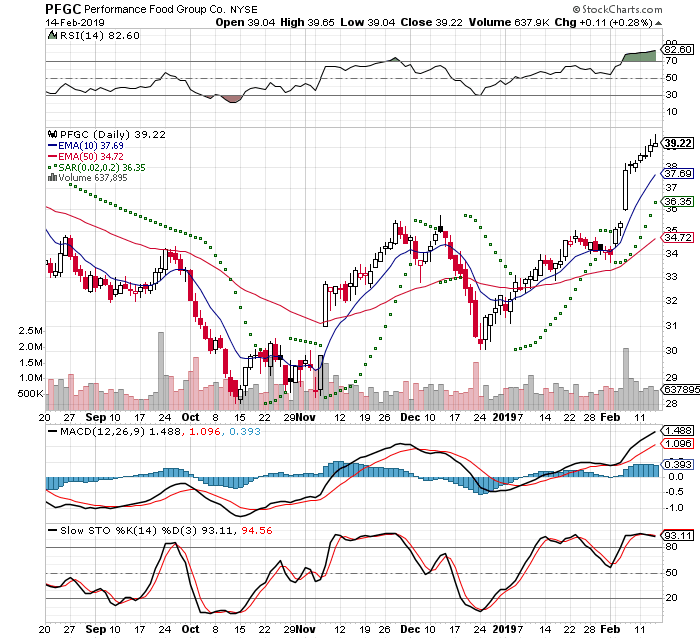

This was an impulsive type of trade and this was not on my radar. I had sold Radware and had room for a new position. I had checked IBD stocks on the move and spotted a buyable gap up.

Check out the setup at: In The Trading Cockpit with the O'Neil Disciples: Strategies that Made Us 18,000% in the Stock Market

This Day 1 of a 7 Trading Day Time Stop

I got filled at $37.68

-5% stop = $35.80

20% Target = $45.22

IBD Rankings 02/06/19

Composite Rating: 95

EPS Rating: 87

RS Rating: 90

Group RS Rating: B+

SMR Rating: C

Acc/Dis Rating: A-

ROE: 15.6%

Debt: 104%

Outstanding Shares: 105.2m

EPS Due Date: 2/06/19

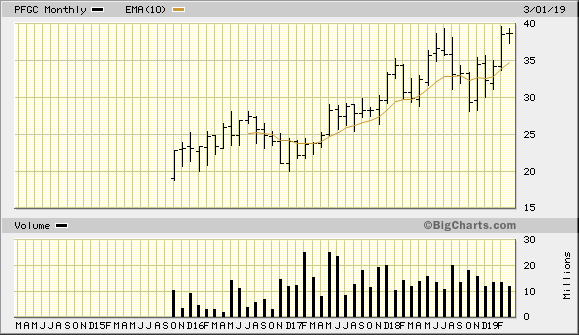

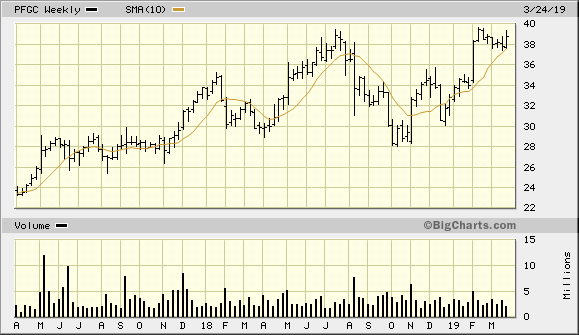

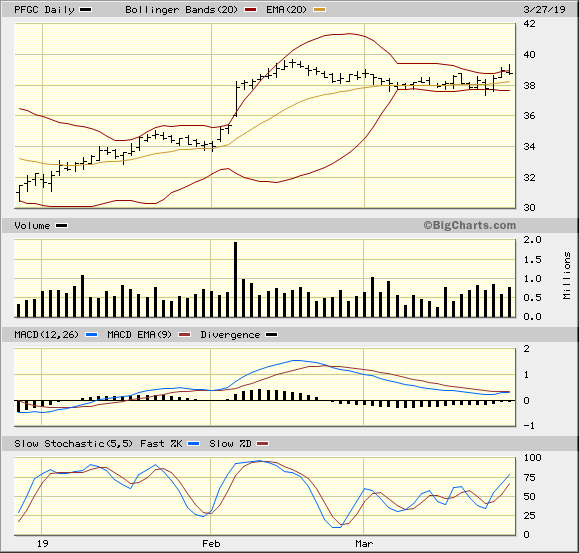

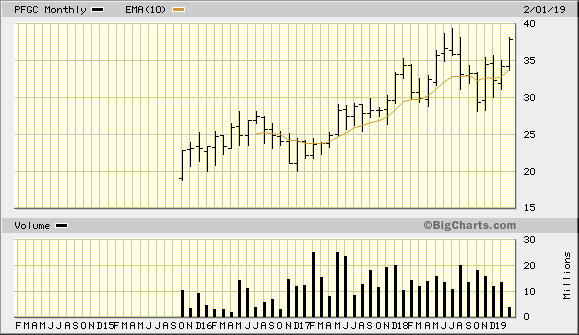

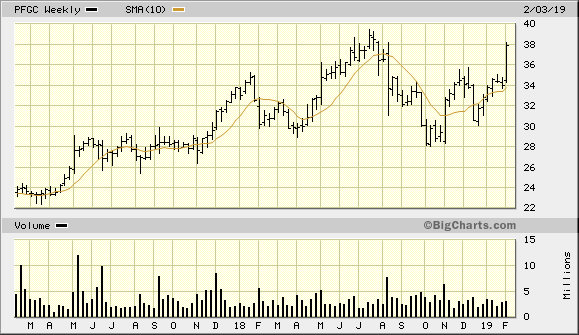

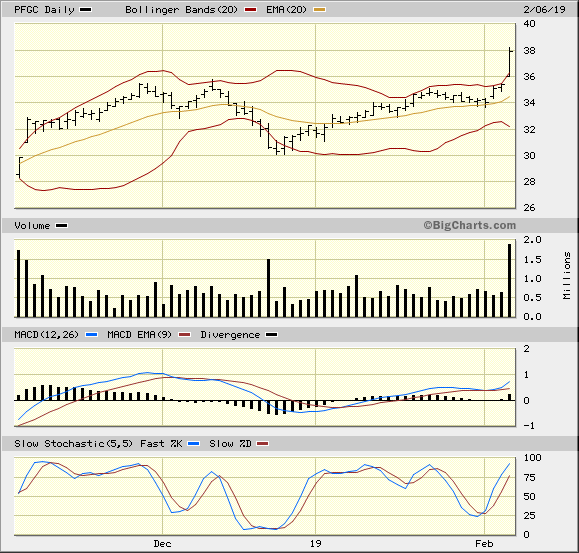

Dr Alexander has a triple screen for viewing charts and Trading for a Living is why I use the following charts

2019-02-14

I closed out the position yesterday, because this had several up days with no pausing. This seemed extended and I wanted to lock in the gains. I was fearful that the one down day would wipe out all of the gains. I got filled at $38.82

38.82 - 37.68 = 1.14 / 37.68 = +3% in 6 Trading Days

2019-03-27

I had kept this on a watch list and I bought this morning after the first hour of trading. This has been shaping up and I wanted to enter a position early. Day 1 of a 7 Trading Day Time Stop.

This is an example of my trade setup and it is for educational purposes. This may not be appropriate for your risk tolerance and you should do your own due diligence

I got filled at $39.05

-5% stop = $37.10

20% Target = $46.86

IBD Rankings 03/27/19

Composite Rating: 83

EPS Rating: 89

RS Rating: 88

Group RS Rating: B-

SMR Rating: N/A

Acc/Dis Rating: B

ROE: 0%

Debt: 0%

Outstanding Shares: 105.2m

Float: 101.0m

EPS Due Date: 5/7/19

Dr Alexander has a triple screen for viewing charts and Trading for a Living is why I use the following charts