Hilltop-Holdings.com

About Us

With $14.8 billion in assets as of September 30, 2019, Hilltop Holdings Inc. (NYSE: HTH) is a Texas-based diversified financial holding company specializing in banking, mortgage origination, financial advisory and insurance through its wholly owned subsidiaries, PlainsCapital Bank, PrimeLending, National Lloyds Corporation, and HilltopSecurities.

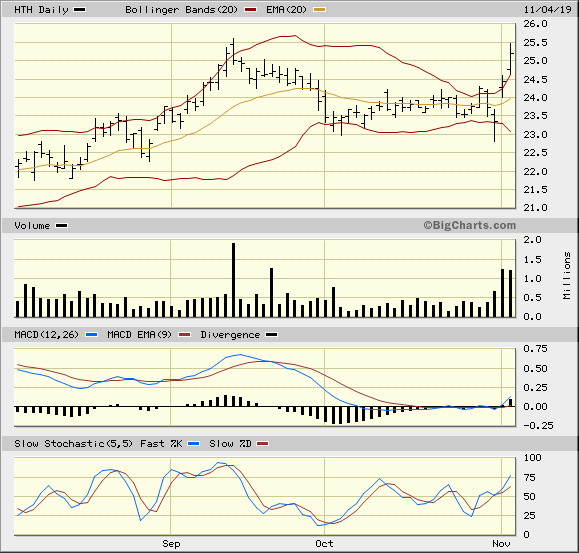

2019-11-04

This trade idea came to me from my weekend stocks review. This was featured in Investor's Business Daily's Stocks on the Move on Friday's issue. They had recently posted earnings and was starting to break out of a tight consolidation base

This stock has had a buy gap up and the momentum was starting to accelerate

Check out the setup: In The Trading Cockpit with the O'Neil Disciples: Strategies that Made Us 18,000% in the Stock Market

I bought 200 shares this afternoon and I got filled at $25.24

Stop Loss -5%

I am having a little tighter stop on this trade and it will place it just above the 50 day EMZ

Upside Target +15%

This will provide a 3:1 risk reward ratio. Depending on the speed that it reaches this target I can sell half the position to hold the rest for a longer term gain

IBD Rankings 11/04/19

Composite Rating: 93

EPS Rating: 85

RS Rating: 90

Group RS Rating: C+

SMR Rating: C

Acc/Dis Rating: B+

ROE: 6.3%

Debt: 3%

Outstanding Shares: 92.8m

Float: 72.4m

Management owns 21.15%

EPS Due Date: 01/24/20

From TD Ameritrade Quote Summary 11/04/19

P/E Ratio: 11.3

Ex-dividend date: 11/14/19

Zack's has this as a Strong Buy: HTH

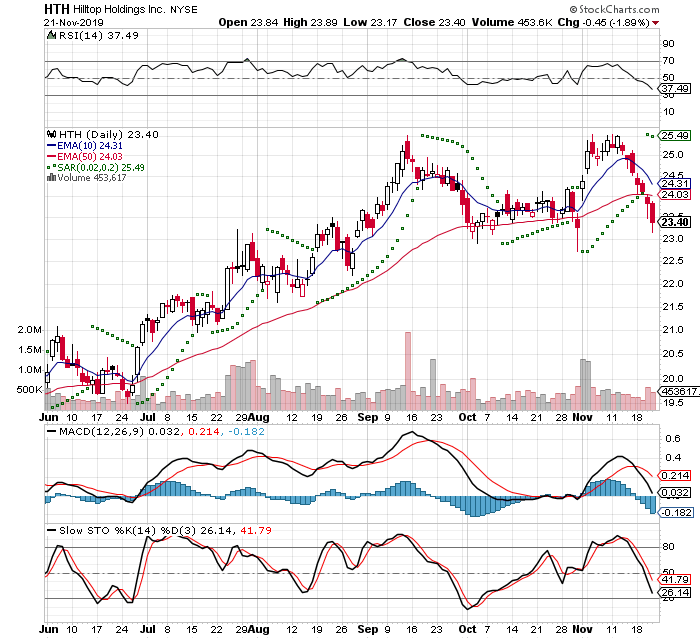

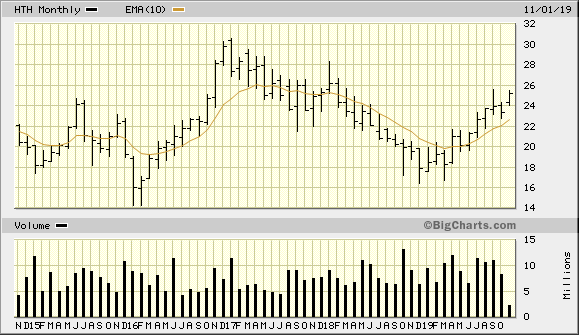

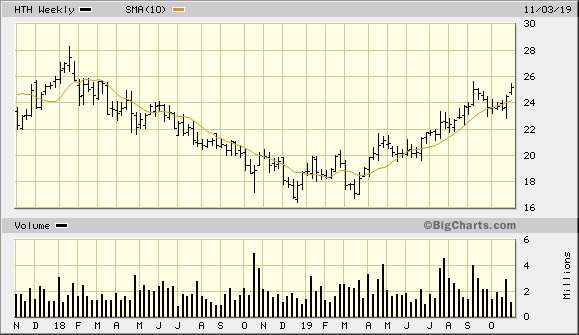

Dr Alexander has a triple screen for viewing charts and Trading for a Living is why I use the following charts

2019-11-21

I closed out of the position today, because it moved against me and hit my stop. I got filled at $23.39

$25.24 - $23.39 = -$1.85 / $25.24 = -7.3%