2019-03-05

This trade idea came from Investor's Business Daily 03/01, because it was featured on the front page under Stocks on Move, Up.

From the company's About page "Core-Mark has grown into one of the largest distributors and marketers of consumer goods in North America." They have stand alone displays in many retail locations.

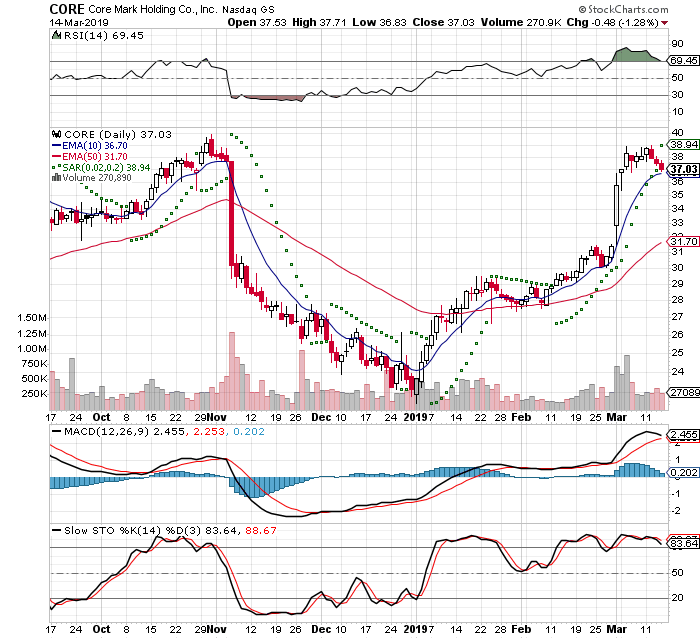

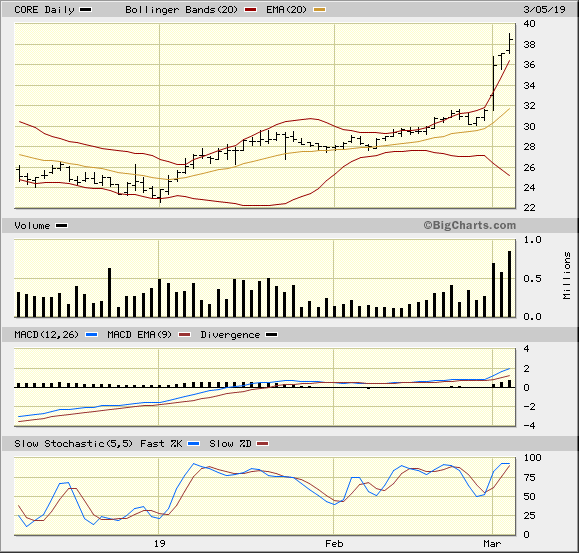

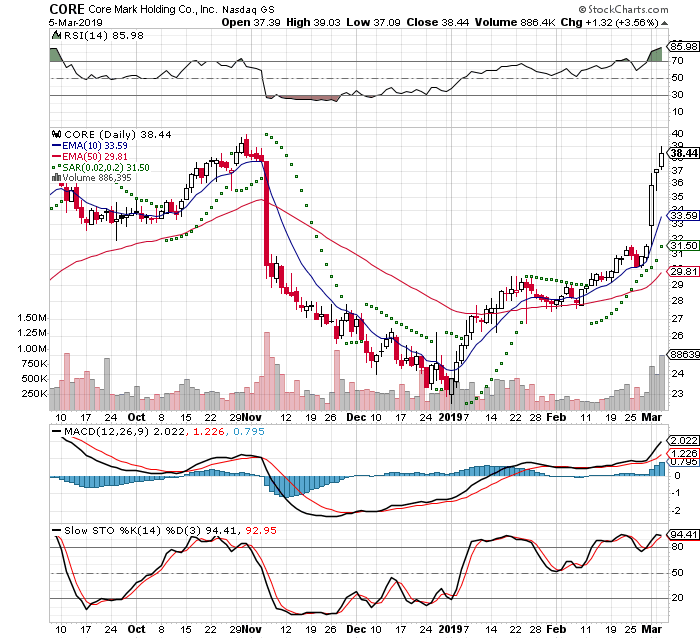

This broke out of a consolidation period on strong volume on Friday. This is a cup formation and I'm expecting this to form a handle for a few weeks. They are reporting earnings in 2 months 05/08

I placed a market order for 100 shares about 11:30, because it had held and was a little off the previous day's close. This Day 2 of a 7 Trading Day Time Stop

I got filled at $35.88

-5% stop = $34.09

20% Target = $43.06

IBD Rankings 03/05/19

Composite Rating: 88

EPS Rating: 76

RS Rating: 98

Group RS Rating: B+

SMR Rating: D

Acc/Dis Rating: A+

ROE: 10.5%

Debt: 92%

Outstanding Shares: 45.7m

EPS Due Date: 5/6/19

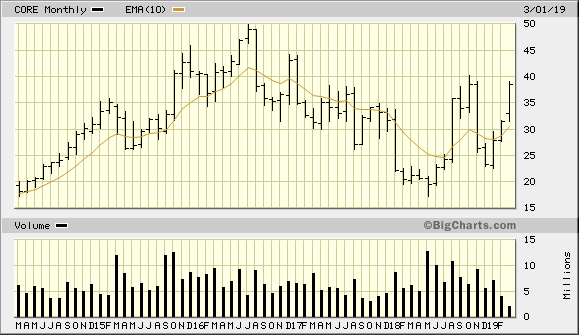

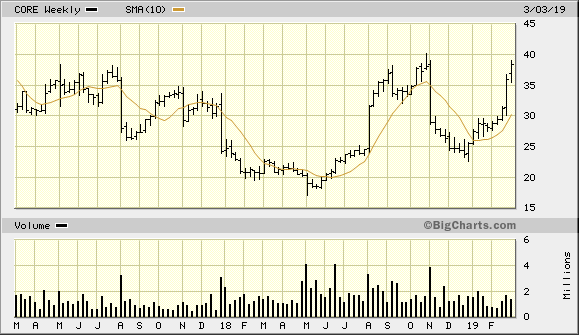

Dr Alexander has a triple screen for viewing charts and Trading for a Living is why I use the following charts

2019-03-14

I closed out of the position today, because momentum has stalled. I wanted to lock in some gains and this will still be on my watch list. Looking at the weekly chart I'm expecting more selling and needing time for a handle form around the $34-35 range.

I got filled at $37.13

$37.13 - $35.88 = $1.25 / $35.88 = +3.5% in 10 days