2018-04-03 FCAU

Fiat Chrysler Automobile

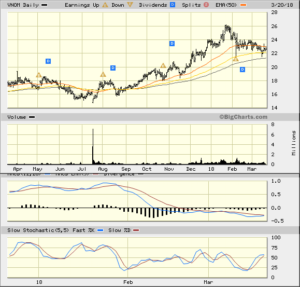

This stock appeared in today’s Investor’s Business Daily Stocks on the Move

It closed today at $21.79 on strong volume and I liked the chart. They are posting earnings on Apr 26, 2018 and I wanted to buy the options beyond this date.

I placed an order for an out of the money call option:

Buy to Open $22.00 Call May 18, 2018 – 45 Days

IV 40%

Delta .5087

Open Interest 118

Current IBD Rankings

Composite Rating: 86

EPS Rating: 98

RS Rating: 97

Group RS Rating: C-

SMR Rating: C

Acc/Dis Rating: B

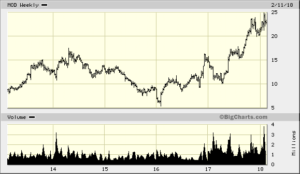

This is a large cap stock

1558.9m shares outstanding

PE Ratio: 7

Debt: 84%

ROE: 19.7%

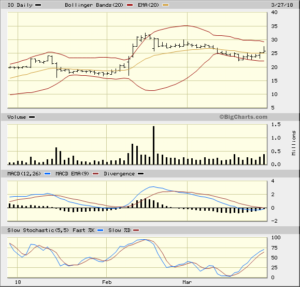

Parabolic SAR flipped below

MACD crossed turning up

MACH flipped positive