2019-02-25

This trade idea came to me from a news event that happened to a competitor. Thursday after hours Stamps.com reported earning and the exclusive contract with the US Post Office broke off. Stamps.com gaped down severely.

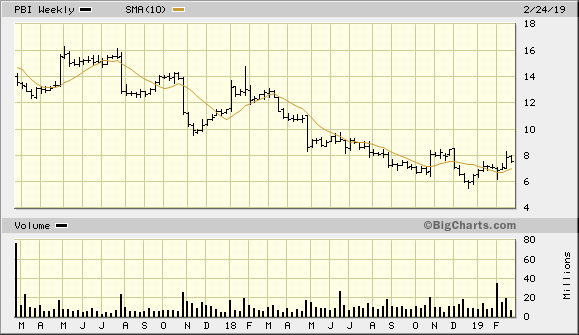

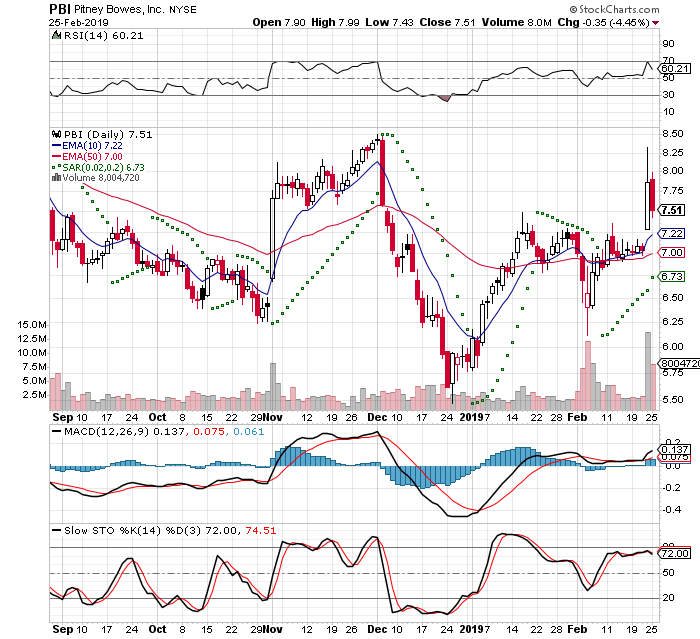

I had checked PBI and it had started moving up in premarket. Then continued moving up at the open and I purchased 200 shares. This ended up significantly up for the day on strong volume.

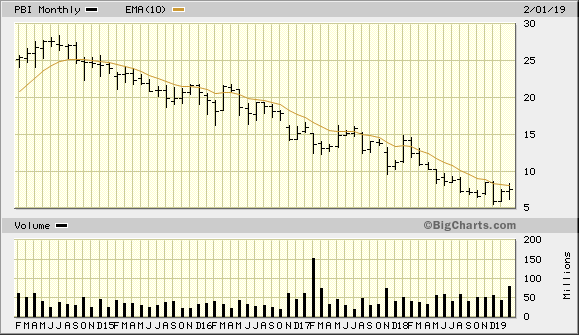

This is a very short term trade and this company is NOT a CANSLIM candidate for several reasons. The EPS and RS are not even close to the 80 cut off. The price is way below the $16 minimum and has been in a downtrend for a long time

This Day 2 of a 7 Trading Day Time Stop

I got filled at $7.59

-5% stop = $7.21

20% Target = $9.11

IBD Rankings 02/25/19

Composite Rating: 23

EPS Rating: 47

RS Rating: 15

Group RS Rating: A+

SMR Rating: A

Acc/Dis Rating: B-

ROE: 102.2%

Debt: 1888%

Outstanding Shares: 187.6m

EPS Due Date: 04/30/19

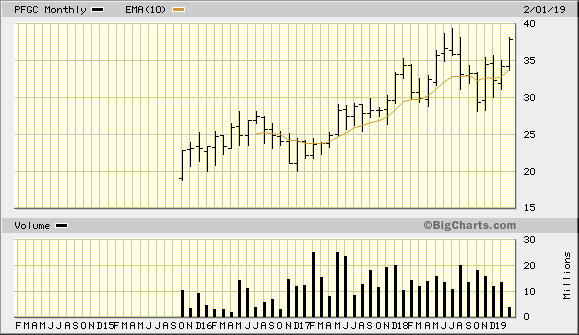

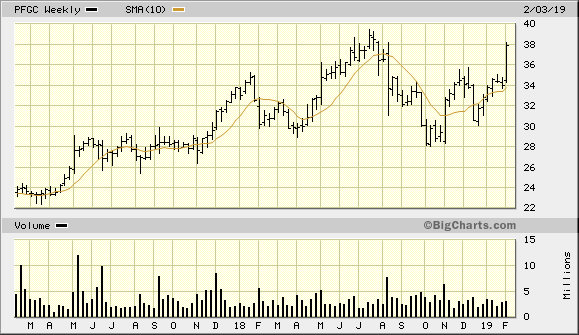

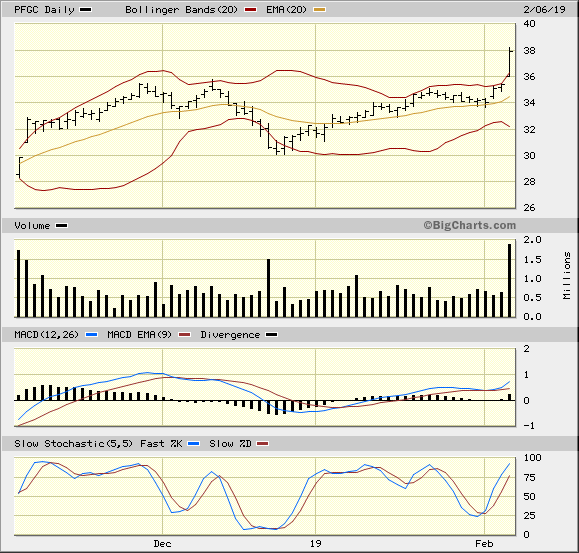

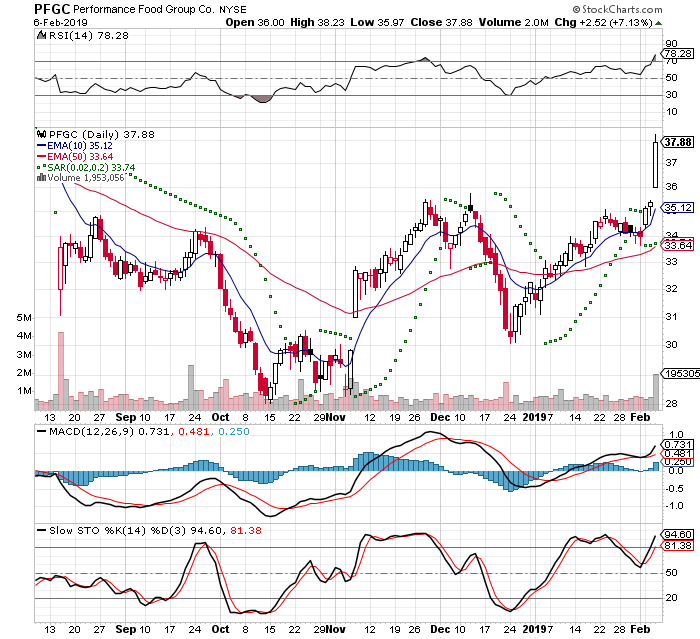

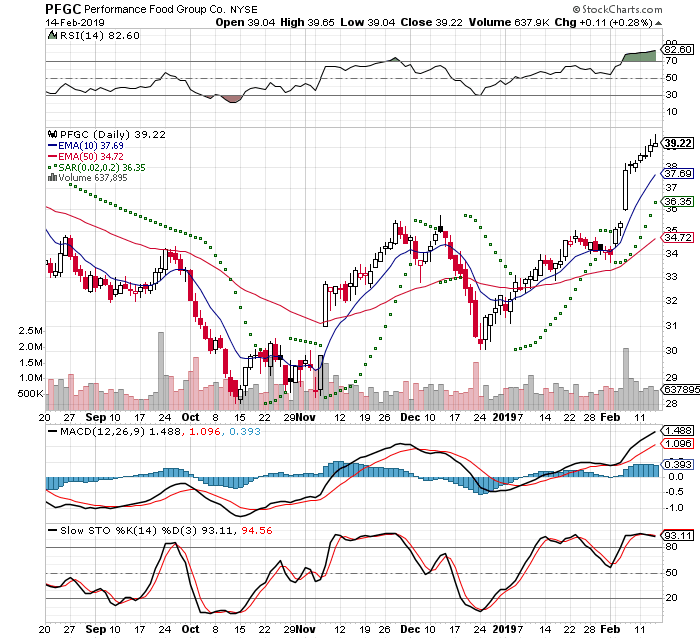

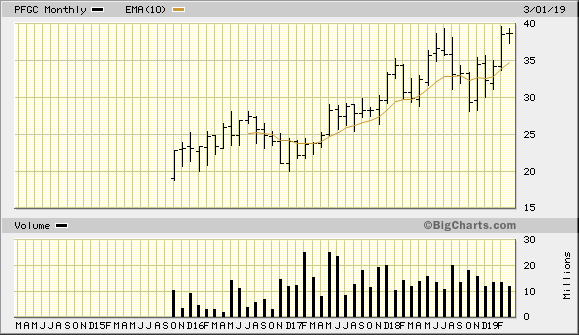

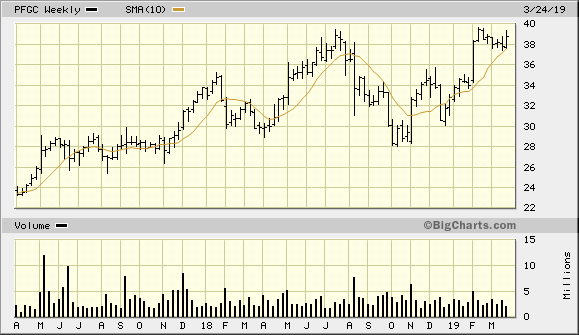

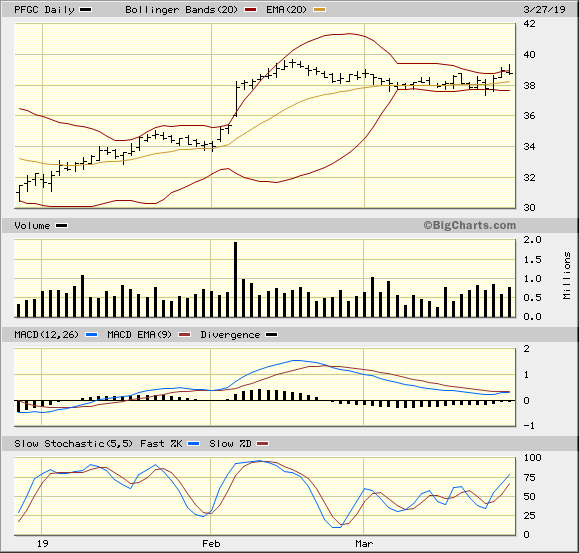

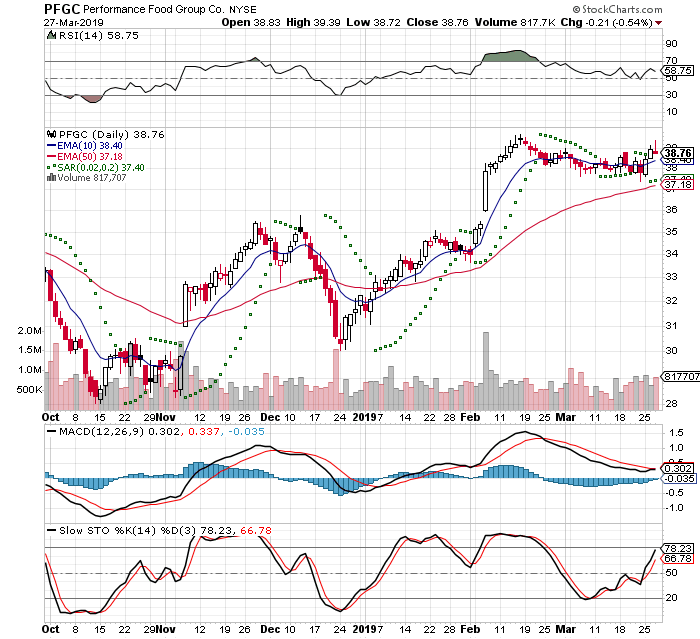

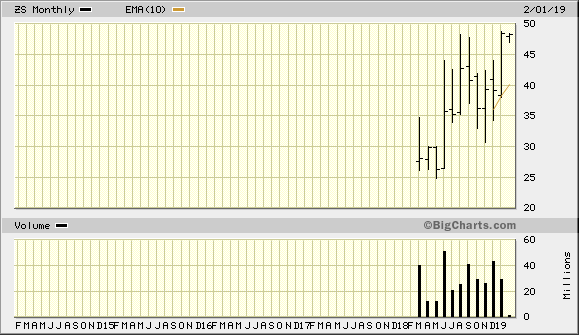

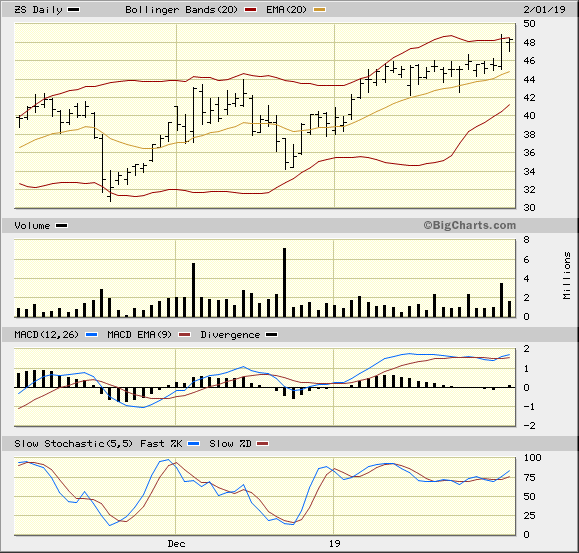

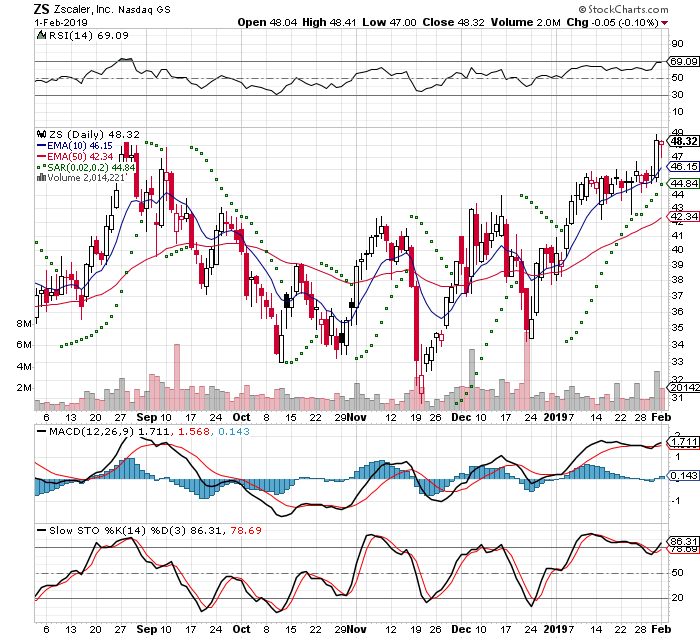

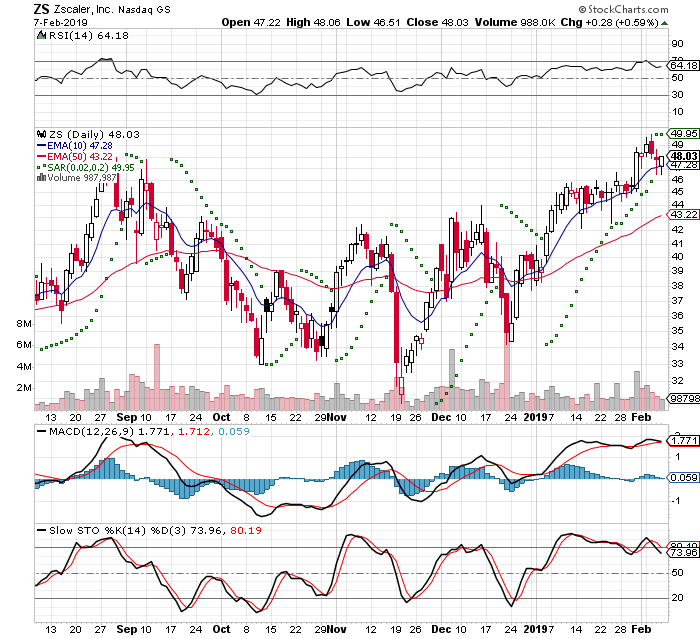

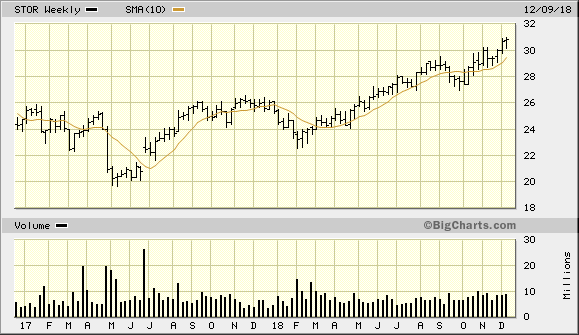

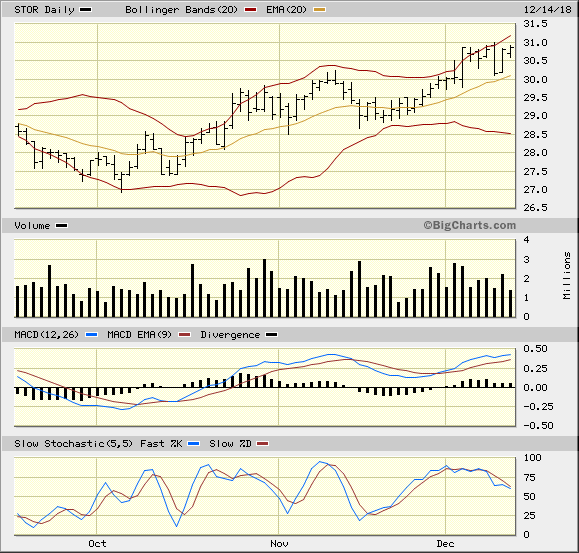

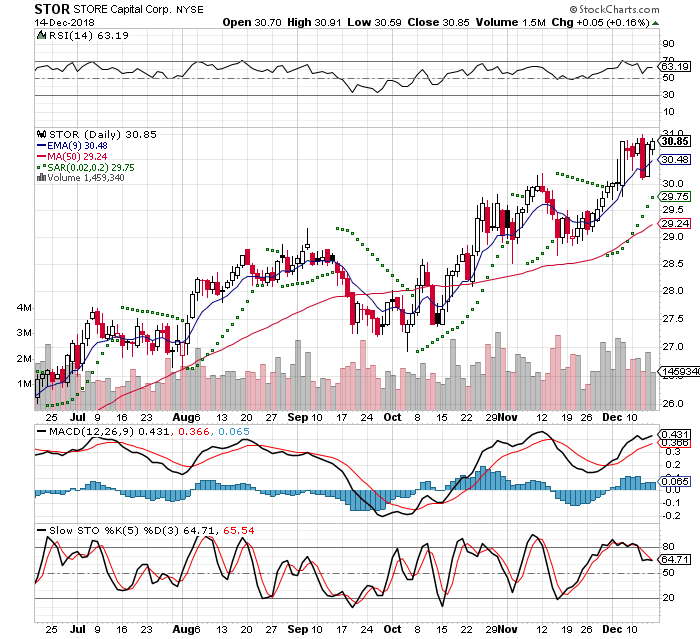

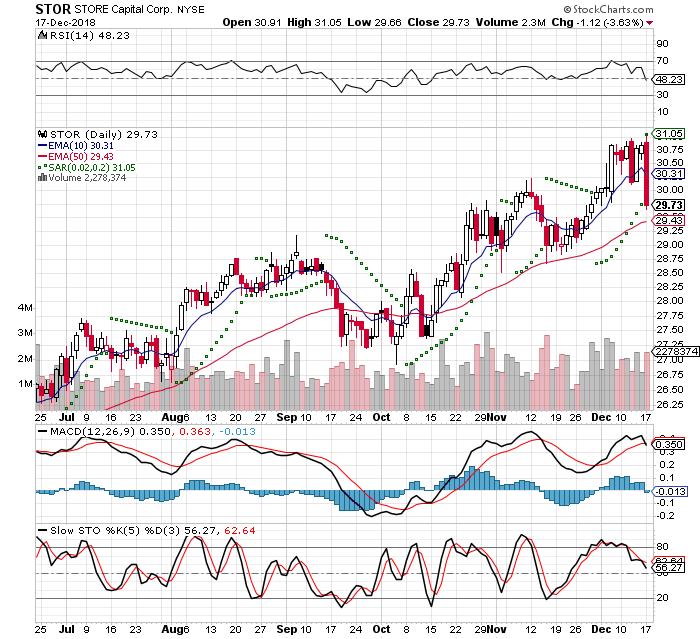

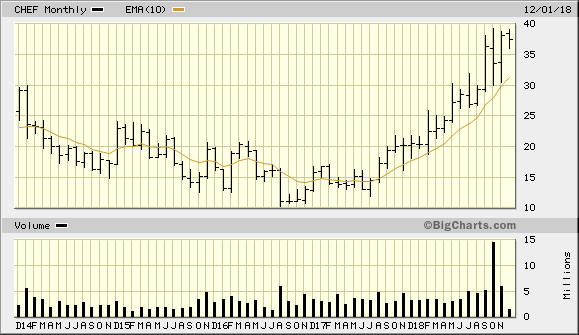

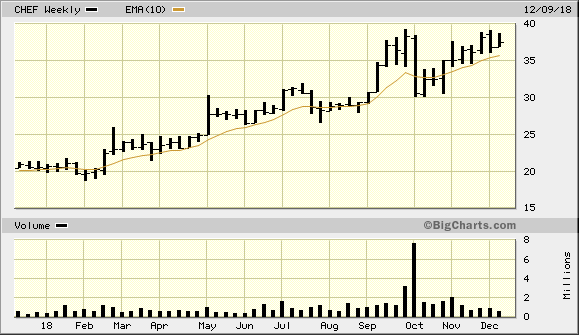

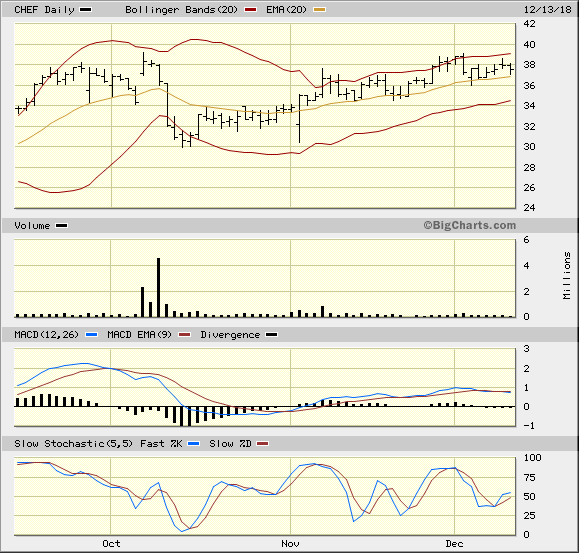

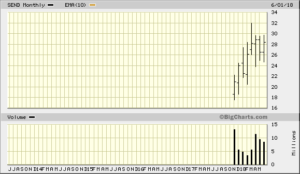

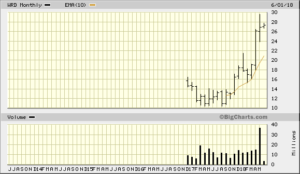

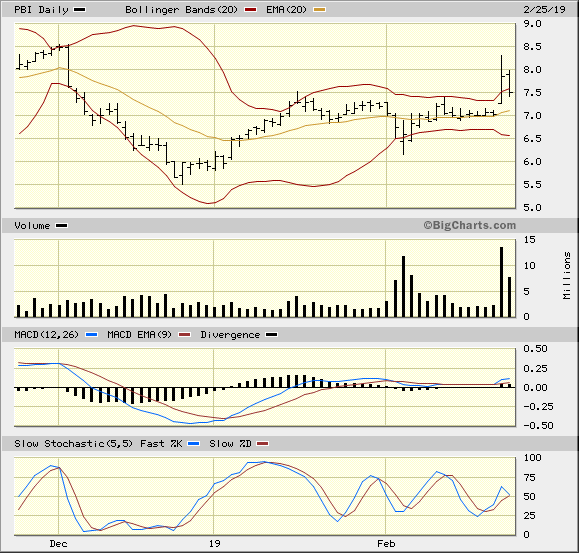

Dr Alexander has a triple screen for viewing charts and Trading for a Living is why I use the following charts

2019-03-03

I closed the position, because it hit my stop loss. This was a small quick loss and I got filled at $7.29

7.59 - 7.29 = -.30 / 7.59 = -4%