CareDx

Who We Are

CareDx, Inc., headquartered in Brisbane, California, is a molecular diagnostics company focused on the discovery, development and commercialization of clinically differentiated, high-value diagnostic solutions for transplant recipients. CareDx offers products across the transplant testing continuum, including AlloMap® and AlloSure® for post-transplant surveillance and QTYPE®, TruSight® HLA, Olerup SSP® and Olerup SBT® for pre-transplant HLA testing.

2019-07-11

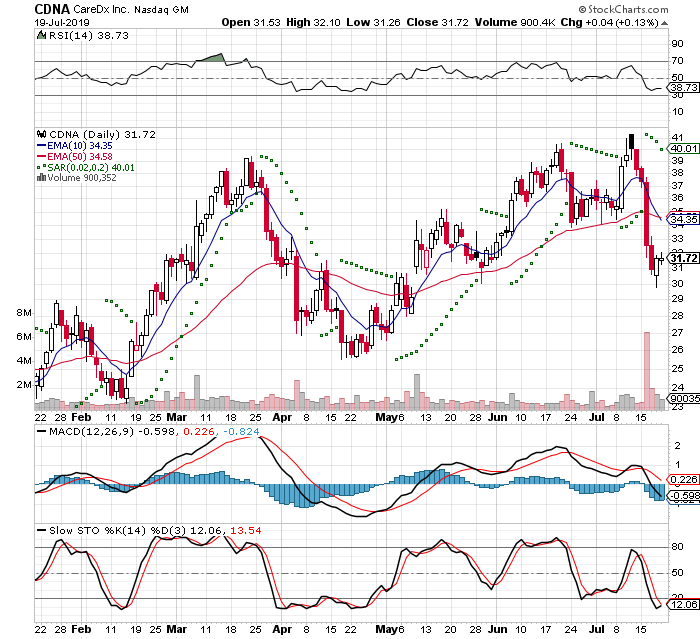

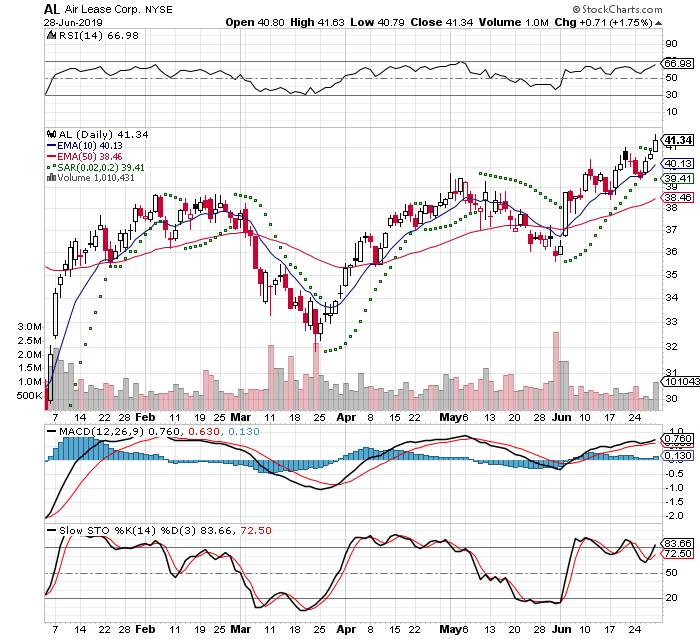

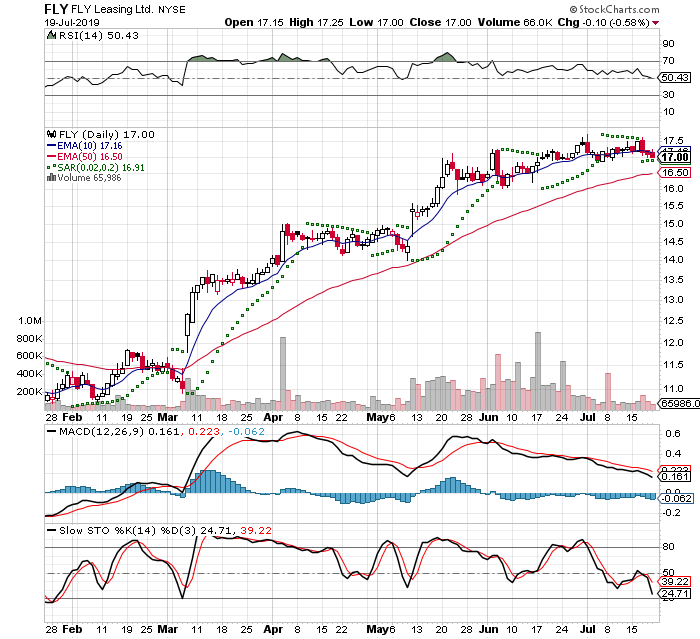

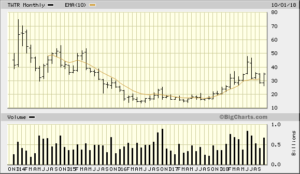

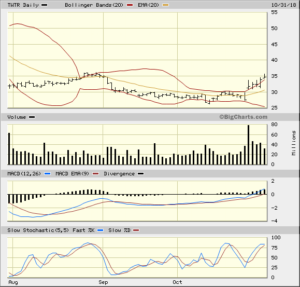

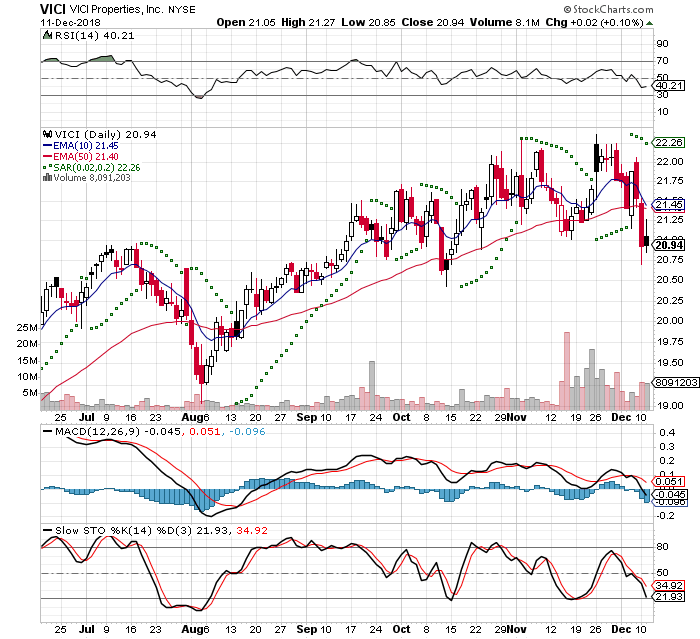

This trade idea came to me from investors.com Stocks on the Move on Wednesday 07/09. I liked the chart and placed the trade the following morning

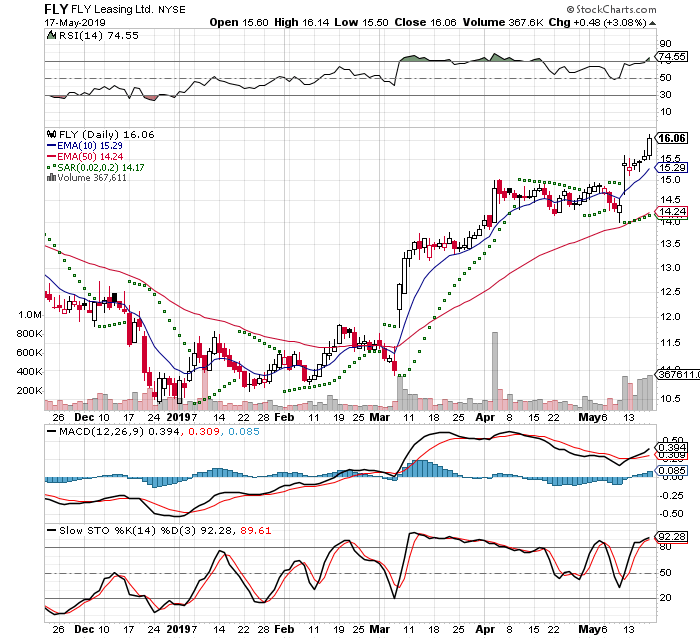

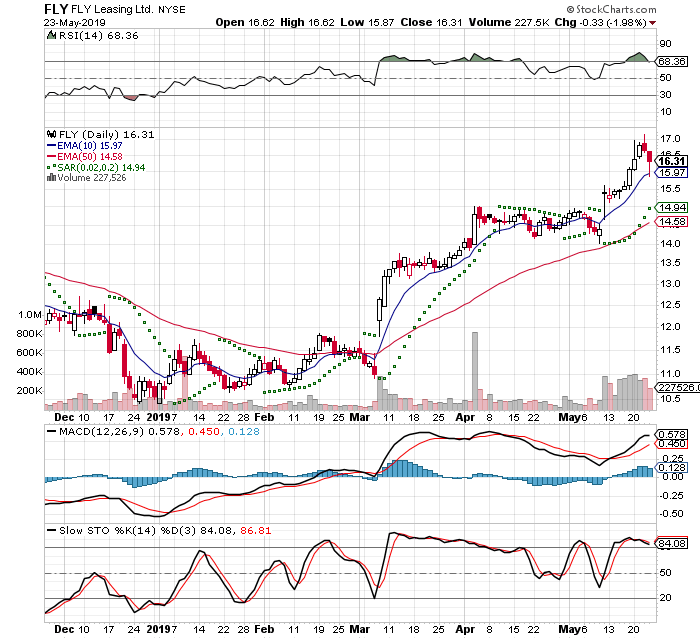

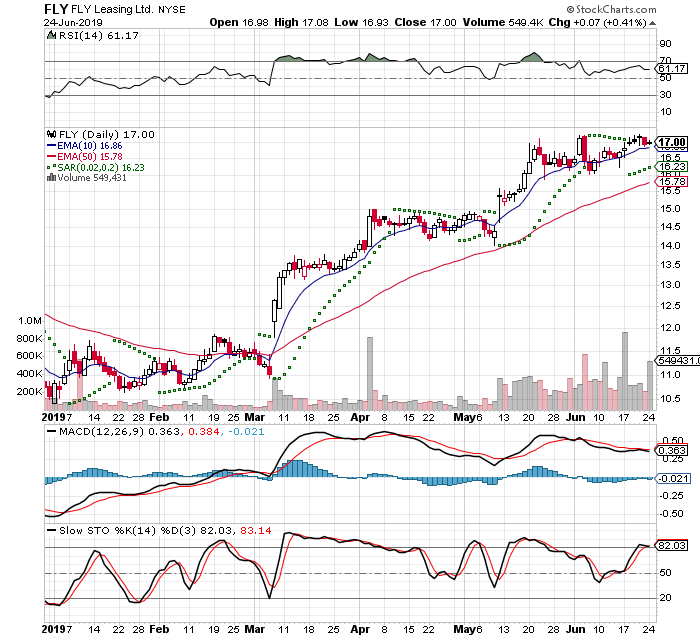

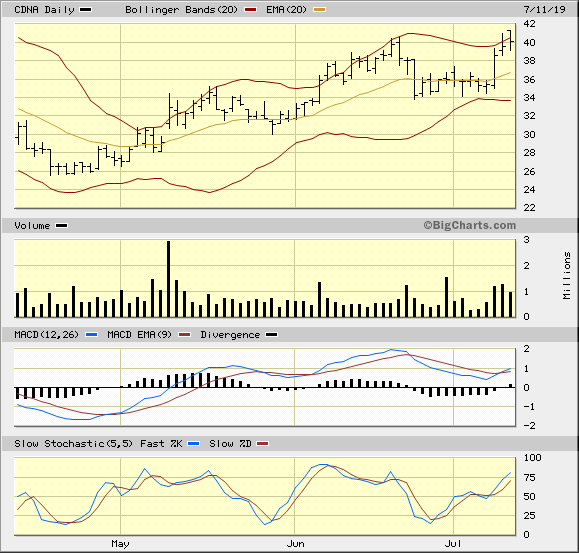

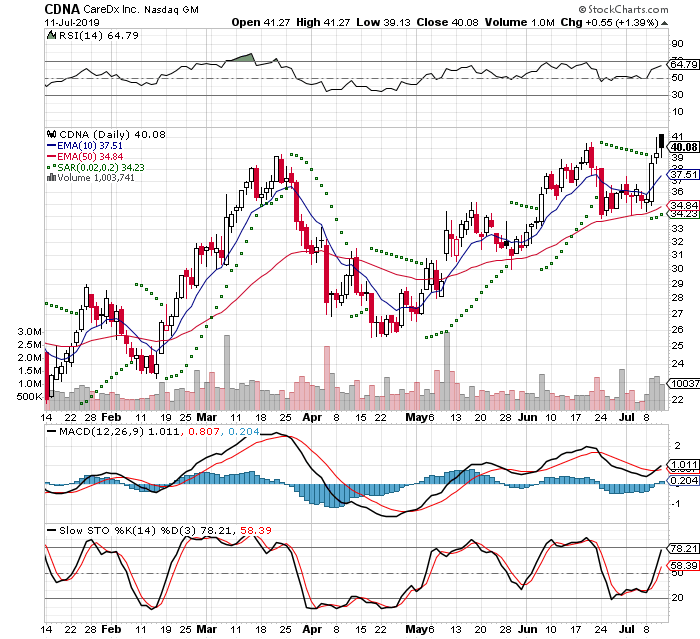

The trade setup is a break out of a 5 month base and selling at the close of a 20 Day EMA. Today is Day 2 of a 7 Trading Day Time Stop

My cost basis: $39.39

-5% Stop: $37.36

+20% Gain: $47.19

IBD Rankings 07/11/19

Composite Rating: 96

EPS Rating: 76

RS Rating: 98

Group RS Rating: A

SMR Rating: D

Acc/Dis Rating: B+

ROE: 0%

Debt: 0%

Outstanding Shares: 42.1m

Float: 40.4m

EPS Due Date: 8/09/19

Trading for a Living: Psychology, Trading Tactics, Money Management

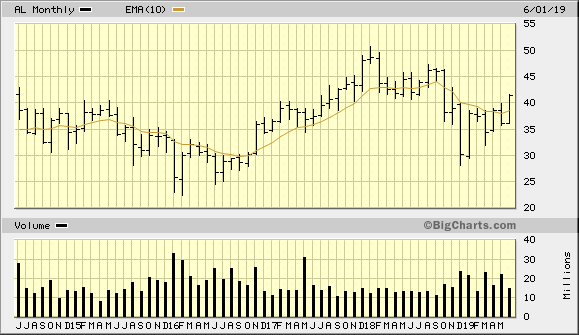

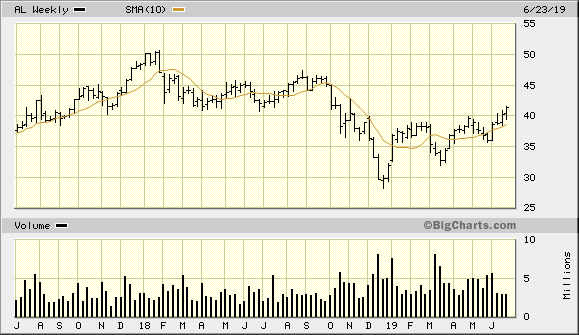

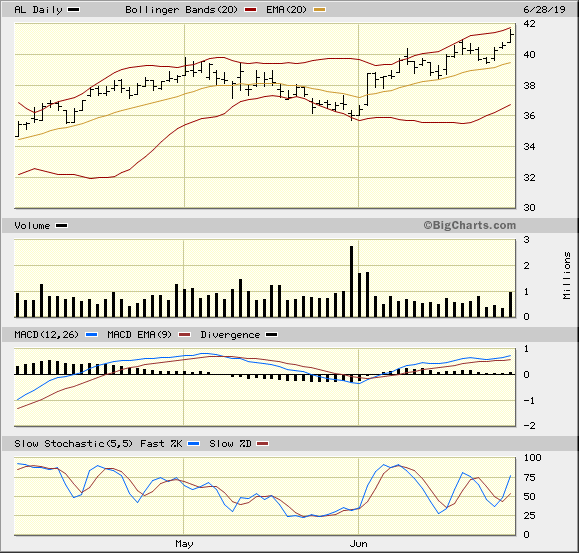

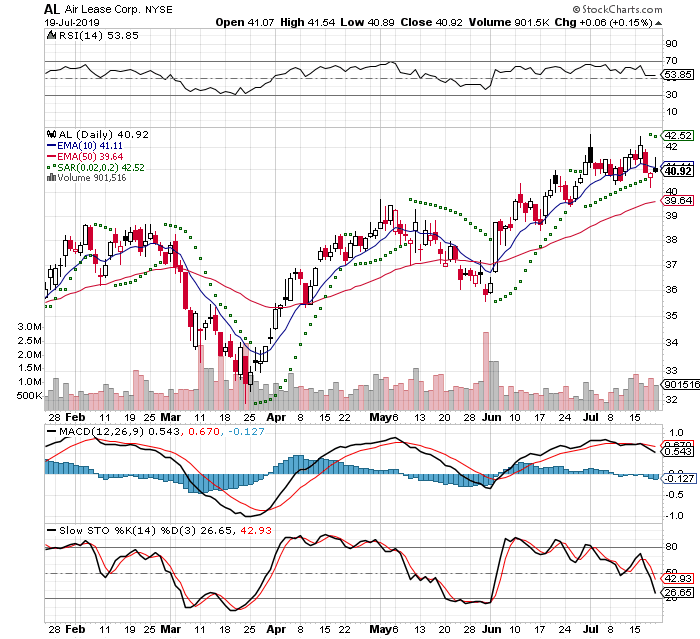

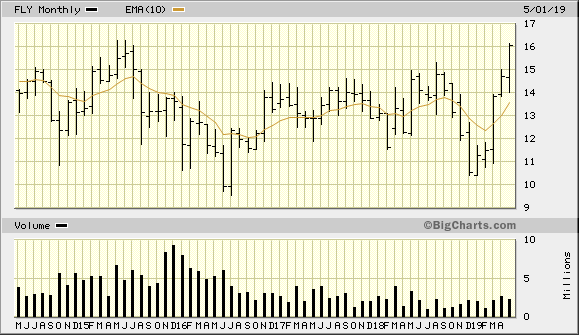

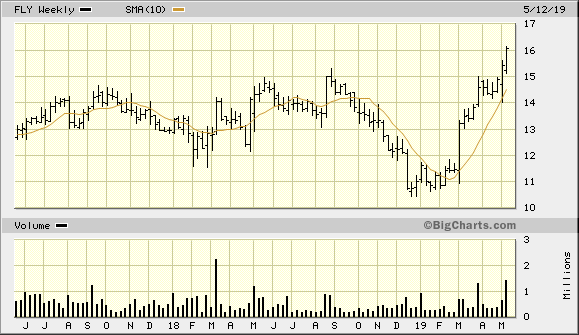

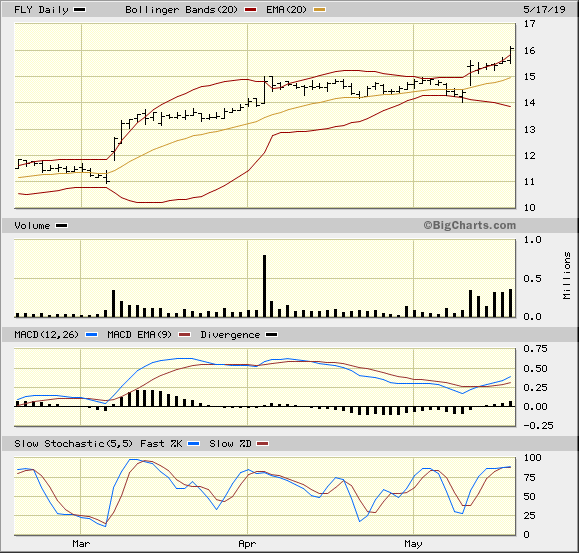

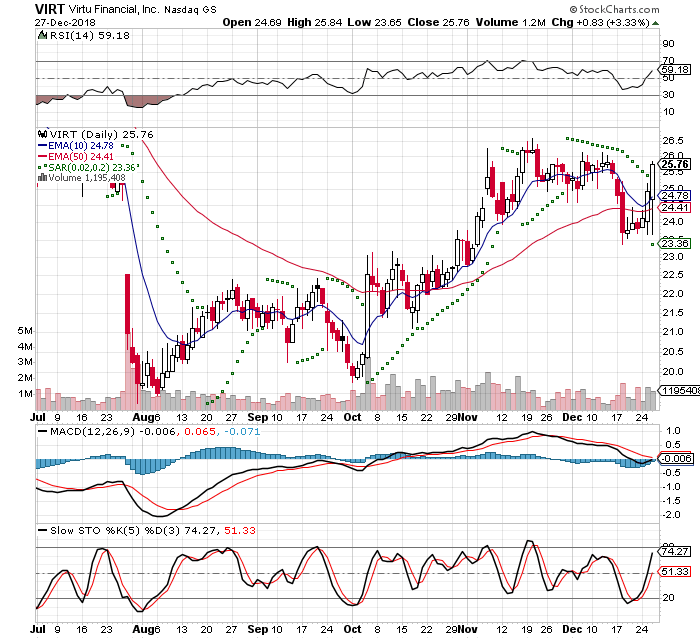

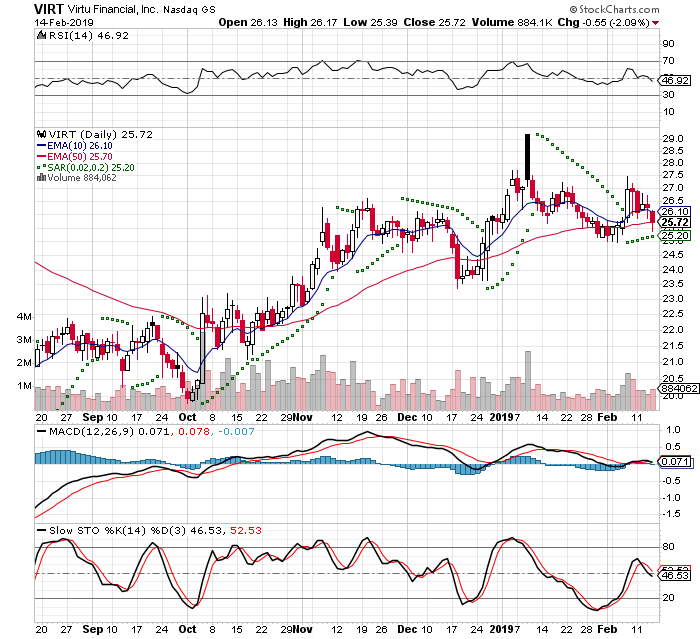

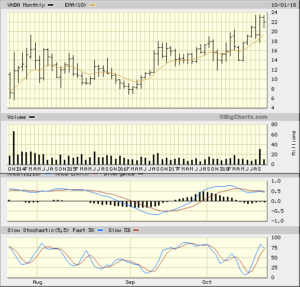

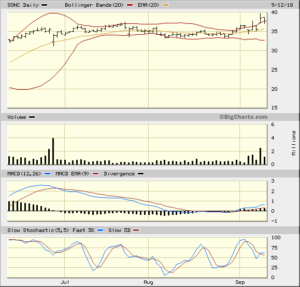

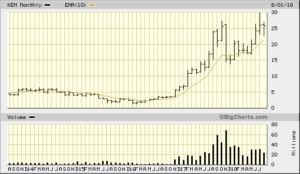

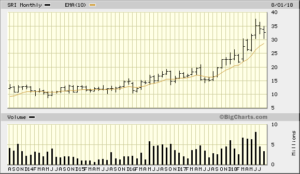

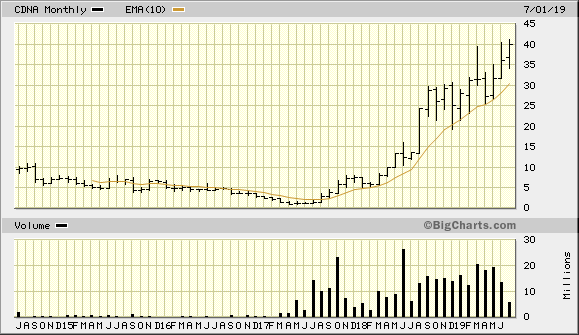

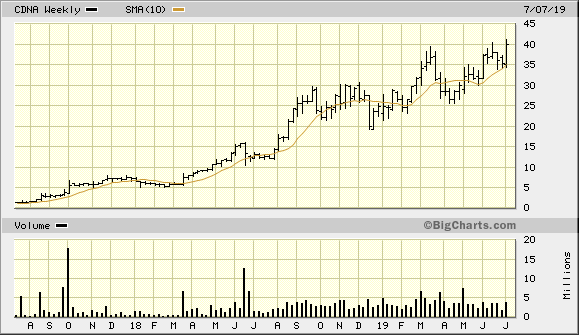

Dr Alexander has a triple screen for viewing charts and Trading for a Living is why I use the following charts

2019-07-20

I closed out of this position on Tuesday 07/16, because it hit my -5% stop on Monday's close. This opened down another 5% at the opening. I had thought it might bounce and it didn't it headed lower.

I checked the news and the main product failed a test. In fact it would cause harm using as intended. There are lawsuits filed for false representations. I could not sell fast enough

I normally avoid the medical field, because of this volatility. I was unfamiliar with the company and relied on the market action to enter the trade. Expensive tuition and lesson learned

I got filled at 33.45

39.39 - 33.45 = -5.94 / 39.39 = -15%