From CAE About page

CAE is a worldwide leader in training for the civil aviation, defence and security, and healthcare markets.

2019-06-09

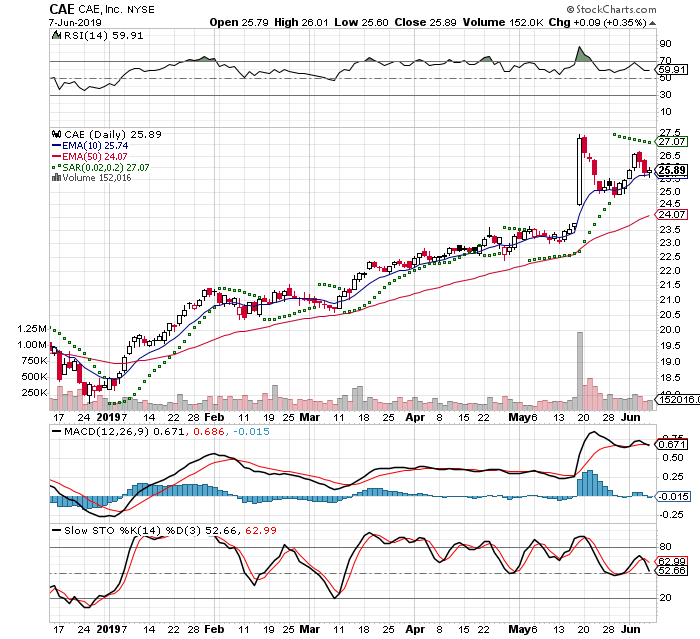

This trade idea came to me by running a scan from TD Ameritrade on Tuesday and I reviewed this on a bad day for the market. This resulted in 3 companies and this was the best candidate

I set the scan to:

Revenue Growth: +25% - >100%

Current Price: $20 - $50

EPS Growth: 15% - >100%

Volume: >100,000sh

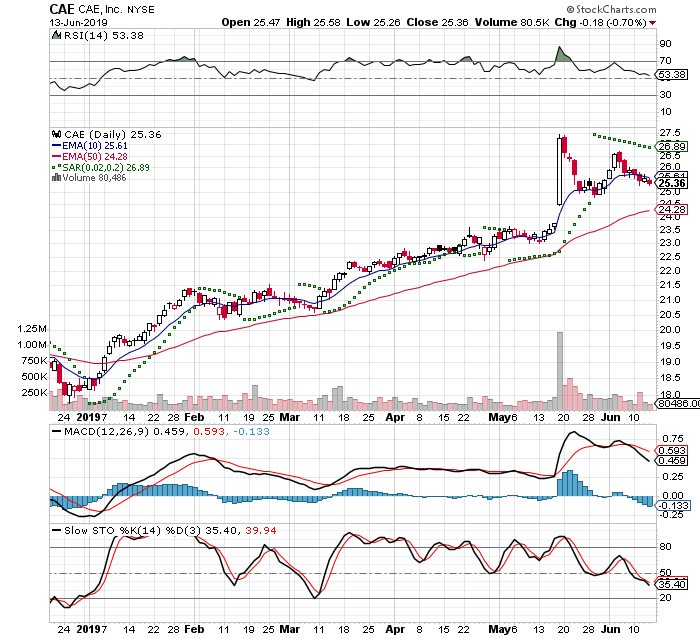

MACD Histogram: Negative to Positive

Price/Sales: 2, 2-3

I bought on Wednesday 2019-06-05 in the afternoon, because I expected a dip. The stock had gone up 4 straight days and the MACDH had changed to positive. I am currently down a small percentage and looking to exit quick if it starts to move against me.

This Day 3 of a 7 Trading Day Time Stop. The IBD Rankings are below the CANSLIM standard

IBD Rankings 06/09/19

Composite Rating: 96

EPS Rating: 84

RS Rating: 94

Group RS Rating: A+

SMR Rating: B

Acc/Dis Rating: D+

ROE: 14.3%

Debt: 53%

Outstanding Shares: 266.3m

Float: 263.6m

EPS Due Date: 8/12/19

I got filled at $26.12

-5% Stop: $24.75

20% Target = $31.26

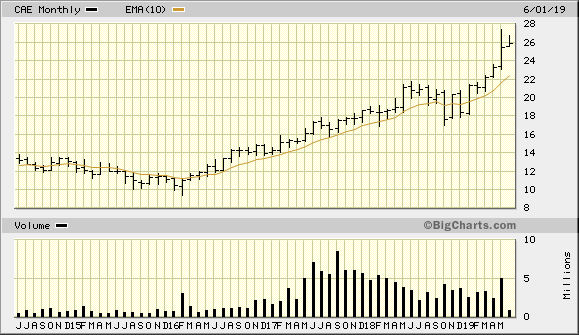

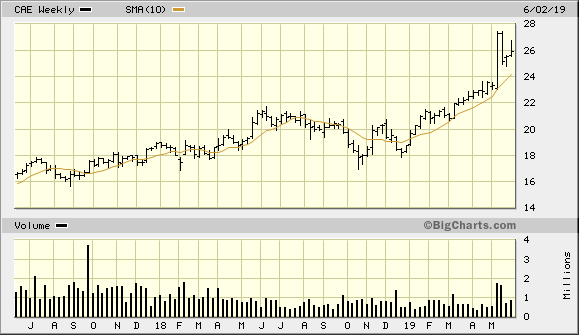

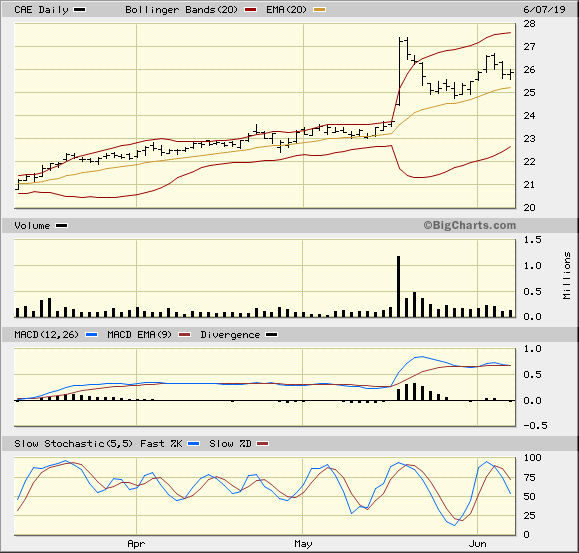

Dr Alexander has a triple screen for viewing charts and Trading for a Living is why I use the following charts

2019-06-13

I closed out the position today, because it hit my time stop. I had expected a pause, but then rebound. I got filled at $25.54 with a slight loss

$26.05 - 25.54 = -$0.51 / $26.01 = -2% in 7 days