Orion Engineered Carbns – OEC

2018-07-22

I had been watching this stock from last quarter and I think the time is right for a pop. I’m watching the MACD cross over. The current stock price is at $32.30

-5% stop loss: $30.89

+20% gain: $38.76

Here are the IBD Rankings on the Friday edition of IBD Weekly VOL. 35, No.16 Week of July 23, 2018

IBD Rankings today

Composite Rating: 96

EPS Rating: 88

RS Rating: 87

Group RS Rating: B

SMR Rating: A

Acc/Dis Rating: B

ROE: 126.2

Debt: 0%

Outstanding Shares: 59.3m

Dr Alexander has a triple screen for viewing charts and Trading for a Living is why I use the following charts

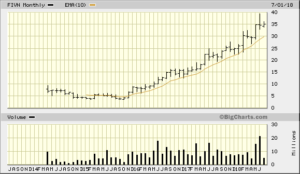

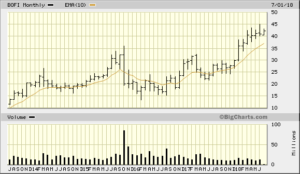

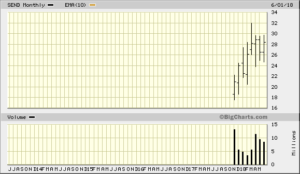

5 year monthly chart from bigcharts

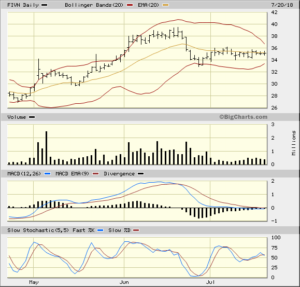

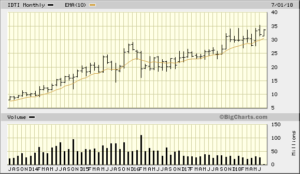

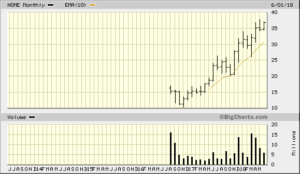

1 year daily chart from bigcharts. I use a 3 tier 50 day EMA. What I’m looking for is a cross over for the shorter term over the long term. The 50 EMA should be a level for institutional support

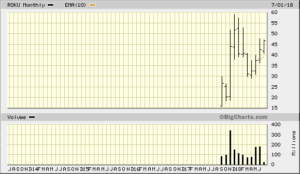

The 3 Month Daily has the MACD and histogram crossing the zero line|

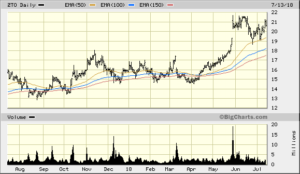

3 Month Daily from StockCharts.com

3 Month Daily from StockCharts.com

2018-07-23

My order got filled at $32.35 at the open. This slightly adjust my numbers:

-5% stop loss: $30.73

+20% gain: $38.82

2018-09-05

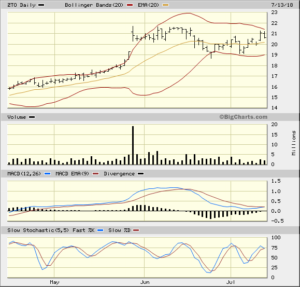

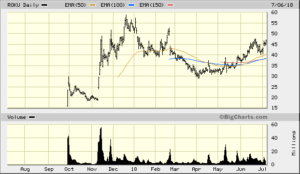

I closed this position to protect a profit. This was trading well and I was up approximately 10%, but things changed I had expected it to clear the resistance at $36. It didn’t…

I had checked this and realized that I should be further ahead then where it was trading. I knew something was wrong and I sold

Opened position at: $32.35

Closed position at: $33.05

+ $70 or +2.2%

I will still be watching this company, but the timing is not right now. Here is the 3 month daily from Stockcharts.com