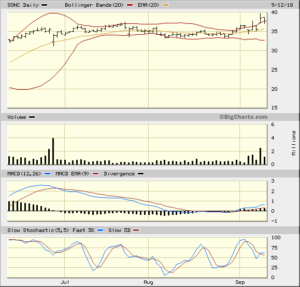

Sonic Corp (SONC)

2018-0912

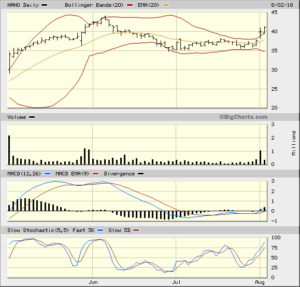

This was in Investor’s Business Daily Stocks on the Move yesterday and I placed a limit order today at yesterday’s close. I have giving myself a time stop of 7 days. If this does not turn positive then I will sell. This is Day 1 and it wasn’t good, but I am still within the stop. Looking at the charts there should be support at 35, but that is below my 5%. We shall see…

I got filled at: $38.38

-5% stop: $36.41

+20% Target: $46.06

IBD Rankings today

Composite Rating: 81

EPS Rating: 83

RS Rating: 92

Group RS Rating: A1

SMR Rating: N/A

Acc/Dis Rating: B

ROE: 33.2.2%

Debt: 66%

Outstanding Shares: 57.4m

EPS Due Date: 11/02/18

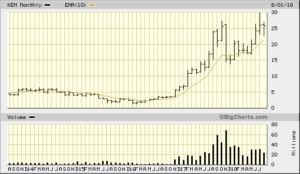

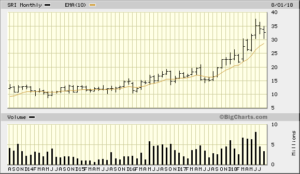

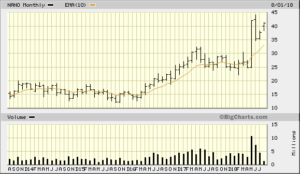

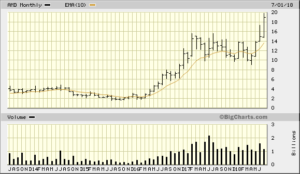

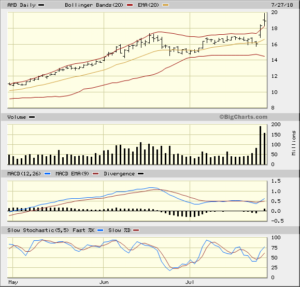

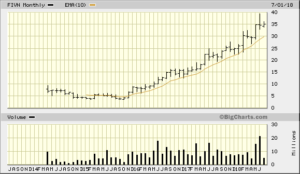

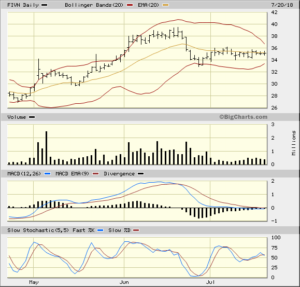

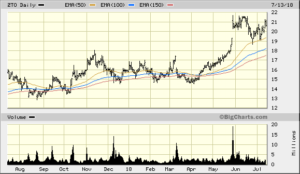

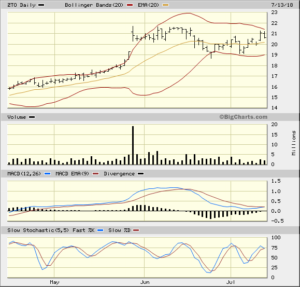

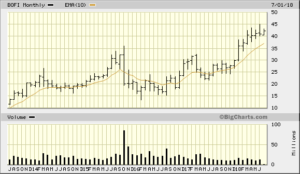

Dr Alexander has a triple screen for viewing charts and Trading for a Living is why I use the following charts

2018-09-25

I sold today, because Sonic was bought out and the upside beyond today is limited. I was down about -6.5%. This is beyond my normal -5% stop, but I wanted to give this one a wider stop.

The way this has been trading I moved it to -8% which is the classic CANSLIM stop loss.

See How to Trade Stocks by William O’Neil. My copy has creases, folds, underlines, asterisks, and mud. This is a must read.

I had liked the way this was trading and I bought it. I was loosing money and this was more luck, but I’ll take it.

Current 3 Month Chart from Stockcharts.com