Our fleet of 103 aircraft – with a value of approximately $3.2 billion – is leased under multi-year operating lease contracts to 44 airlines in 25 countries.

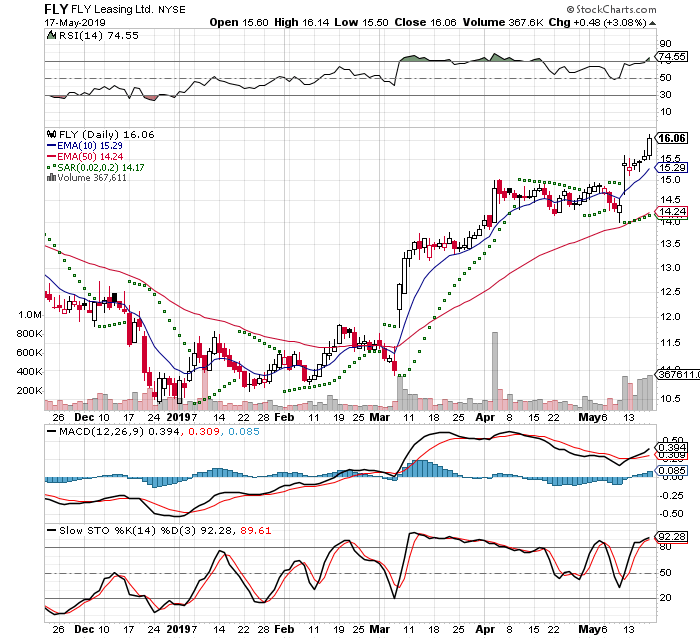

2019-05-19

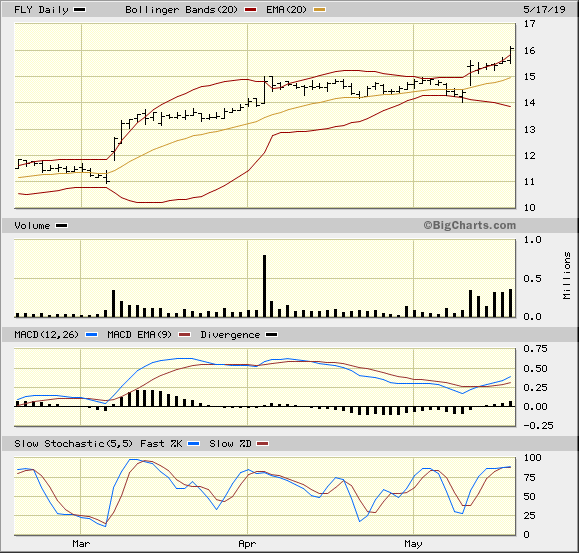

This trade idea came to me from a friend of mine on May 3rd. I found the chart interesting, but earnings were being announced on May 9th. I felt this was a bit risky in order to buy the stock. So I looked at the options and found the 05/17 calls were fairly cheap and was willing to risk a small amount for an earnings play

I bought 2 May 17, 2019 $15 call options and I got filled at .35. I planned on holding this till earnings. Then see if I was willing to purchase the stock

The announcement came and the stock popped up and stayed above my cost basis $15.35. I held to expiration and bought at 200 shares at !5.00, but I had to take into account the cost of the option plus commissions for purchasing the stock

My cost basis: $15.44

-5% Stop: $14.67

+20% Gain: $18.53

IBD Rankings 05/19/19

Composite Rating: 96

EPS Rating: 81

RS Rating: 94

Group RS Rating: B

SMR Rating: A

Acc/Dis Rating: A

ROE: 14.6%

Debt: 427%

Outstanding Shares: 914.9m

Float: 28.4m

EPS Due Date: 8/21/19

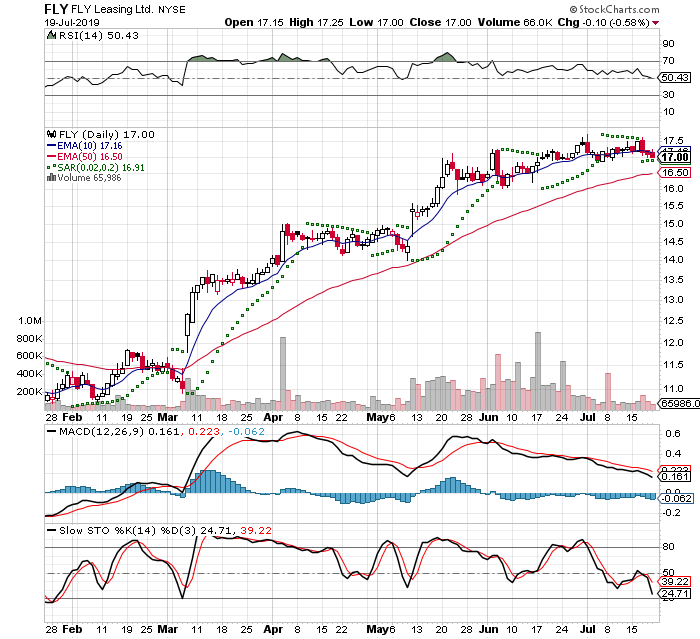

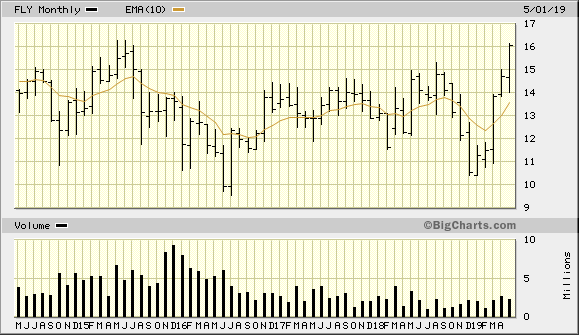

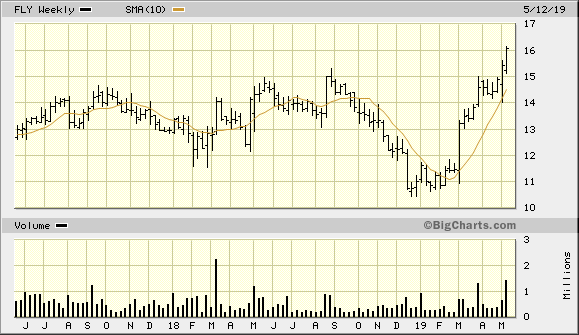

Dr Alexander has a triple screen for viewing charts and Trading for a Living is why I use the following charts

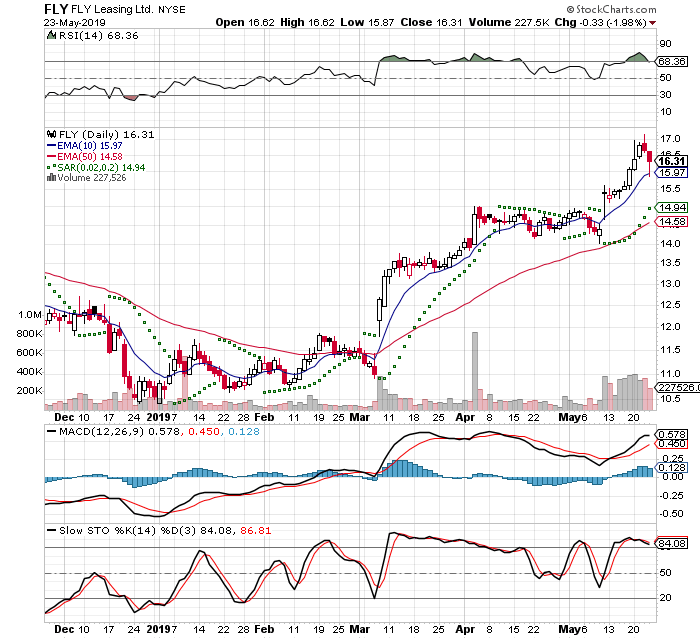

2019-05-23

I closed out the position today, because it had become extended. During my review yesterday I had marked it as a daily HOLD, but after sleeping on it I wanted to sell.

I wanted to lock in the profits and apparently I was in good company. The stock was down sharply in the morning

I got filled at $16.19

($15.48 - $16.19) = .71 / 15.48 = 4.59%

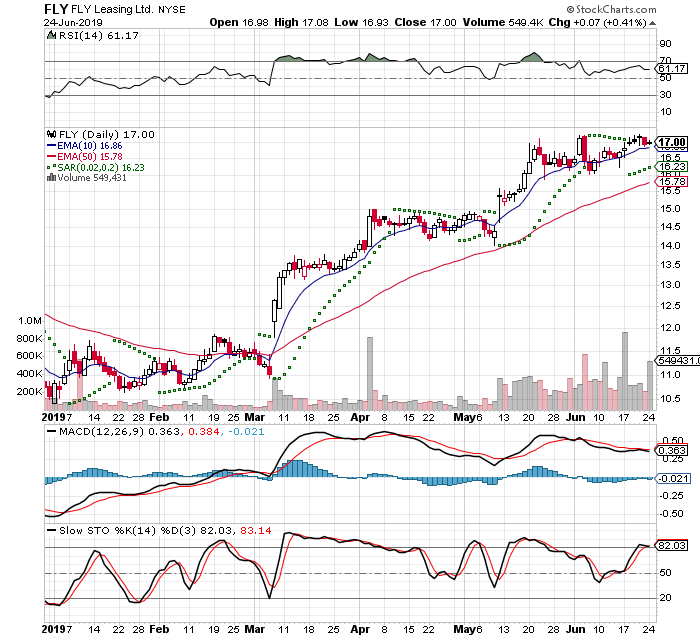

2019-06-23

This stock idea came from a review of my watch list on Tuesday 2019-06-18. I bought the next day and got got filled at 17.07. Today is Day 4 of a 7 Trading Day Time Stop

2019-07-20

I closed out of this position on Friday. It was not doing what I had expected. I owned it for 22 Trading Days and I wanted to be more in cash. I was filled at 17.08

17.14 - 17.08 = -.06 / 17.14 = -3.5%