Vici Properties Inc (VICI)

2018-10-15

This trade idea came from my review of the Investor’s Business Daily – IBD Weekly, VOL 35 N.O. 28 Week of October 15, 2018. This was ranked in IBD50 as #44

This company is a REIT and was considering on investing longer term money one of those. This morning I bought within the first hour of trading. I’m increasing my stop to -8%, because I’m not as concerned about the exact entry

I got filled at: $20.87

-8% stop: $19.20

+20% Target: $25.04

IBD Rankings today

Composite Rating: 97

EPS Rating: 98

RS Rating: 75

Group RS Rating: B-

SMR Rating: A

Acc/Dis Rating: C+

ROE: 1.8%

Debt: 102%

Outstanding Shares: 370.2m

EPS Due Date: 10/28/18

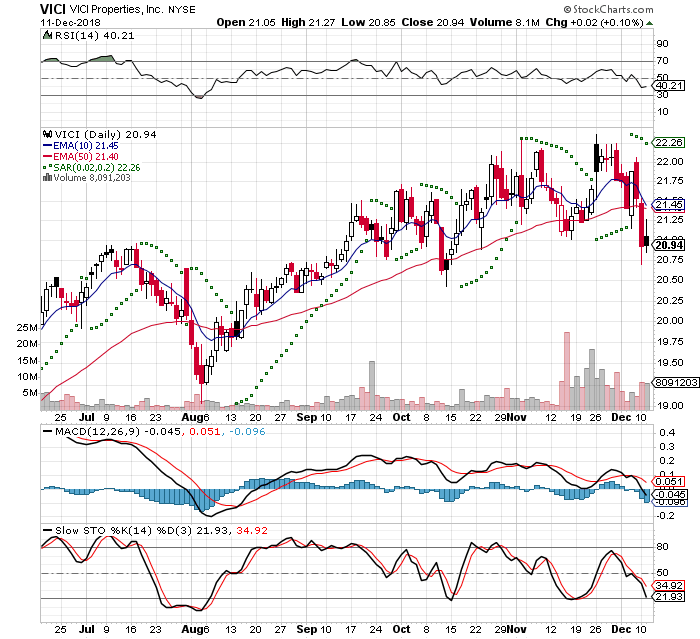

Dr Alexander has a triple screen for viewing charts and Trading for a Living is why I use the following charts

2018-10-18

This morning I bought an additional 100 shares, because I liked the way it was trading. There was a good day yesterday on strong volume – about 2.5x’s.

I got filled at: $21.60

-8% stop: $20.52

+20% Target: $25.92

This raised my cost basis, but it is going the direction I wanted it to go and I’m averaging up. Adding to a losing position can destroy an account. I admit I’m wrong and move on

My average position numbers are:

Cost: $21.34

-8% stop: $19.36

+20% Target: $25.48

The MACD is still positive and the MACDH is about to cross the zero line

Here is the 3 month chart from Stockcharts

2018-12-11

I closed out the position today $21.22 at a loss of -$.01, because it was not performing correctly. There was an article a couple of days ago about this being a possible short candidate for hedge funds.

Here is the current 3 Month Chart from Stockcharts.com